The Australia 200 market appears content with minimal gains. This seems to have stemmed from the fact that investors are closely anticipating the RBA’s interest rate announcement scheduled for the coming week. More details are provided below.

Key Price Levels

Resistance: 8,700, 8,825, 9,000

Support: 8,500, 8,400, 8,300

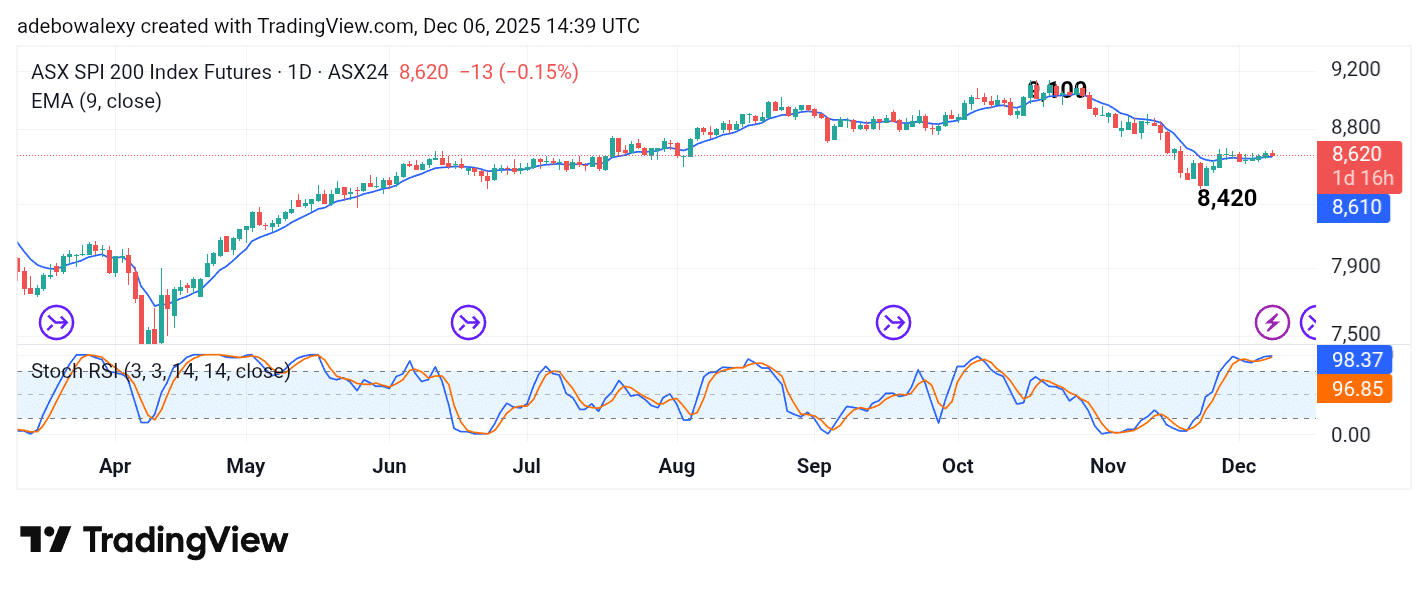

Australia 200 Market Sits Back on the 9-day EMA

On the ASX 200 daily chart, one can see that recent price action has been crawling above the 9-day Exponential Moving Average. This has been happening throughout the week, but on Friday the market rejected downward, bringing the price to close while testing support at the 9-day EMA.

Likewise, the Stochastic Relative Strength Index (SRSI) indicator lines have risen deep into the overbought region. The lines are also converging for an upward crossover, which aligns with the appearance of the latest price candle on the chart.

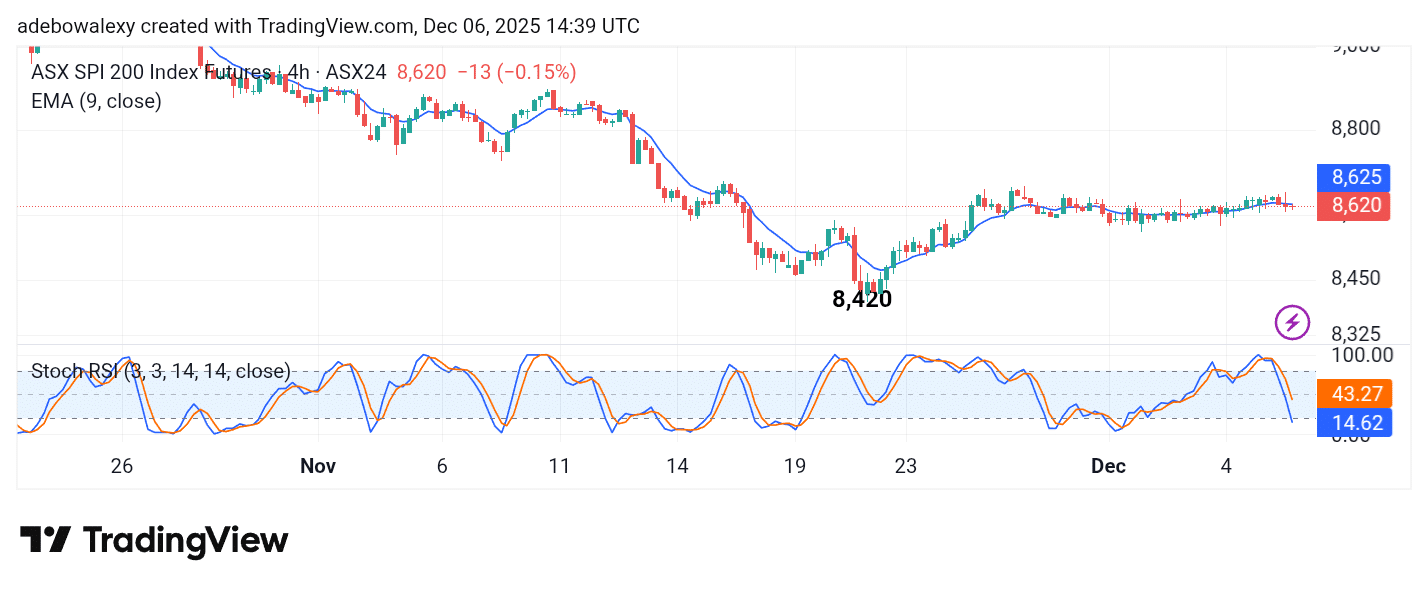

ASX 200 Headwinds Look Weak

Even on shorter time frames, the Australia 200 price action isn’t moving significantly. The latest candle is a red one, showing only a negligible decline.

However, the most recent candle has appeared below the 9-day EMA curve. Meanwhile, the SRSI indicator lines are dropping rapidly into the oversold region despite minimal price declines.

This suggests that the current headwinds are weak and may soon lose their grip, giving room for bullish forces to push toward the 8,700 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.