The digital assets industry has changed dramatically in recent years. What was once seen as a risky bet is now becoming a standard part of investment portfolios. A recent CoinShares report shows how this shift happened and what it means for investors.

According to research by James Butterfill of CoinShares, institutional investors have changed how they view Bitcoin and other digital assets. What started as casual coffee shop meetings five years ago has evolved into formal boardroom discussions with Chief Investment Officers.

Why Investors Are Adding Digital Assets to Their Portfolios

The reasons for investing in digital assets have changed significantly. In early 2024, “diversification” replaced “speculation” as the top reason investors added digital assets to their portfolios.

This shift happened around the same time as the launch of spot Bitcoin ETFs in the United States.

These ETFs gave digital assets the credibility they needed. With major regulators essentially giving Bitcoin their stamp of approval, investment committees became more comfortable discussing it as a legitimate option.

The data shows that speculation is no longer the main driver for investment. It now typically ranks third or fourth, falling behind client demand, diversification, and blockchain technology exposure.

Growing Allocation in Investment Portfolios

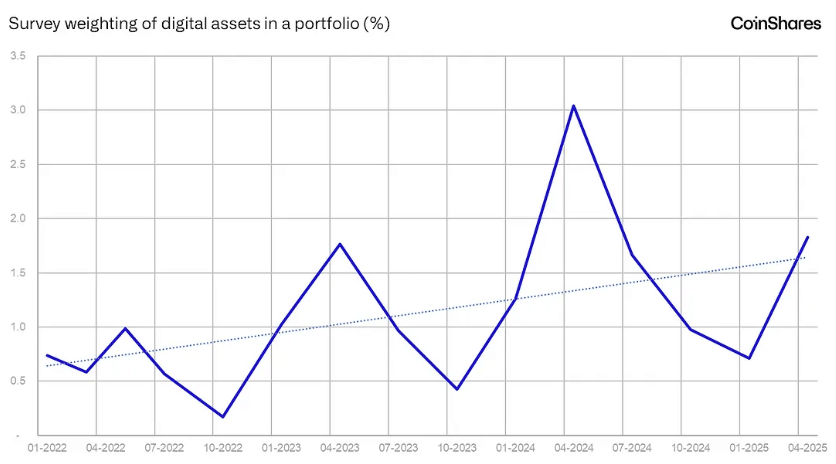

Investment in digital assets continues to grow steadily. The CoinShares survey reveals that average allocations have increased from about 0.5% to over 1.5% since 2021.

Different types of investors show different levels of comfort with crypto assets:

- Family offices and hedge funds tend to have the highest exposure

- Wealth managers remain more cautious

- Institutional investors typically hold smaller positions

- Even pension funds are beginning to build positions

The research found that adding just a 4% Bitcoin allocation to a standard 60/40 equity-bond portfolio increases volatility by only about 100 basis points while potentially doubling the Sharpe ratio (a measure of risk-adjusted returns).

This improved understanding of how digital assets work has helped address common misconceptions. For example, the report notes that Bitcoin’s environmental impact is often overstated, with 56% of mining now powered by renewable energy.

Similarly, concerns about criminal use are exaggerated, with illicit transactions accounting for just 0.6% of global money laundering.

As crypto assets continue to gain acceptance, they’re increasingly being viewed as a mainstream investment option rather than a fringe interest, marking a significant shift in the investment landscape.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.