The U.S. dollar embarked on a vigorous ascent on Friday, buoyed by a surprising surge in inflation data, which has ignited expectations of the Federal Reserve keeping interest rates at higher levels for an extended duration.

The dollar index, measuring the greenback against six major currencies, notched a 0.15% gain, pushing it to 106.73. This upward trajectory marked a continuation of the dollar’s bullish momentum from the preceding day, when it experienced a remarkable 0.9% surge, the most significant single-day rise since March 15.

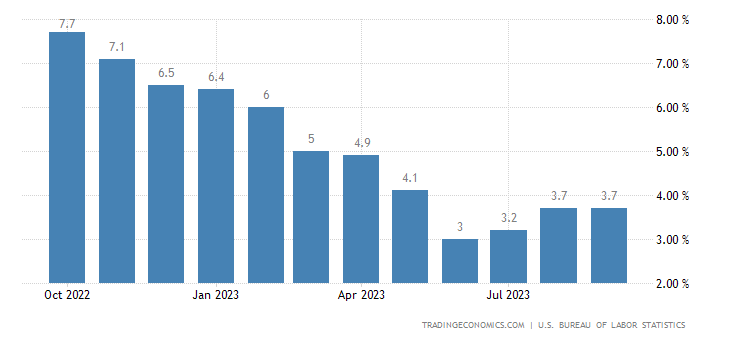

This robust rally was catalyzed by the release of the U.S. Consumer Price Index (CPI) data on Thursday, revealing a 0.4% increase in September, in line with the annual rate of 3.7%.

These figures surpassed market expectations, which had predicted 0.3% and 3.6%, respectively. The CPI report followed the producer price index (PPI) released on Wednesday, which also outperformed expectations with a 0.5% rise in September and an annual rate of 4.8%.

Higher Inflation, Higher Rates; Higher Rates, Stronger Dollar

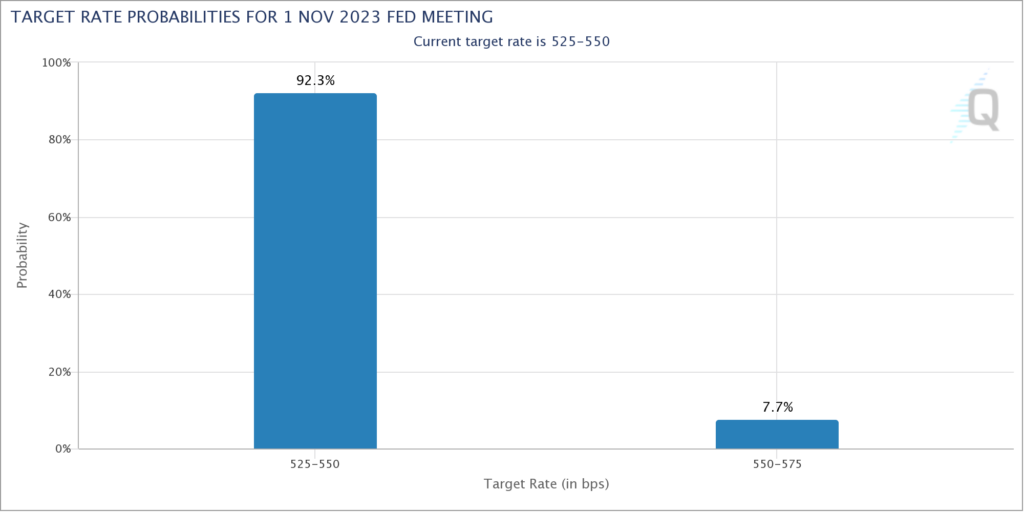

These inflation statistics paint a picture of price pressures in the U.S. economy refusing to relent as quickly as many had hoped. Consequently, it is increasingly likely that the Federal Reserve will maintain its firm grip on monetary policy to rein in inflation. Higher interest rates have an inherent appeal for investors, rendering the dollar more attractive.

Backing this view, some Federal Reserve officials voiced their stance on Friday. Philadelphia Fed President Patrick Harker expressed his belief that the central bank has likely completed its rate hikes, emphasizing the ongoing moderation in price pressures while acknowledging the uncertainty surrounding the duration of the necessary rate elevation, as reported by Reuters.

Simultaneously, data released on Friday indicated that U.S. import prices had risen less than anticipated in September. A robust dollar played a role in lowering the cost of non-energy products, potentially assisting in mitigating domestic inflation over time.

The dollar’s resurgence weighed heavily on other currencies, particularly the Japanese yen, which retraced towards the 150 level it briefly touched the previous week before staging a sharp rebound. Currently, the yen is trading at 149.62 per dollar, with market participants keeping a watchful eye for any signs of intervention by Japanese authorities aimed at curbing its depreciation.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.