With the anticipated Fed rate cut still in view, investors are exercising caution around the USD, keeping it on a losing streak. Meanwhile, the Japanese economy is showing improvement in Producer Prices, which have risen by 2.7%. This has supported the Japan 225 market, allowing it to edge higher.

Key Levels

Resistance: 51,000, 52,000, 53,000

Support: 49,000, 48,000, 46,000

Japan 225 Finds a Lofty Perch

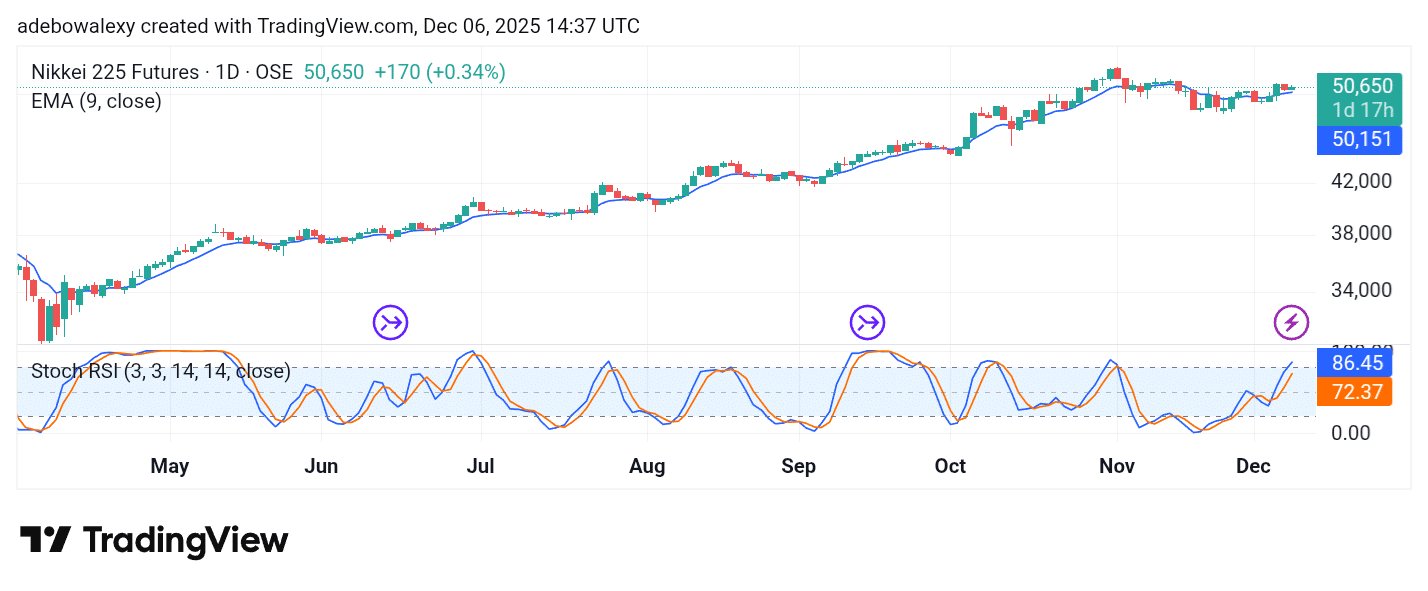

The NIKKEI 225 daily chart shows that the market experienced notable price increases over the past week. As a result, the index now trades above the 9-day Exponential Moving Average (EMA) curve.

The last candle on the chart is also green, indicating that bullish pressure dominated the week’s final session. Additionally, the Stochastic Relative Strength Index (SRSI) lines continue to trend upward, with the lead line now piercing through the 80 mark. Technically, this suggests that the market may maintain its upward trajectory.

NIKKEI Market Stays Composed

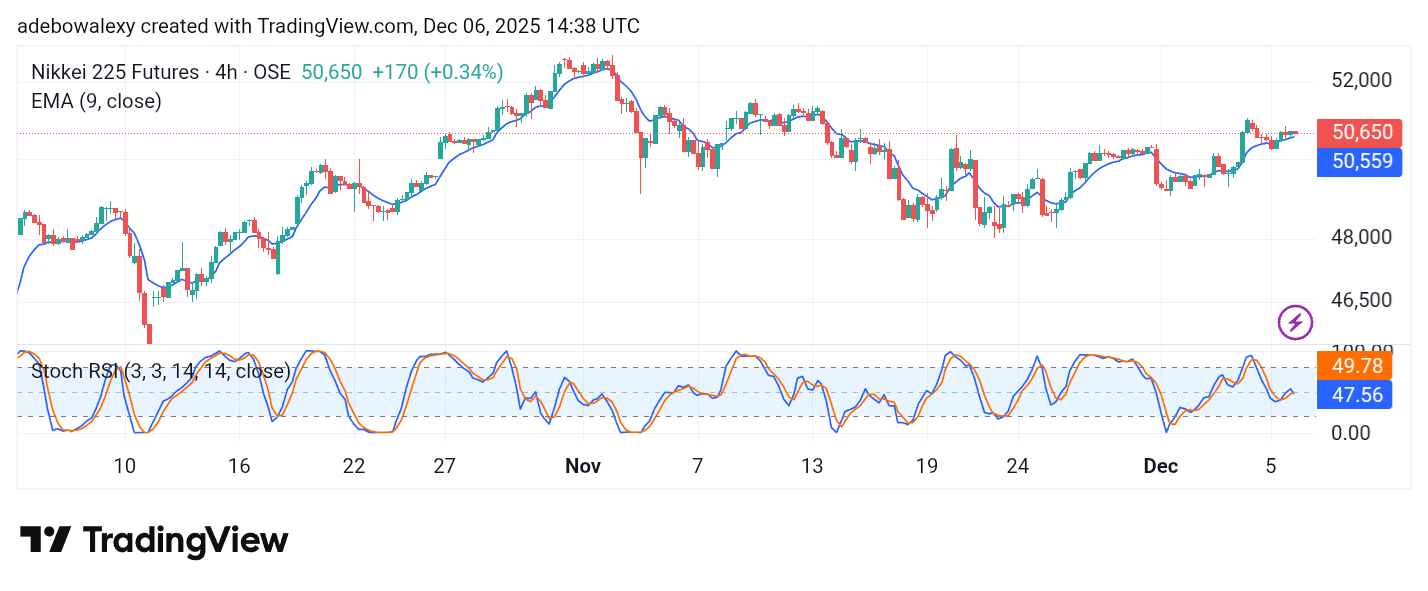

On the 4-hour Japan 225 chart, price action remains above the 9-day EMA curve. The latest candle is red but still keeps the index trading above a key level, as the bearish movement is minimal.

The SRSI indicator lines are tilted toward a bearish crossover, which has occurred around the 20 mark. This hints at a possible downward correction. However, the fact that trading continues above the 9-day EMA suggests that the market may still rebound from the 50,559 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.