The Indian rupee showcased its most remarkable single-day surge in over two months today, confounding market observers and eliciting a wave of interest. The driving forces behind this surge are attributed to a substantial influx of dollars into the equity markets and strategic sales of the greenback orchestrated by state-run banks.

Indian Rupee Jumps to Three-Week High Against USD

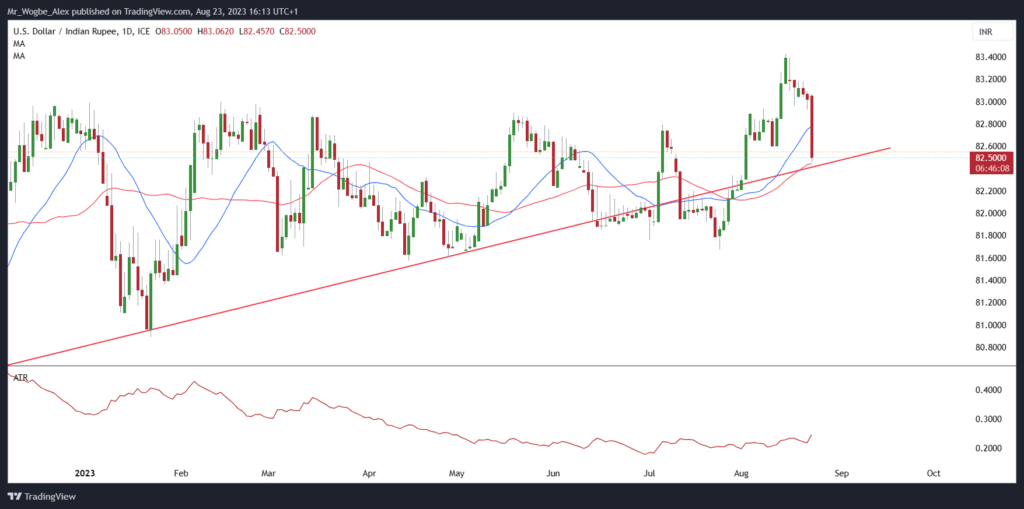

As of the time of writing, the rupee is up by an impressive 0.63% after reaching a three-week high of 82.45 against the U.S. dollar earlier today. This marked improvement from the preceding session’s close at 83.02 undoubtedly captured the attention of traders and investors alike.

The late-hour vigor injected into the market by state-run banks, characterized by their deliberate shedding of dollars, played a pivotal role in tempering the strength of the dollar-rupee pairing. According to Reuters, a seasoned trader from one such institution underscored the significance of this concerted effort, affirming its impact on overall market sentiment.

As the Indian central bank, the Reserve Bank of India, proactively engages in measures to alleviate pressure on the national currency, fresh dynamics come into play. Recent reports have surfaced, revealing that the Reserve Bank has steered select banks away from initiating fresh arbitrage positions within the non-deliverable forwards (NDF) market. This strategic maneuver is aimed at buttressing the rupee’s performance against external pressures.

In the broader panorama, even as the dollar exhibits its ascendancy against a range of Asian currencies, the Indian rupee remains resolute, maintaining its stance above the crucial 83 INR benchmark. The elevation in U.S. Treasury yields nearing maturity has inevitably led to waning demand for various Asian currencies.

In the backdrop of a resilient U.S. economy, investor sentiment takes center stage, swayed by contemplations on the duration of prolonged high interest rates. The recent milestone of the 10-year U.S. yield scaling multi-year highs set a precedent, infusing markets with both curiosity and caution.

Traders Wait in Anticipation Ahead of Jackson Hole Symposium

Anticipation reaches its zenith as the market eagerly awaits the impending address by Fed Chair Jerome Powell at the illustrious Jackson Hole Symposium. Scheduled for Friday, this discourse is poised to unravel the enigma of the impending interest rate trajectory, a subject that has commanded much attention and speculation.

Simultaneously, market participants keenly anticipate the curtain-raiser in the form of the release of the Reserve Bank of India’s monetary policy committee meeting minutes, slated for Thursday. These minutes hold the promise of illuminating the central bank’s strategies, thereby providing a compass for the market’s near-term navigation.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.