The Japan 225 market has experienced a notable upside rebound over the past week. The index has continued edging higher in subsequent sessions, and at this stage, bullish momentum appears ready to push for further gains.

Key Levels

Resistance: 43,500, 44,500, 46,000

Support: 42,000, 40,500, 39,000

NIKKEI Upside Progress Looks Strong

While the Japan 225 has posted significant gains, indicators suggest that upward momentum is likely to continue.

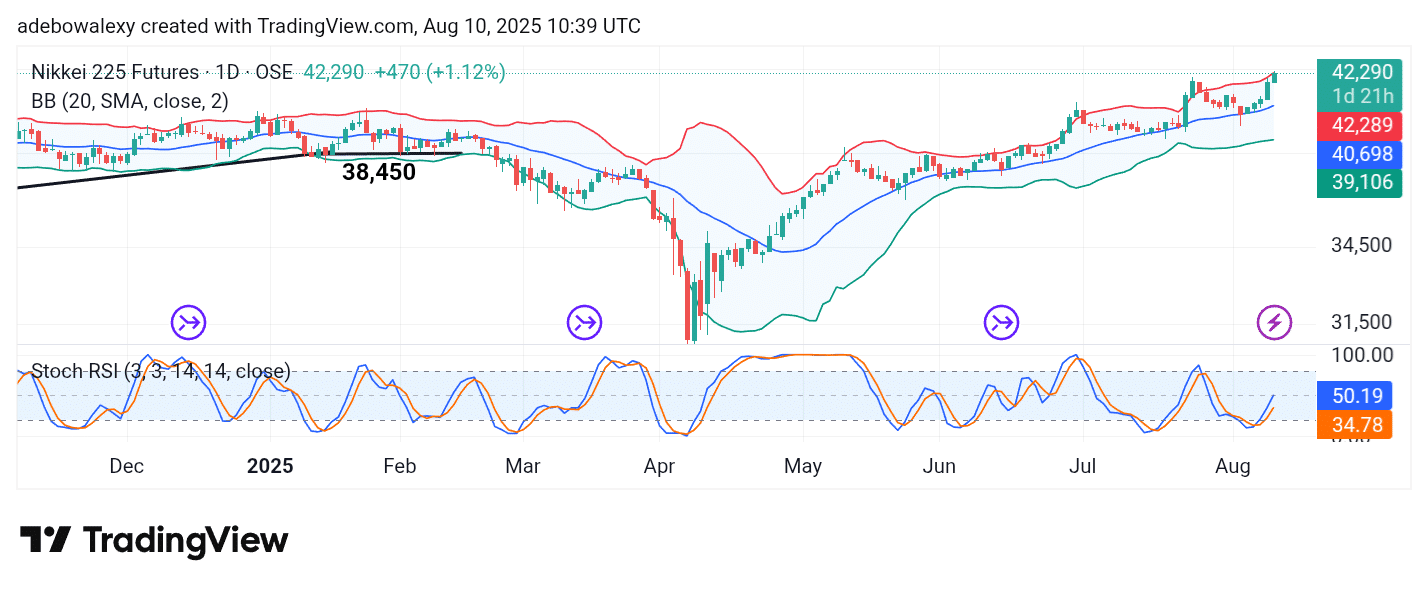

On the daily futures chart, the Bollinger Bands (BB) indicator maintains a steady upward slope, with its upper boundary widening to accommodate potential price increases.

Meanwhile, the Stochastic Relative Strength Index (SRSI) lines are still climbing out of the oversold region, reinforcing the technical outlook for continued upward movement.

Japan 225 Bulls Are Resisting Downward Pressure

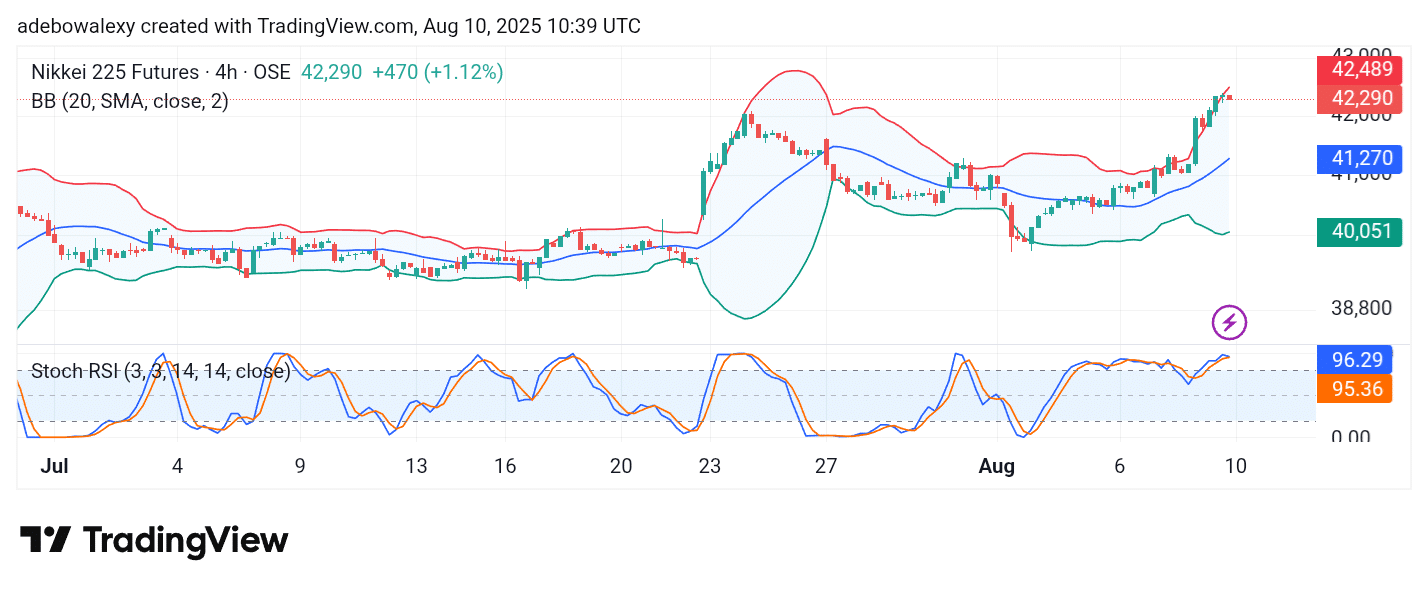

On the NIKKEI 225 4-hour chart, the last two sessions show a consolidation phase, keeping the market firmly above the 42,000 support level. The BB indicator remains well-spread, signaling room for further gains.

However, the SRSI lines have moved deep into the overbought territory, hinting at a possible pullback. That said, the next major move will likely hinge on emerging fundamental drivers. Traders will be watching closely for catalysts that could propel the index toward 43,500 and potentially beyond.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.