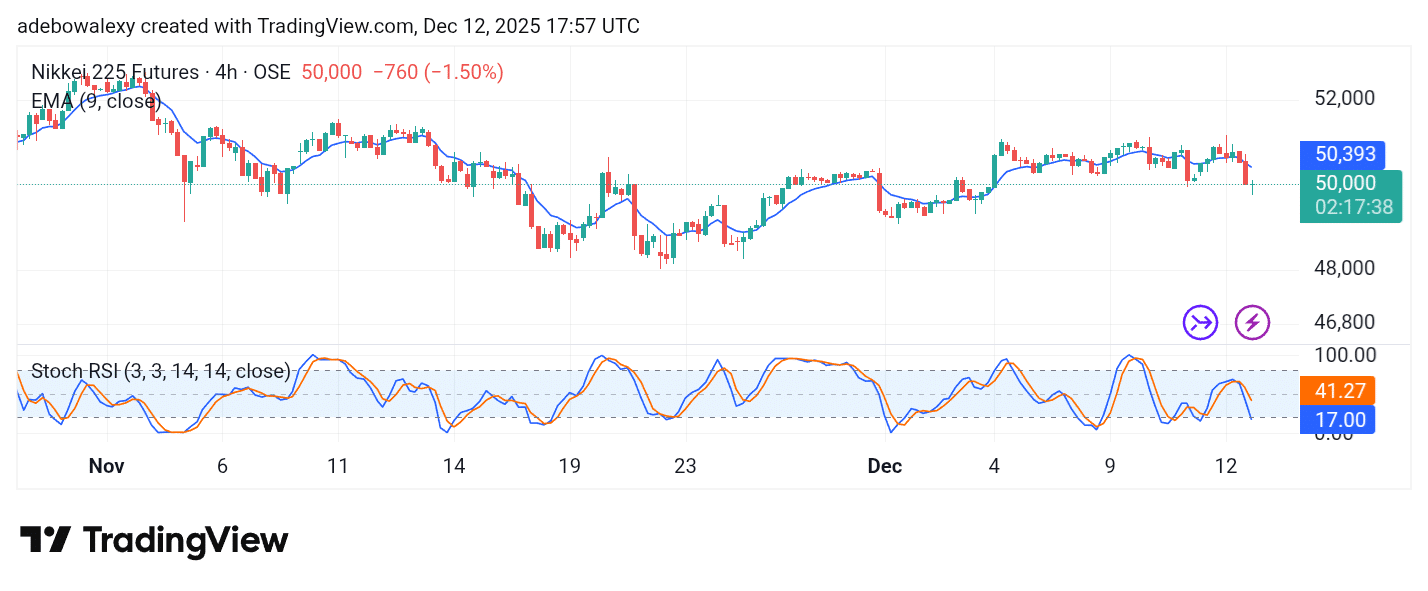

With stocks not performing well globally, it could be seen that the Japan 225 is shaping that way as well. This has brought the futures to retreat below some key technical levels at the close of the week’s trading.

Key Levels

Resistance: 51,000, 52,000, 53,000

Support: 49,000, 48,000, 46,000

Japan 225 Crosses Into Bearish Territory

With a last-ditch effort, bullish resistance in the NIKKEI 225 market breached the bullish defense at the 9-day Exponential Moving Average line. As a result, this has brought the futures to now trade below this level as bears position to gather more gains.

The Stochastic Relative Strength Index (SRSI) indicator lines can be seen descending more decisively via the lead line. Albeit, it does seem like the movement of the SRSI indicator lines is moving too fast when considering the actual movement of price action. This may signal that a re-entry point for upside forces is available.

NIKKEI Makes a Re-Entry Move

The Japan 225 4-hour chart has affirmed the earlier stated opinion above. While the market significantly dipped in the previous session, the last price candle on the chart has arrived bullish. However, it appears upside forces may be facing an uphill task considering the location of the current session.

Also, the SRSI indicator lines are dropping strongly into the oversold region. Despite all this, one thing is definite, and that is the fact that upside forces are mounting a resistance to bearish pressure at a psychological support (50,000). Therefore, it seems logical for traders to anticipate an upward bounce toward the 51,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.