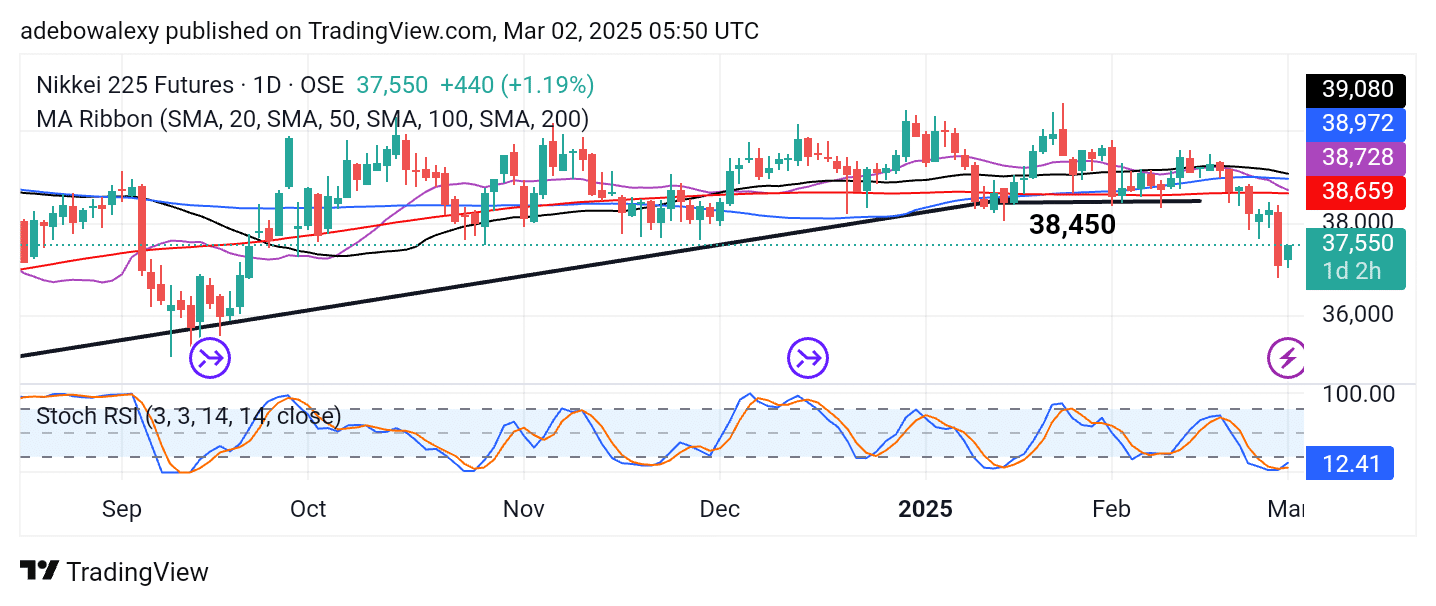

The NIKKEI 225 market dipped sharply on Thursday. This appears to be the aftermath of a sharp decline in oil prices following Iraq’s decision to resume oil exports from Kurdistan, as well as market preparations for Washington’s new tariff. Be that as it may, the market seems to be recovering moderately but remains subdued.

Key Price Levels:

Resistance Levels: 38,000, 39,000, 39,500

Support Levels: 37,500, 37,000, 36,500

Japan 225 Bounces Upward Above 37,000

Following the sharp price decline seen in the NIKKEI 225 market on Thursday, price action rebounded moderately by the close of the week. However, the upward movement appears to be under strong pressure, given that price activity remains below all the Moving Average (MA) lines.

Nevertheless, the Stochastic Relative Strength Index (Stochastic RSI) indicator stays positive with its upside crossover in the oversold region. The last price candle on this chart is green, aligning with the Stochastic RSI’s behavior to suggest short-term gains.

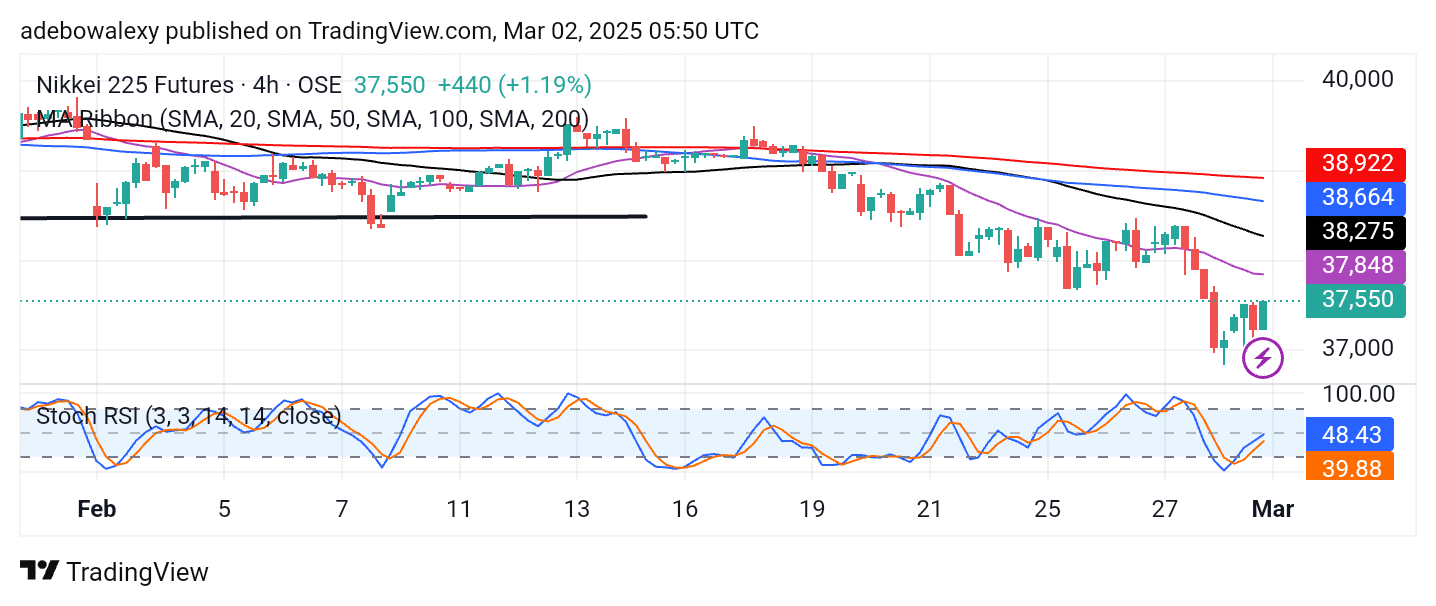

Nikkei 225 Seems Keen on Short-Term Gains

Price activity in the Japan 225 4-hour market suggests that market participants may be eyeing short-term gains. Price action remains below all the MA lines but shows vigor. This can be seen as the market quickly recovers from the decline in the previous session. As a result, the last price candle is visible and stays green.

Additionally, the Stochastic RSI lines can be seen rising into the overbought region. The lines of this indicator are currently just below the 50 mark, and as such, upside momentum may continue to build. Consequently, this could push the market further toward the 38,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.