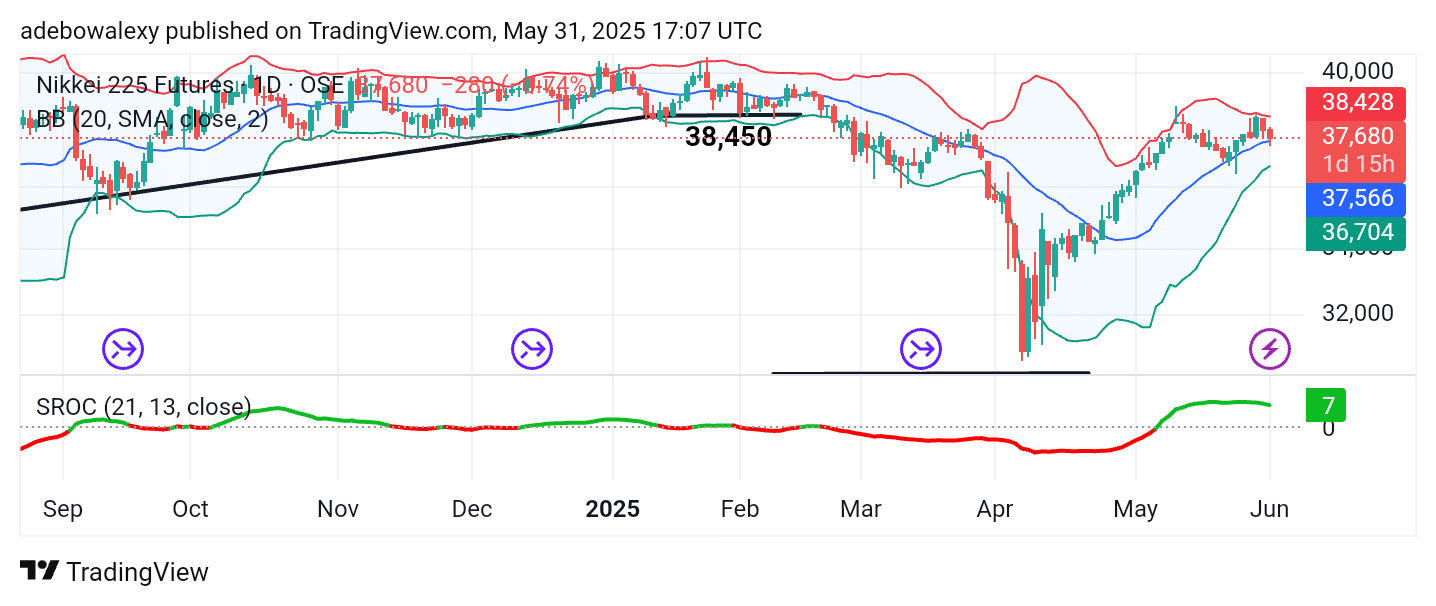

The Japan 225 market recently encountered strong resistance around the 38,450 price level. This resistance appears to have been driven by prevailing negative sentiment in the Japanese economy, including China’s recent lifting of its ban on Japanese seafood and a 27% decline in housing data for April. Let’s take a closer look at the market’s technicals.

Key Price Levels

Resistance: 39,000, 39,500, 40,000

Support: 37,000, 36,000, 35,000

Nikkei 225 Hits a Strong Support Base

Midweek price action in the Japan 225 daily chart showed a moderate downward retracement on Thursday, which extended into Friday’s session. Nevertheless, the index remains above the middle band of the Bollinger Bands, even as the bands themselves begin to contract—often a signal of potential volatility ahead.

Meanwhile, the Smoothed Rate of Change (SROC) indicator remains above the equilibrium level, suggesting underlying bullish momentum. As a result, traders might anticipate a potential upward rebound, with the middle Bollinger Band likely to act as support.

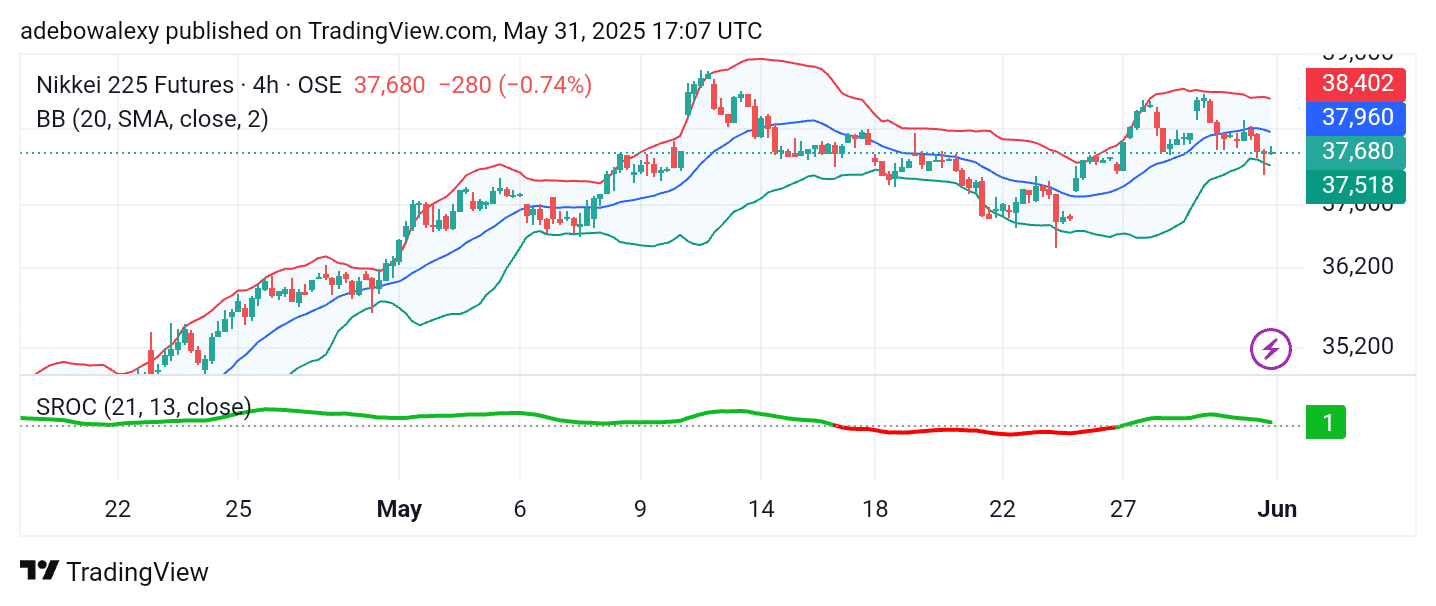

Japan 225 Holds Above Lower Limit

Over the last three sessions, there have been signs that price action may be initiating an upward rebound. The most recent candlestick is a small, compressed green candle, indicating weak but present buying pressure. Price remains below the middle band of the Bollinger Bands, signaling that a full recovery is not yet confirmed.

The SROC indicator shows a slight downward slope toward the equilibrium level but remains above it, implying that bullish potential still exists. That said, a significant upward retracement will likely depend on positive economic developments that could fuel renewed buying interest. Therefore, as traders position themselves toward the 39,000 level, it is crucial to stay informed about domestic economic indicators and developments in Japan.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.