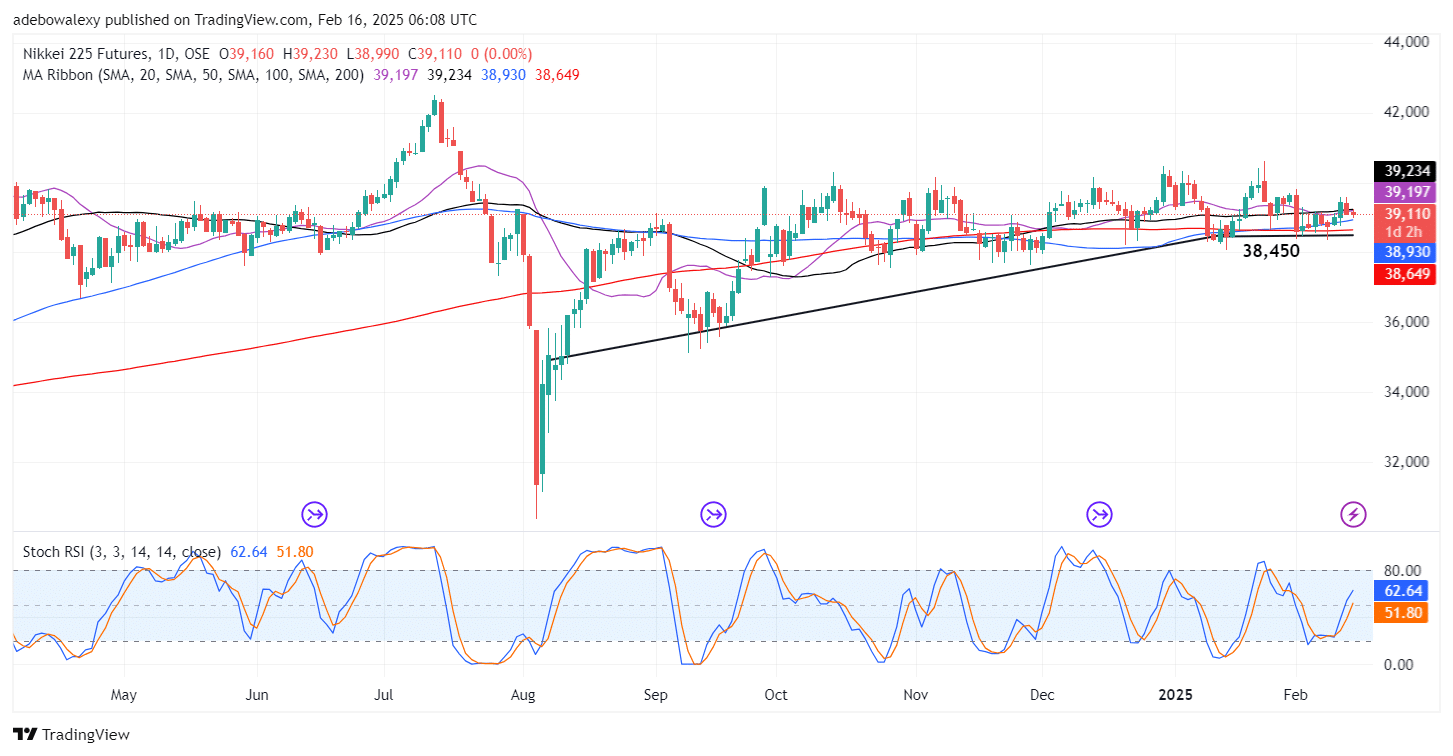

The Japan 225 market has moved off the baseline at the 38,450 price level. However, the market edged lower on Friday as President Trump ordered a review of reciprocal trade tariffs on countries that tax American imports. This threatens Japanese exports and has affected Japanese stocks as well.

Key Price Levels:

Resistance Levels: 38,500, 39,000, 39,500

Support Levels: 38,000, 37,500, 37,000

Japan 225 Remains Subdued

The Nikkei 225 market, as mentioned earlier, has moved off the baseline at the 38,450 price level. However, price action appears to be hitting resistance at the 39,500 level. As a result, headwinds pushed the market back below the 20- and 50-day Moving Average (MA) lines through Thursday and Friday.

Interestingly, the last price candle on the chart remains at the close of the previous session. At the same time, the Stochastic RSI indicator lines are rising steadily upward despite the observed downward retracement. Consequently, it appears that price forces are at a standoff.

Nikkei 225 Bulls Mount Resistance

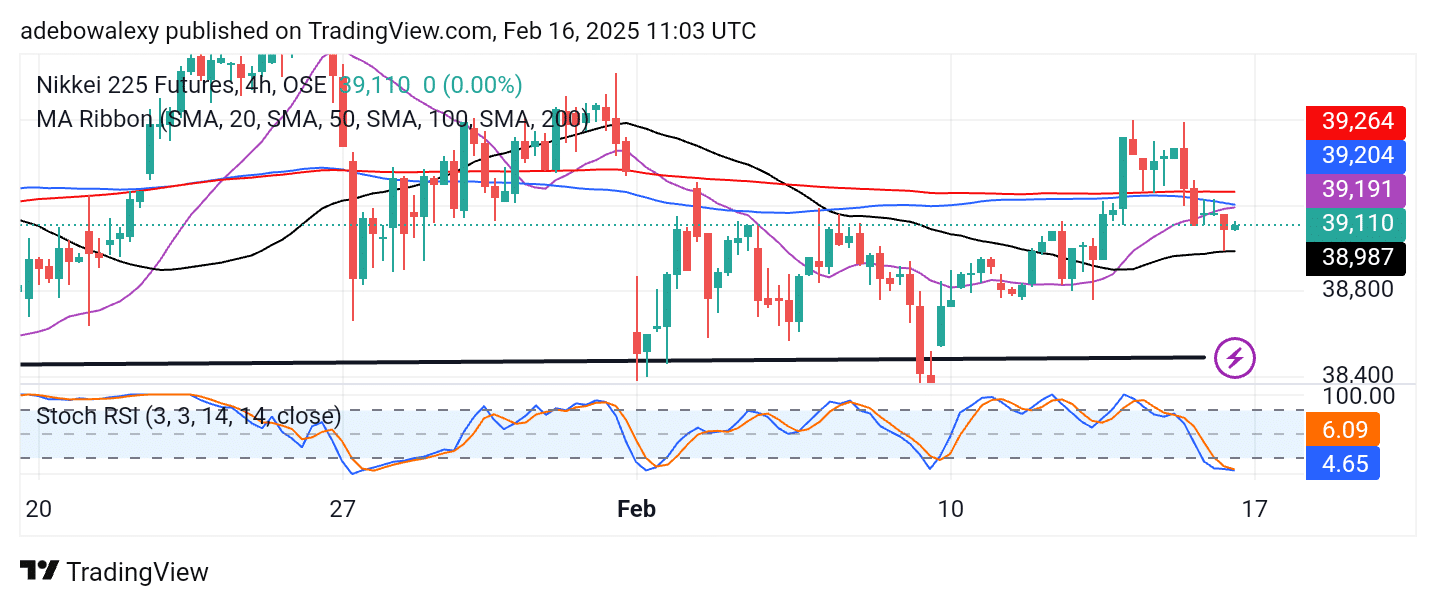

While the daily market chart for the Japan 225 shows that price action has slipped lower and the ongoing session has kept the market stagnant, the 4-hour chart indicates that upside forces are attempting to push the market higher. This can be observed through the appearance of the last price candle on this chart.

The last two price candles have appeared below the convergence of the 20- and 100-day MA lines. However, this convergence currently appears more sideways. Additionally, the Stochastic RSI lines are converging in the oversold zone for a potential crossover. Should this occur, price action may proceed toward the 39,500 mark and beyond.

Make money without lifting your fingers: Start trading smarter today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.