Japan 225 price action has managed to stage a rebound above a key technical level. This comes after the market tested a new all-time high around the 58,000 price level. This rebound suggests that buyers may be re-entering the market.

Key Levels

Resistance: 57,000, 58,000, 59,000

Support: 55,000, 54,000, 53,000

Japan 225 Recoils Off the 58,000 Ceiling

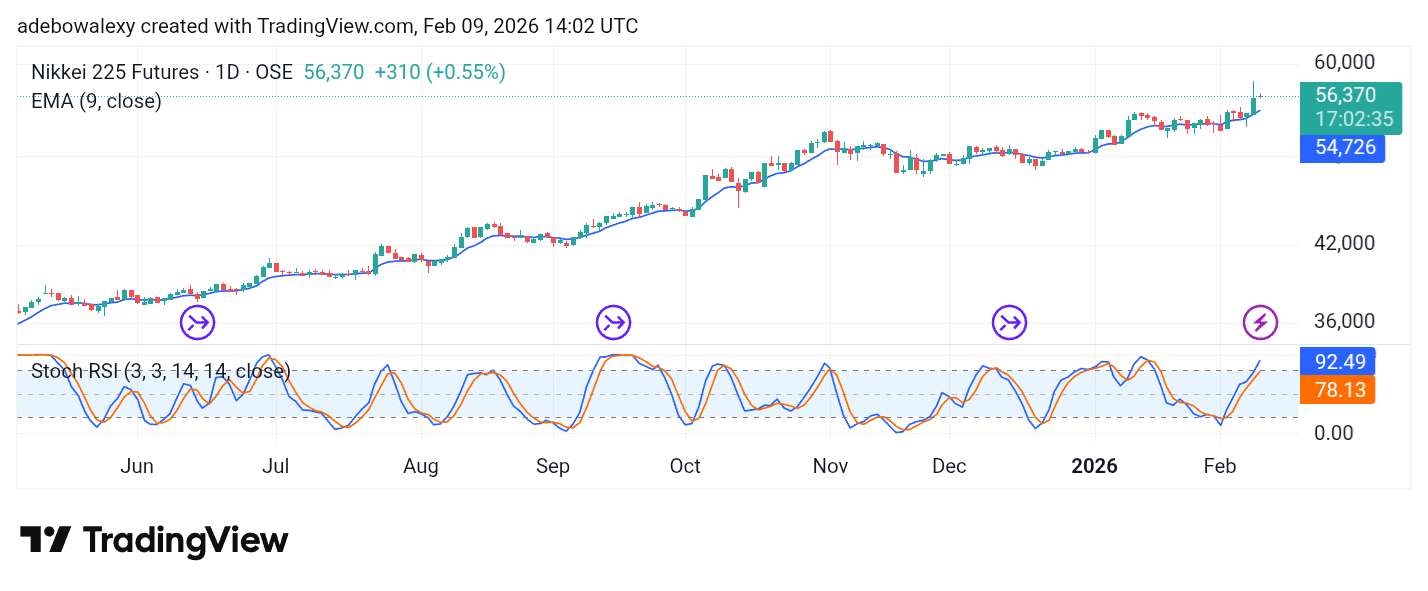

Price activity in the Nikkei 225 market has maintained a long-term upward trajectory. The market earlier established a base above the 50,000 price mark and subsequently pushed higher.

More recently, the index rebounded off the 58,000 resistance level but now appears to be applying the brakes just above the 9-day Exponential Moving Average (EMA) line.

Meanwhile, the lines of the Stochastic Relative Strength Index (SRSI) indicator are rising steeply toward the overbought region. As a result, upside momentum appears increasingly prominent.

Nikkei Stays Afloat

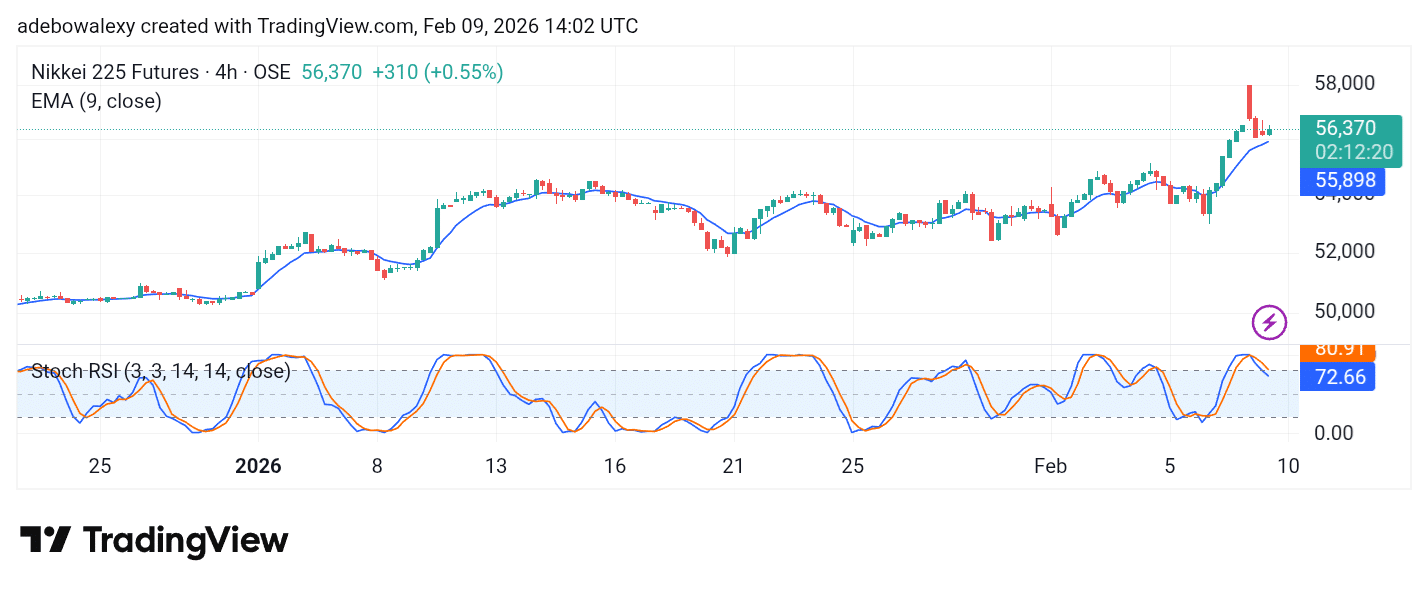

The aforementioned downward rejection in the Japan 225 market is clearly visible on the 4-hour price chart. Here, the most recent price candle is green and has formed just above the 9-day EMA curve. Furthermore, the SRSI lines are dipping toward the 70 level of the indicator.

However, traders may take confidence from the fact that price action has rebounded above the 9-day EMA curve and could resume upward movement, with focus returning to the 58,000 price level.

Make money without lifting your fingers: Start trading smarter today

Related Resources

- Stock & Index Trading Signals — alerts for US30, NAS100, S&P 500

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.