The Japan 225 experienced a significant price decline on Friday. This was largely driven by uncertainty surrounding President Trump’s rapid policy initiatives, as well as concerns over spending cuts and tariffs. These factors have not only impacted stocks but have also had a noticeable effect on business activity in the United States.

Key Price Levels:

Resistance Levels: 38,500, 39,000, 39,500

Support Levels: 38,000, 37,500, 37,000

Japan 225 May Head Further South

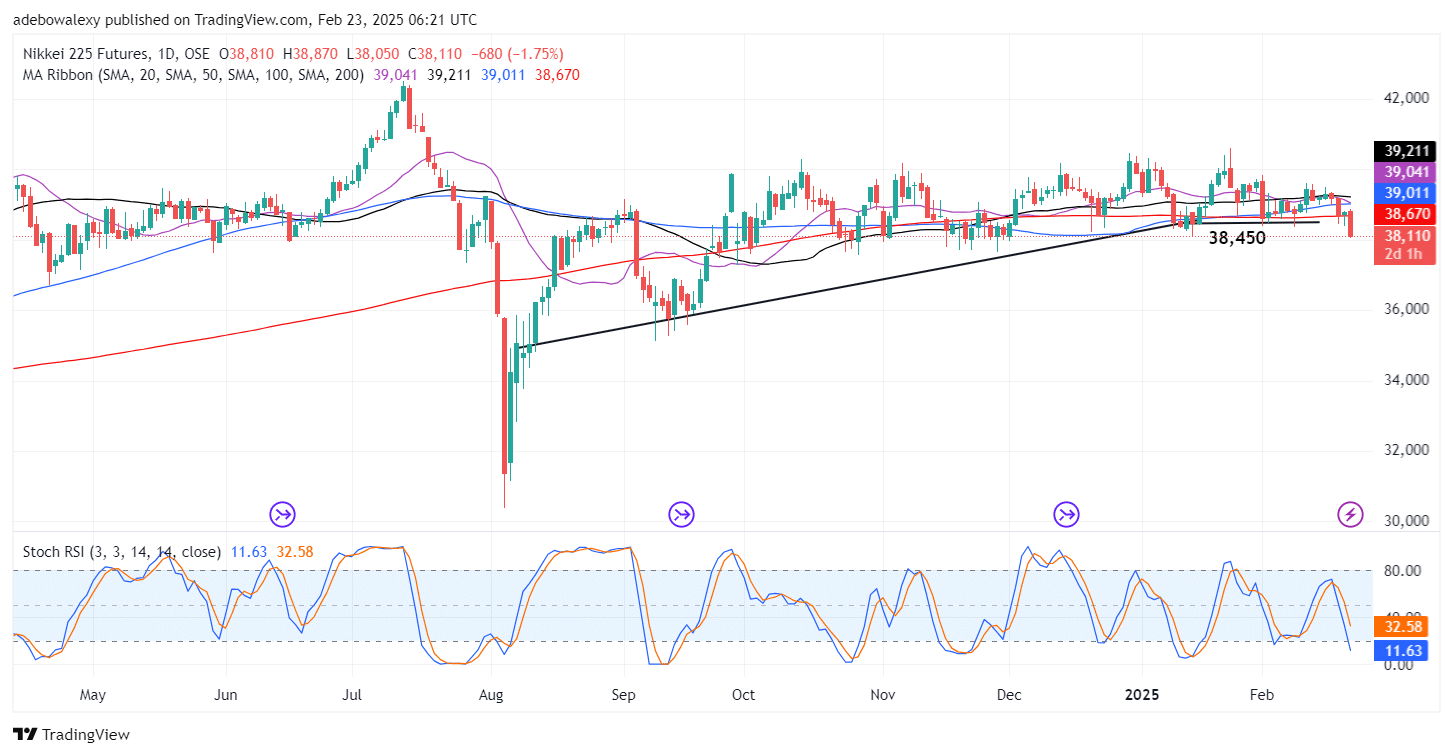

Price action in the Nikkei 225 market dropped sharply on Friday after failing to find support above all the Moving Average (MA) lines on the chart. Since then, price action has continued to retrace lower levels.

The latest price candle on the chart appears as a large red candle, plunging the price of this future below all the MA lines. Likewise, the Stochastic RSI has been falling rapidly toward the oversold region, with no signs of a potential trend reversal. Technically, bears seem to be in full control of price movement.

Nikkei 225 Bulls Stage a Weak Resistance

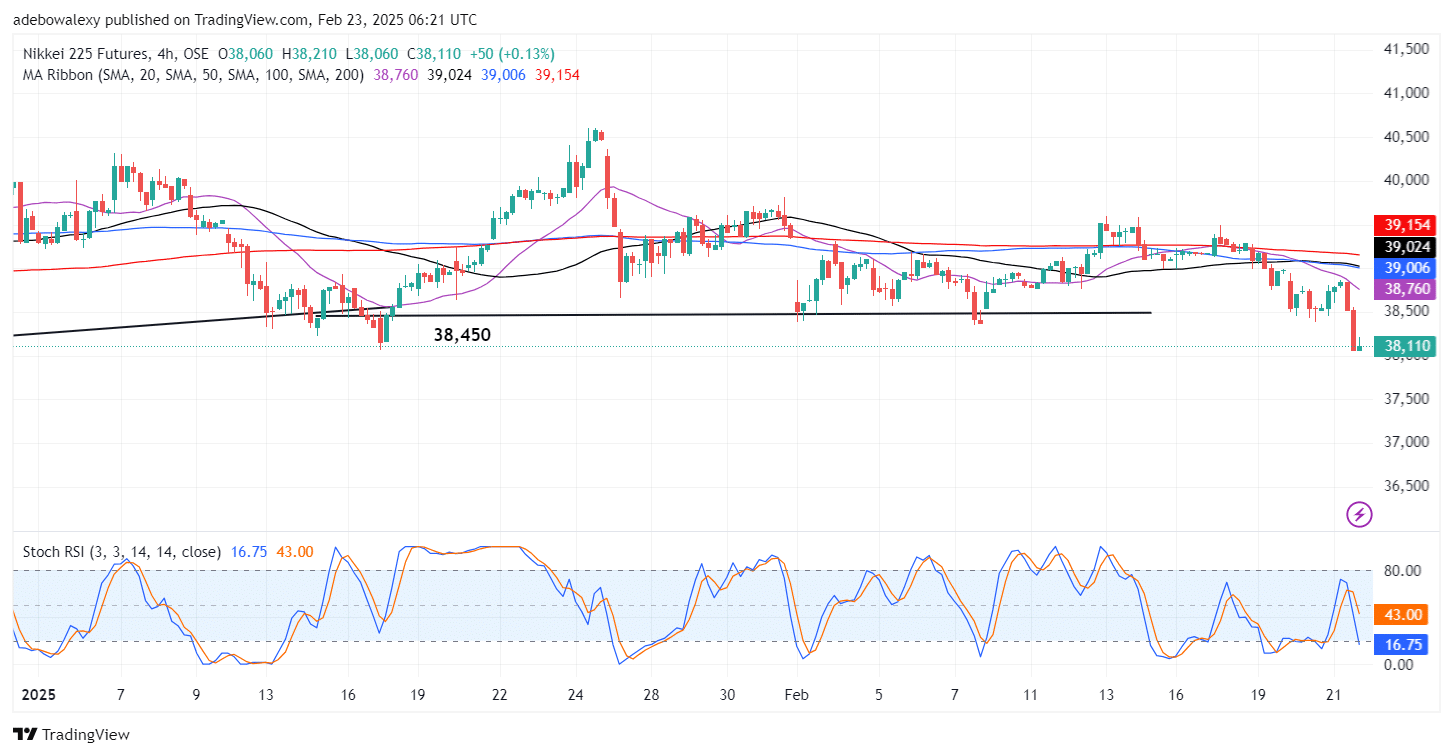

Extending the analysis to the Japan 225 4-hour chart, it is evident that price action remains strongly bearish. However, the latest price candle indicates some buying activity in the market. Despite this, prices remain below all the MA lines, and even the mentioned bullish candle appears to be contracting downward.

The Stochastic RSI lines are falling sharply into the oversold region without showing any signs of an upside reversal. Technically, the behavior of the Stochastic RSI suggests that a significant upside retracement may still develop from this point. Therefore, traders can anticipate a potential breach of the 38,000 support level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.