Forex EAs seem to be all over social media, with claims from various celebrities endorsing them. If you haven’t considered using the best Forex EA yourself, they offer a passage to passive income.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Fundamentally, a forex EA acts as a forex market Personal Assistant. Using pre-set rules, parameters and technical analysis – the EA can buy/sell forex on your behalf. Some traders opt for a semi-automated experience, which means adjusting some of the EA filter and feature settings and leaving it to run.

Other investors want an end-to-end experience and choose a fully automated forex EA. This is great for experienced traders who simply don’t have as much time to trade as they would like. Furthermore, this setting is ideal for newbies who don’t know where to start in the volatile world of forex trading.

In this guide, we’ve compiled a comprehensive guide to Forex EAs. This covers all aspects, such as how they work, the benefits, what to look out for before parting with your money, and an overview of the 5 best forex EAs of 2026.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What are Forex EAs?

A huge part of trading in the forex market (and any other investment sector) is research and keeping your eye on the ball. This means dedicating a lot of time to observing changes in the currency market and keeping up to date with economical and financial news.

Many forex investors trade full-time, and each has their own plan of action. For example, a trader might dedicate 7 hours per day to making moves within the forex market via research.

At the other end of the scale, there are traders who simply don’t have the time to learn the forex market effectively. We live in a busy world, and this is where automated EA technology comes in.

Year on year more forex traders are utilising these multifaceted systems. They are designed to execute an end-to-end forex trade without you having to lift a finger.

All you have to do is deposit some funds into your brokerage account, load up the robot, and you can get on with your life. As such, the forex EA will manage everything for you.

How do Forex EAs Work?

Fundamentally, a forex EA is a trading system which uses technical analysis and predetermined algorithms. The EA searches the forex market looking for potentially lucrative trades.

As we touched on, this can be semi-automated, or fully automated and based on a preprogrammed strategy. The clear benefits of using a forex EA to trade is its ability to enter buy and sell positions 24/7. Not to mention, the obvious lack of trading emotions. More on that next.

What are the Benefits of Forex EAs?

By this point, you know that forex EAs allow you to trade forex without you having to do a thing. If you’re not already sold on the potential benefits of using a forex EA, then read on.

Beneficial for Inexperienced Traders

As we mentioned, one of the biggest benefits of using an EA to trade is that investors have access to a massive global forex market. Consequently, this avoids the need to learn how to trade and read price charts and technical data.

It is, for this reason, that the process can be very time-consuming. After all, spending months on-end learning how to trade from scratch is a very demanding task. The best forex EAs will enable you to skip the need to understand price trends, charts and indicators.

Therefore, the forex EA lets traders participate in forex investing, and because it’s automated, you can just sit back and relax.

24/7 Trading Abilities

Forex EAs shine brightly here as well. A complex computer system doesn’t need 8 hours of sleep to function as humans do.

For example:

- Let’s say that you trade forex full time and your strategy includes dedicating 6 hours per day researching the markets, and 3 hours acting on your findings.

- Whilst the 9 hours you spend putting your strategy into action might be profitable – envisage how much profit you could potentially gain if you could research 24 hours every day?

We need rest and sleep to function properly in our day to day lives, whereas a forex EA can fulfil your trading needs 24/7.

This is ideal for people who work full time but don’t want to miss out on trading opportunities. It can also act an addition to a full-time trading strategy.

No Trading Emotions

The majority of experienced traders are only too aware of the three trading emotions: hope, greed and fear.

One wrong decision based on either of these emotions can have a catastrophic effect on an investor’s portfolio. Letting the trading emotions run away with you can lead to irrational trading decisions.

A forex EA doesn’t have that problem. One of the many advantages of using a product like this is that they are logical and exact by design – making trading decisions and running numbers with no fear, hope or greed at all. The software is programmed to follow theoretical conditions.

Infinite Research

We’ve said it already, but forex EAs don’t need sleep. This means the EA is able to perform an infinite amount of research, without you having to do a thing.

A large number of well-seasoned traders focus their attention on a small number of asset classes. This is because it’s more effective to learn the ins and outs of a select few than it is to inundate yourself with more information than you can process.

It’s a little bit like the saying ‘jack of all trades – master of none’. It would be virtually impossible to effectively research a large number of assets and become successful. Imperatively, integrating such asset diversification manually is a very challenging process to master.

Furthermore, forex EAs are not limited in the same way human traders are. This sophisticated software can scan thousands of different markets at once with hardly any strain on it’s processing capacity.

How Much Will a Forex EA Cost?

There isn’t a clear-cut answer to pricing, as no-two forex EAs are the same. Some forex EA providers work on a commission-based structure. As a result, the platform will take a pre-decided commission (in the form of a percentage) from each successful trade made on your behalf.

Let’s give you an example; imagine that the forex EA provider you have chosen requires a 10% commission rate:

- We’ll say you deposit $1,500 into the forex EA platform.

- 80 trades are made during the month.

- The ROI is 12% – which is $180.

- Next, the provider takes the commission of 10% which is the equivalent of $18.

- You will be left with $162 in gains.

One of the good things about this kind of commission structure is that the EA platform will only make a profit when your trades are successful.

As you can see, it’s in the best interest of the EA developers to place cautious trades to increase your ROI.

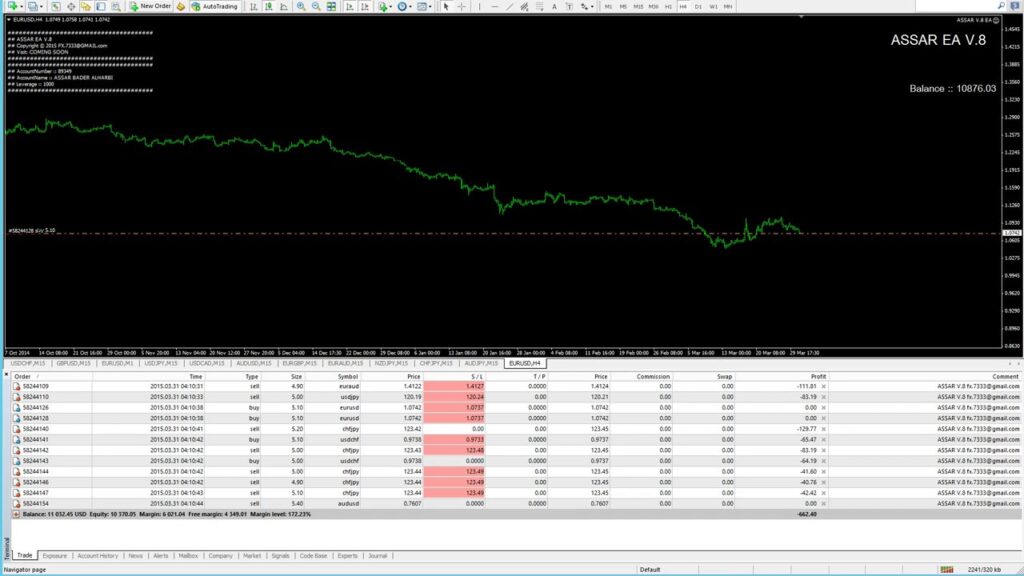

Meta-Trader Software

In the majority of cases, you will just need to pay a one-off fee to obtain a forex EA in the form of software. The platform emails an activation link to you. You then need to install the EA system via a third-party trading platform such as MetaTrader4 or MetaTrader 5. In the case of a flat fee product, there will be no commission as you own the underlying product.

The only possible negative here is that you won’t gain from maintenance. However, all is not lost, as the best forex EAs come with free updates and 24/7 customer support.

Are Forex EAs Safe to use?

There are hundreds if not thousands of providers all vying for traders’ attention, offering results they can’t deliver such as big returns and win rates of 90%.

The chances are these sites are bogus. Any provider offering such far fetched results is almost certainly trying their luck on innocent traders. Sadly, some traders don’t find out these claims are unfounded until it’s too late and they’ve kissed their money goodbye.

Some sound advice would be if you’re unsure about a provider, do some research. Joining a platform offering a free trial period or money-back guarantee is a great idea in this respect. At Least that way, you can leave if it’s not all it’s cracked up to be. In doing so, you’re going in with your eyes open, and not leaving yourself, and your money, vulnerable.

How to Choose a Suitable Forex EA?

Proceed with mindfulness, not least because knowing that forex EA scammers are out there can save traders getting stung for thousands of dollars. There will always be unscrupulous websites just waiting to take advantage. It’s important to be cautious.

With that mind, we would suggest making the following considerations prior to purchasing a forex EA.

Are the Forex EA Claims Genuine?

It’s easy to make promises of 90% monthly returns. After all, anyone willing can set up a website offering the moon on a stick. A good rule of thumb is ‘if it seems too good to be true – then it probably is’.

If the forex EA platform you are looking at is promising huge monthly profits with low risk – that should raise alarm bells. As we covered, it’s a good idea to choose forex EAs which provides authentication for it’s claimed results.

These stats illustrate how the forex EA performs over a period of time. A genuine platform will provide access to all of this useful information, to prove they are legitimate and not just good at marketing.

What’s the Minimum Deposit?

Some forex EA providers specify a minimum deposit amount before letting you access the EA system. With that in mind, you should always check the site’s terms and conditions to check the minimum deposit required.

It would be demoralising to invest $1,500 of your hard-earned cash, only to discover later that it was a swindling EA platform. More often than not the minimum deposit will be around the $200 mark, although on some sites this is just a suggestion. If the provider offers clients a money-back guarantee, that is a positive sign.

On the flip side, if you are using forex EA software that is compatible with MT4/5, then the minimum deposit will be dependent on your choice of broker.

How Much Automation do you Want?

As you’re now aware, there is a lot of variation in terms of how automated an EA can be. As such, you should consider how hands-on you would like to be in the trading process.

- Would you like to have a certain amount of control? Some traders favour using the forex EA to execute forex market research, but then manually enter buy and sell positions themselves.

- Perhaps you would prefer to put in the money and let the EA do all of the work? This means that you can make the most of an end-to-end service, doing absolutely nothing.

- When it comes to buying and selling, some traders like to have a say in whether or not to act on the EA’s findings. So, rather than letting the EA decide, you could wait for a signal and then enter your own buy/sell and stop-loss/take-profit conditions.

Ultimately, it’s your choice – and will depend on your trading style and experience in forex trading. It’s worth checking out the EA provider’s website to see what trading pattern and strategy the software uses.

What Payment Options are Available?

On the subject of payment options, all forex EA platforms are different. For example, some might only accept cryptocurrencies or PayPal. Then there will be the providers who will accept a range of more conventional payment methods (such as debit/credit cards).

If there is a specific payment method you need to use, it’s important to check what is available before you do hours of research and build your hopes up.

Is There a Redemption Period?

Being unable to access your funds can be a real chink in the armour. It’s a good idea to check the terms and conditions of the forex EA provider to make sure there is no redemption period or withdrawal limitations.

Of course, this particular consideration is only relevant if you are opting for a 100% automated process – meaning that the provider will deploy the robot at their chosen brokerage site.

What Currency Pairs am I Able to Trade?

Some forex EAs trade all currency pairs under the sun. Whereas others specialise in a set few, or even in just one.

This is especially important information with regards to where your precious money is being invested.

Further Considerations

There are a few other things to consider when you’re on the hunt for your perfectly suited forex EA. Baring in mind that you will be risking your hard-earned money, we would suggest reading through the following points.

Are There Order Size Limitations?

Another great use for EA demo accounts is evaluating the EA’s performance when changing your order size. Some platforms might only perform well with small orders and don’t handle change.

The best forex EAs will perform the same regardless of these factors.

Are Live Trading Results Available?

We’ve warned you of the perils of fraudulent forex EAs. The best platforms provide real-time trading results, because simulated results can be controlled. Simulated trading is unable to show liquidity, which is crucial for live forex trading.

Has the EA Provider Been Backtested?

Backtesting isn’t the most important information about a forex EA. But, it is going to give you a good idea of how the EA software works in different market conditions. This includes metrics like high volatility and economical changes.

What is the Forex EA Drawdown Percentage?

Drawdown is the difference between the nearest low price point and the high point. The contrast between the balance of your trading account shows the lost profit from lost trades.

Some traders like a cautious maximum drawdown of 5%, whereas some are happy to go as high as 15%. It is entirely down to personal choice. This information will be available for both trade by trade, and consecutive.

How to Get Started With a Forex EA

Like the sound of how forex EAs work and want to deploy a robot of your own? If so, we are now going to explain how to sign up to a forex EA provider to get you started on the right track.

Step 1: Choose a Forex EA Provider

To begin, you need to select a forex EA you want to use to trade. If you’re struggling to find one, we’ve included our best forex EAs of 2026 further down this page.

Step 2: Decide on Your Trading Preferences

Some forex EAs offer a selection of trading possibilities such as different assets, take profit and stop-loss options.

If you are inexperienced in the forex market, then a fully automated EA will probably be the best route for you. By letting the EA do all of the work you can start trading right away.

Again, taking advantage of a free trial or demo account is a good way to find your feet with the platform.

Step 3: Make a Deposit and Start Trading

Once you have selected the forex EA account and either received or downloaded the software – you can deposit some funds. As we’ve said, always check which payment methods are accepted.

If you choose a manual account you will need to action trades yourself. If you have decided to stick with 100% automated you can sit back and relax. Most forex EA providers will let traders change these settings at a later date.

Buy a Forex EA for MetaTrader 4/MetaTrader 5

In the case of buying an EA from an online platform and downloading it – the process is simple. All you need to do is upload the file into either MetaTrader 4 or MetaTrader 5 and the forex EA will start trading almost immediately. The respective website will always state which platform is needed.

You can still set up your own minimum and maximum order size as well as various other adjustments to suit your strategy. When using this option we recommend running it on the demo account to make sure it’s working as it should.

How to Spot an Accredited Forex Broker

When you’ve purchased a forex EA that requires MT4/MT5 – you’ll need to sign up to a reputable forex broker to use it. After all, the software needs a platform to be able to make trades for you!

Always check that the forex broker is above board, fully licenced, and regulated by the appropriate body. Any legitimate forex broker has to adhere to strict licensing rules – such as fund segregation. Essentially, the brokerage must keep clients funds away from its own to protect it against any business debt etc.

All brokers must provide annual reports showing client activity. Regulatory bodies scrutinise the provided data. In the case of corruption, the regulator is well within its right to action appropriate consequences.

There are dozens of forex broker regulators worldwide. Some of the better-known bodies are:

- ASIC: Australian Securities and Investments Commission.

- FCA: Financial Conduct Authority (United Kingdom).

- CFTC: Commodities and Futures Trading Commission (United States).

- BaFIN: The Bundesanstalt für Finanzdienstleistungsaufsicht (Germany).

- CySec: Cyprus Securities and Exchange Commission.

Crucially, if your chosen forex broker is not regulated by a tier-one licensing body – avoid it.

The Best Forex EAs of 2026

There are thousands of providers offering ‘all singing and all dancing’ forex robots. Most of them offer traders a ‘get rich quick’ alternative to traditional trading. But the truth is, there are a lot of fake and phoney companies waiting to pounce on unsuspecting traders.

Having said that, we have warned you throughout this guide about the potential downfalls of choosing the wrong forex EA. Consequently, you now know what to look out for.

Here we have put together a list of the top 5 forex EAs to consider in 2026.

1. FX Fury

This has to be one of the more reputable forex EAs on our list. It makes trades every day using highly methodological strategies and a low amount of risk. This forex EA can trade as many as 7 currency pairs at any one time, and trades can be left open for a lengthy amount of time. In terms of its trading strategy - FX Fury is a scalper that runs on an M15 time frame and enforces trading time restrictions.

Especially in recent years, this robot has shown the ability to adapt to the latest trends in the market. At this point in time, the FX Fury EA has had over sixty automatic updates, which is a great sign. You can test as many theories as you like with this robot EA provider, as it provides unlimited demos with every licence.

Even if you are just looking to deploy a robot to do your forex research, the provider has you covered. The FX Fury EA has some other things going for it as well. For example, over 2,500 people use FX Fury on their forex trading accounts every single day. This reputable forex EA provider is constantly updating and bettering its product for traders.

- Compatible with MT4

- Claimed win rate of 93%

- Results verified via Myfxbook

”2.

”

For traders who like to grow their trading portfolio slowly over time, there’s ‘Forex Steam 10 EA light’. We found this forex EA to be one of the best value-for-money products on the market. ” ” pros1=”Average win rate of 75%” pros2=”Claims to attract 3,000 new clients every day” pros3=”Simple pricing structure” cons1=”” cons2=”” cons3=”” cta-label=”Visit Forex Steam 10″ cta-url=”https://learn2.trade/visit/forex-steam-10″ disclaimer-text=”There are no guarantees that you will make money with this provider”]

3. Binary Strategy Forex Robot

Real-life traders and coders created this Binary Strategy Forex EA. As you might have guessed, this forex EA concentrates on the binary options market. It has to be said that the binary options market is particularly prone to swindlers. So if this is a market which interests you then practice caution before commitment. This forex EA provides 2 strategy options which are based on divergence.

The two strategies are ‘valor’ and ‘spirit’. Unlike some forex EA providers, Binary Strategy Forex provides both products for the price of one. Overall, the majority of brokers will accept these strategies. Although you might discover that as far as binary options go, some forex EA designers don’t make the results readily available. In this case, Myfxbook (a third-party testing site) won’t have access to host these results.

The Binary Strategy Forex EA provides daily trading results which can all be found on the website. The platform provides detailed backtesting techniques on MT4. This means the software was fully tested for years and years before they started trading.

Here is a handful of features you should expect from this forex EA:

- Forex robot type: Binary Options.

- Price: Under $200.

- All pairs available.

- M15 timeframe (expiry time 15 minutes).

- Average of 70-95% win rate.

- Price of less than $200

- Can trade any current pair

- Average win rate of between 70%-95%

4. Forex Astrobot

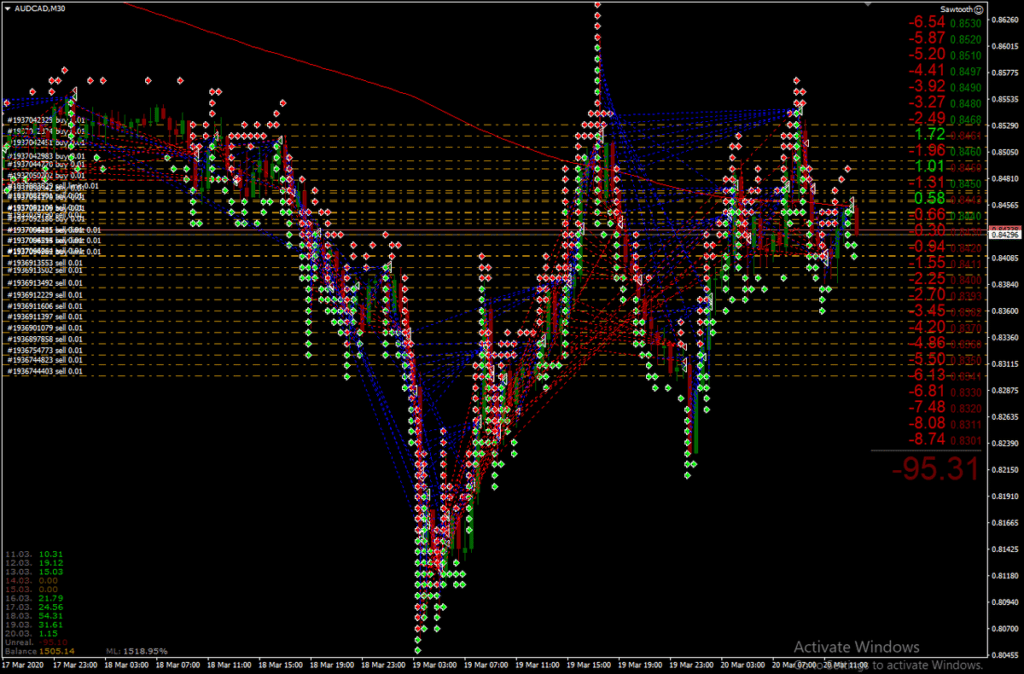

This forex EA is fully automated and says that traders can make a profit of as up to $16,000 in one month. Rita Lasker (renowned forex trader) created Forex Astrobot. This MetaTrader4 forex EA allows you to trade different time frames such as M15, M30 and H1 - and covers most currency pairs. You will be made aware of any new trading opportunities in one of three ways: email, MT4 popup alert or mobile push notification.

This forex EA has a built-in money management feature. This means you can alter the size of your lot when market conditions are potentially going in your favour. In the event of an extreme price shift, the forex EA uses a built-in algorithm named ‘slippage’. This tool can stop you from going into a forex trade with the wrong parameters.

Depending on the condition of the market the TakeProfit feature in this EA offers up to 3 take profit levels. Forex Astrobot EA also has the following features as part of the product:

- Average win rate up to 80%.

- M15, M30 and H1 timeframe.

- All pairs available.

- Cost - from $100 to around $230 (for the ‘ultimate version’).

- Trailing stop strategy.

- 24/7 support.

If you purchase this forex EA and don’t like it for whatever reason, you can take advantage of the 30-day money-back guarantee and cancel it.

- 24/7 support available

- Claims an average win rate of up to 80%

- 30-day money-back guarantee

5. Robomaster EU

The Robomaster EU designers highly recommend this forex EA for professional scalpers. You can purchase a single licence for €149 or the unlimited licence account for €199.

- 3 robots to choose from

- Fair pricing model

- Lots of forex strategies included

EA Trade Machine

This was the second forex EA released by Robomaster.eu and also uses a scalping strategy. The forex EA comes with preprogrammed settings, simple user instructions and customer support. The price tag for the EA Trade Machine is €199 for an unlimited account, and €149 for a standard account.

Features offered by the EA Trade Machine providers include:

- M5 timeframe Pacific, Asian and American session trading time.

- 7 currency pairs.

- 20% – 50% potential profit (per month).

- The strategy is stated as ‘trading in the direction of global trends’ (channel trading).

Rocket EA

Rocket EA includes a step-by-step user manual, pre-optimised setting files and 24/7 customer support. The Rocket EA trades 12 currency pairs at once, which means the software is able to diversify your risk. If you’re interested in trading results, there are 12 separate backtests. Whilst that doesn’t seem like much, it’s a step in the right direction.

Some of the features you can expect from Rocket EA are as follows:

- Trades 24 hours a day, 5 days a week.

- Asian trading time.

- 10% – 20% potential profit.

- 15 currency pairs for trading.

- M15 timeframe.

Anglerfish Forex EA

This forex EA studies trends on M5, M15, H1 and H4 time schedules. The provider claims that the potential gains are 10%-30% per calendar month.

The following currency pairs can be traded on this EA; EUR/USD, EUR/GBP, GBP/USD, EUR/AUD, USD/JPY, EUR/CA.

Anglerfish Forex EA costs €175 for the economy version of the product (1 licence), and €225 for Anglerfish Full with unlimited licences. Both include detailed user manuals, support 24/7 and set up files for automatic product configuration.

Some of the key features and filters included on the Anglerfish Forex EA software are:

- Price slippage filter.

- Maximum spread.

- Stop-loss system.

- Trade time filter.

- Robomaster.eu claims a 98% success rate on trades with Anglerfish.

Forex EA Big Fish

This forex EA was designed to deal with all market conditions. The goal is to provide a steady profit by using a flexible algorithm. The price of the Big Fish EA is €97 for a single licence, and €120 for the unlimited licence version.

Like the other 3 forex EAs by this group, it comes with 24/7 customer support, detailed manuals and setting files.

The robomaster.eu platform has summarised what’s on offer with the Big Fish EA as:

- Trades 24 hours a day, 5 days a week.

- Created to trade USD/JPY.

- 10% – 50% profit potential.

- Trades on pullbacks (depending on what direction the trend is going).

- M5 timeframe.

Best Forex EAS: In Conclusion

The bottom line is that forex EAs are a superb way to trade without lifting a finger, meaning that you can avoid the need to understand charts and research for months on-end.

Becoming a well-seasoned forex trader can take years, so it’s no wonder more newbies are turning to forex EAs for easy access to the market. You simply download the EA of your choice and let it do all of the buying, selling and technical analysis for you.

And professional investors aren’t missing a trick either. By altering a few settings and allowing the EA to be semi-automated, this clever algorithmic software is also a great addition to an existing forex trading strategy.

Crucially, taking full advantage of all free trials, money-back guarantees and demo accounts is a logical way to find your feet in the forex EA space before you throw money into it blindly.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

Can I use more than one forex EA on the same account?

Will there be any monthly fees when using a forex EA?

Is there a minimum deposit required to trade with a forex EA account?

How do I know if a forex broker is legitimate?

Am I able to cancel a forex EA if I don't like it?

Read more related Articles:

Forex Trading for Beginners: How to Trade Forex and Find the Best Platform 2024