Following the announcement of a new U.S. trade tariff ahead of the trade talk deadline, shockwaves rippled through the futures market, causing most stocks and indices to tumble. The Japan 225 (NIKKEI 225) has not been spared. As a result, this index has been trending downward, breaching key psychological support levels.

Key Levels

Resistance: 41,000, 43,500, 46,000

Support: 39,000, 37,000, 35,000

NIKKEI May Descend Lower

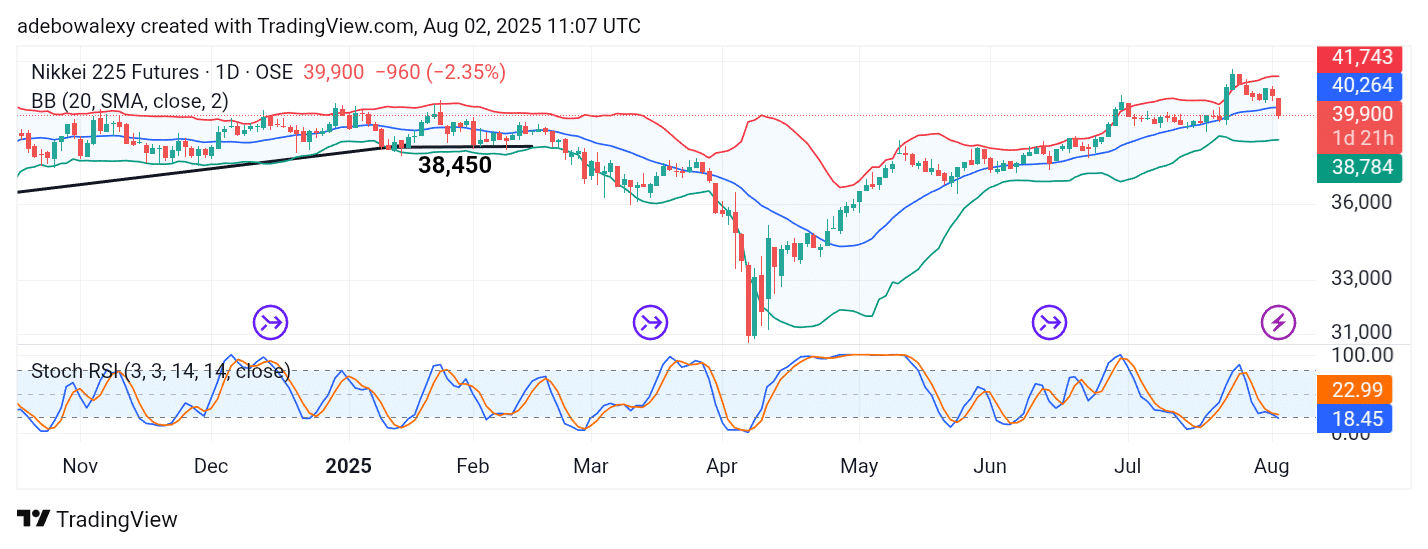

Price action on the Japan 225 daily chart appears to have recently failed a bearish test. The latest price candle is seen breaching the support formed by the middle band of the Bollinger Bands (BB) indicator. However, the BB itself still maintains a generally upward trajectory.

Meanwhile, the Stochastic Relative Strength Index (SRSI) continues to move southward, even after an unsuccessful attempt to cross upward below the 50 mark. The appearance of a prominent red candle suggests that the market may be poised for further downward retracements.

Headwinds Likely to Persist in the Japan 225

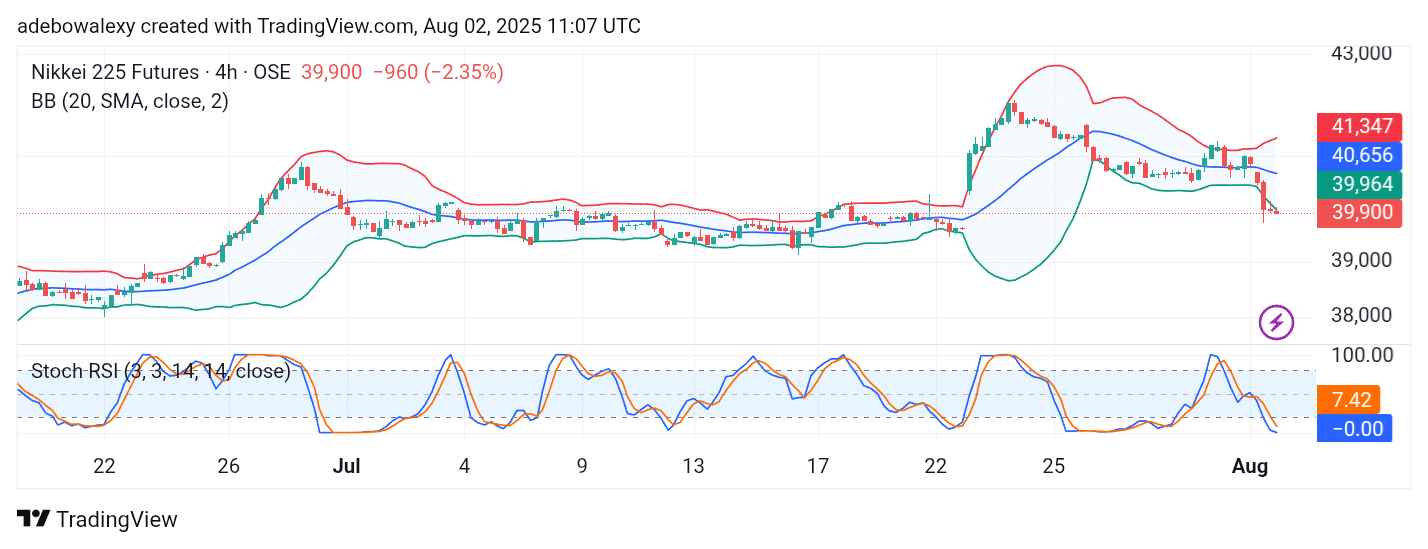

On the 4-hour chart of the NIKKEI 225, price action continues to press lower. The most recent two candles are clearly positioned below the lower band of the BB indicator. However, since price action has pushed beyond the indicator’s lowest limit, the downward momentum appears to be weakening.

In addition, the SRSI lines have descended deeper into the oversold region, indicating ongoing bearish pressure. Consequently, the market may still test the 39,500 and 39,000 support levels in the near term.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.