Bitcoin experienced one of its most dramatic sell-offs this year on Thursday, October 17, 2025, with the cryptocurrency falling to $103,000 and triggering liquidations worth $1.2 billion across crypto exchanges.

The sharp decline marks the largest daily redemption since August and signals a significant shift in market sentiment.

What Triggered the Bitcoin Crash?

The sudden price drop caught many traders off guard, particularly those who had built up leveraged positions expecting a continued rally. According to market data, nearly 79% of liquidated positions were long trades, affecting over 307,000 trading accounts.

The largest single liquidation was a $20.4 million ETH-USD position on Hyperliquid, highlighting how derivatives markets amplified the downward pressure.

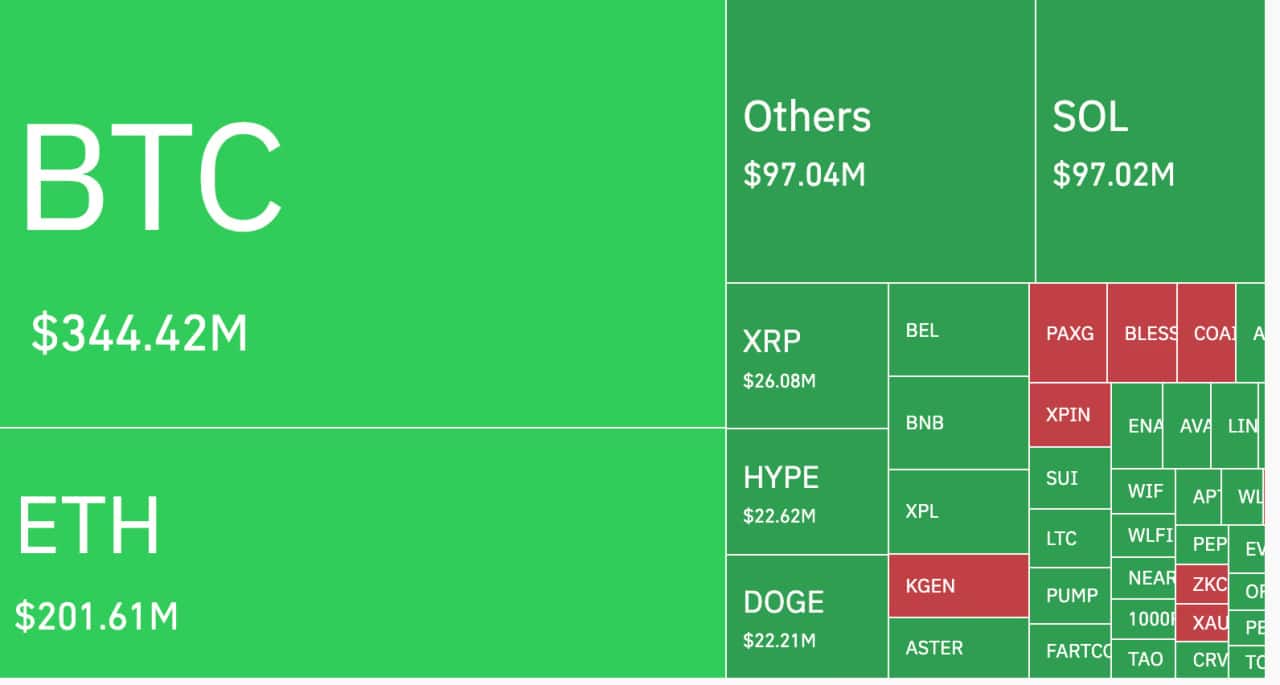

Bitcoin accounted for $344 million of total losses, followed by Ethereum at $201 million and Solana at $97 million.

The sell-off created what traders call a “liquidation loop”—when forced closures trigger more selling, which then forces more positions to close in a cascading effect.

Several factors contributed to the market turbulence. Renewed tensions between the U.S. and China dampened risk appetite across global markets.

Additionally, structural issues with Binance’s data feeds and a stronger Japanese yen added to market uncertainty. Citi analysts noted that bitcoin has shown increased sensitivity to equity market movements, making it more vulnerable to broader financial market shifts.

ETF Outflows Signal Changing Sentiment

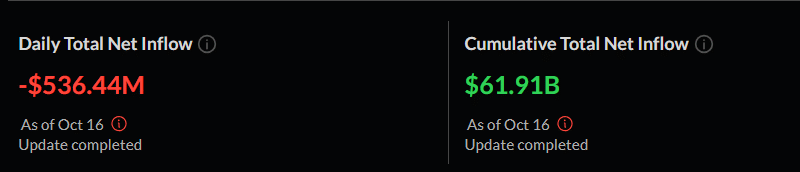

The bearish momentum extended to Bitcoin ETFs, which saw $536.4 million in net outflows on Thursday.

BlackRock’s iShares Bitcoin Trust lost $29 million, while Fidelity’s FBTC experienced $132 million in redemptions.

Even Grayscale’s converted GBTC product shed $67 million. This reversal is particularly notable given the strong ETF inflows earlier in 2025.

Despite the current volatility, some analysts remain optimistic about Bitcoin’s long-term prospects. Citi maintains its year-end target of $133,000 for Bitcoin, citing continued institutional interest through ETFs.

However, traders are now watching key support levels closely, as Bitcoin has given back most of its early-week gains and risks testing the psychologically important $100,000 mark.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.