The crypto liquidation event on October 10, 2025, was the worst day in crypto market history.

Over $19 billion in leveraged positions were wiped out within hours—a staggering figure that dwarfs every previous market crash. About 1.6 million traders watched their positions disappear as exchanges automatically closed out their accounts.

For context, this event was nearly 20 times larger than the March 2020 COVID crash and roughly 12 times bigger than the FTX collapse in November 2022.

The catalyst came late Friday afternoon (October 10, 2025) when President Trump announced a 100% tariff on all Chinese imports, set to take effect November 1.

The timing couldn’t have been worse. US equity markets had already closed for the weekend, meaning there was minimal liquidity when panic hit. Crypto markets, which never sleep, became the outlet for all that selling pressure.

But the tariff announcement alone doesn’t explain why the damage was so severe. The real culprit was massive amounts of hidden leverage built up across the system. Traders had borrowed heavily to bet on rising prices, creating a house of cards waiting to collapse.

Why This Crypto Liquidation Was Different

Several factors combined to create perfect storm conditions. Out of the $19 billion liquidated, roughly $16.7 billion were long positions compared to just $2.5 billion in shorts—a 7 to 1 ratio.

This showed that most traders were caught betting the same way, expecting prices to keep climbing.

When prices started falling, these leveraged positions got margin calls. Exchanges automatically sold off collateral to protect themselves, which pushed prices even lower. That triggered more liquidations, creating a cascade effect.

Bitcoin dropped about 15% from its high. Some smaller coins got hit even harder, with prices plunging 50-80% in just 15 minutes.

The infrastructure problems made everything worse. Major exchanges like Binance and Coinbase experienced outages as their systems struggled to handle the massive volume.

When platforms go down during a crash, traders can’t exit positions or adjust strategies. Market makers pulled back during the chaos, leaving order books one-sided with plenty of sellers but almost no buyers.

What Traders Can Learn From This Crisis

This event reinforces several crucial lessons that every crypto trader should understand:

- Avoid leverage at all costs: Many traders using even moderate amounts of borrowed money saw their entire accounts wiped out. When prices move fast, you don’t have time to react. The exchange will close your position automatically to prevent you from owing them money.

- Rethink stop-loss orders: During the crash, stops turned into market orders. With no liquidity, traders got filled at prices far worse than expected—sometimes 50% lower than where they thought their stop was set. Mental stops using price alerts give you more control.

- Diversify across exchanges: Traders who had everything on one exchange found themselves locked out when that platform went down. Spreading holdings across multiple exchanges means if one fails, you still have access to your other funds.

- Focus on longer timeframes: Short-term traders trying to catch quick moves got crushed. Those with positions on higher timeframes, like the daily or weekly charts, had better odds of surviving the volatility.

Is This a Buying Opportunity?

While $19 billion in liquidations sounds catastrophic, the market actually cleared out excessive speculation. The system flushed weak hands and overleveraged positions.

Many institutional investors saw the crash as a chance to buy quality assets at discount prices. The fact that Bitcoin held above $105,000 and quickly bounced back suggests underlying demand remains strong.

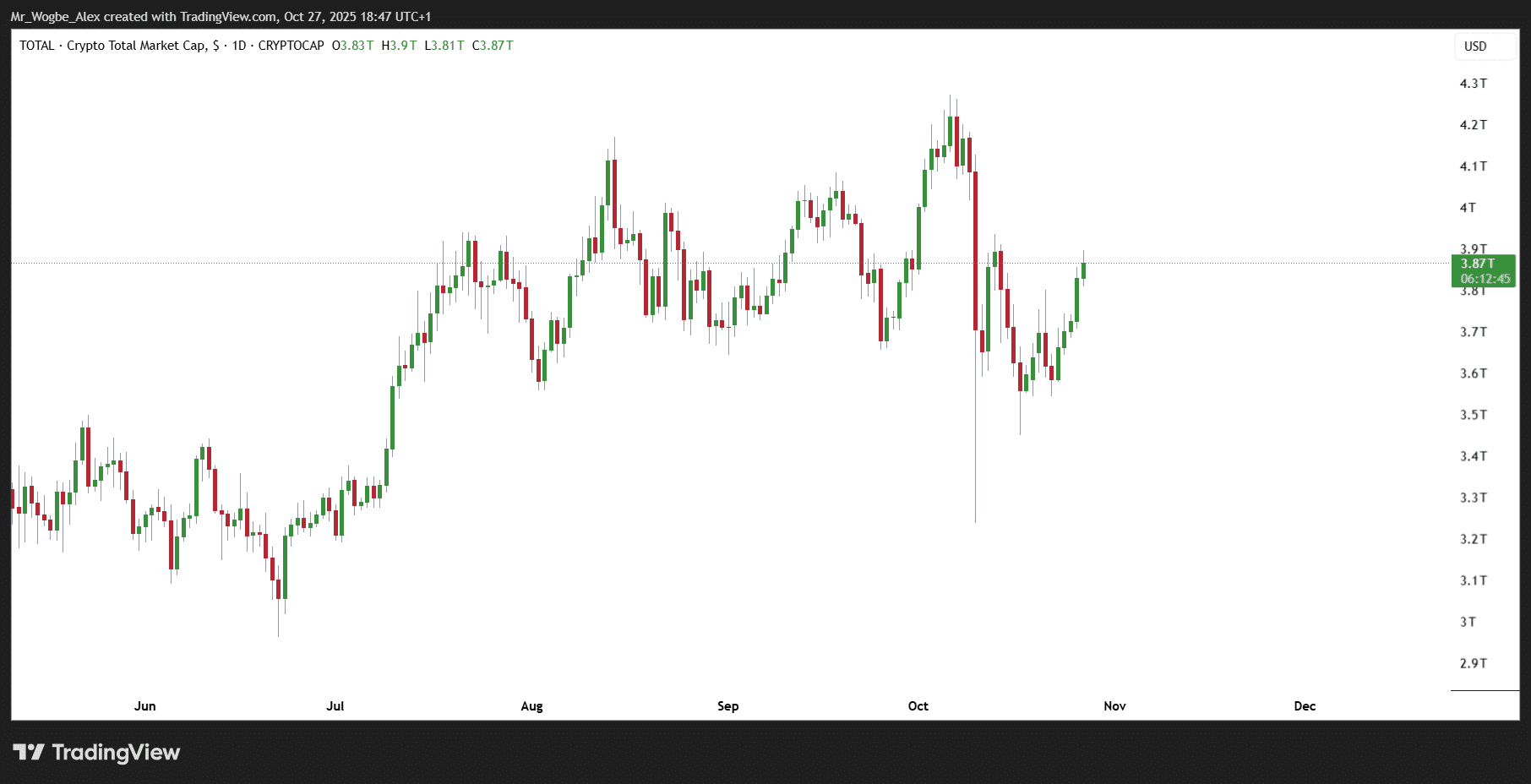

The total crypto market cap dropped from $4.13 trillion to $3.24 trillion during the crash. But within days, the market recovered to around $3.7 trillion as buyers stepped in.

Major cryptocurrencies like Bitcoin, Ethereum, and Solana took hits but maintained key support levels. Meme coins and speculative altcoins suffered much worse, with some dropping 70% or more.

This crash exposed real weaknesses in crypto market infrastructure, but the market survived. For those with strong stomachs and long time horizons, the structural forces like ETF adoption and institutional inflows continue supporting growth.

The October 10 liquidation will go down in history, but understanding why it happened and how to protect yourself is essential for anyone serious about participating in this market.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.