In a recent editorial by Forbes, contributor Naeem Aslam mapped-out five key factors that are likely to underpin a bullish price action for gold in the coming days.

The key factors include:

A second wave of the novel Coronavirus: Naeem notes that investors are very hesitant towards riskier assets due to the rising Covid-19 cases globally, giving gold a strong safe-haven appeal.

Possible new tariffs on Europe: The Forbes contributor cites that President Trump was weighing new tariffs on $3.1 billion worth of exports from the UK, Spain, Germany, and France. If Trump continues on this path as tensions soar, investors will be forced to seek non-risky assets.

China-US trade war: The trade war between the world powers has taken an even more tense form as the phase-one US-China trade deal has become extremely strained due to the Coronavirus pandemic.

US Unemployment Claims: Naeem notes that the weekly jobless claims data shows just how bad things have gotten in the US labor market. Also, the prospects for a recovery in the near-term seems very unlikely.

Earnings season: Hopes were stoked when some economies began re-opening across the globe. However, that optimism will likely be erased considering the possible second wave will likely trigger unfavorable restrictions on companies’ activities.

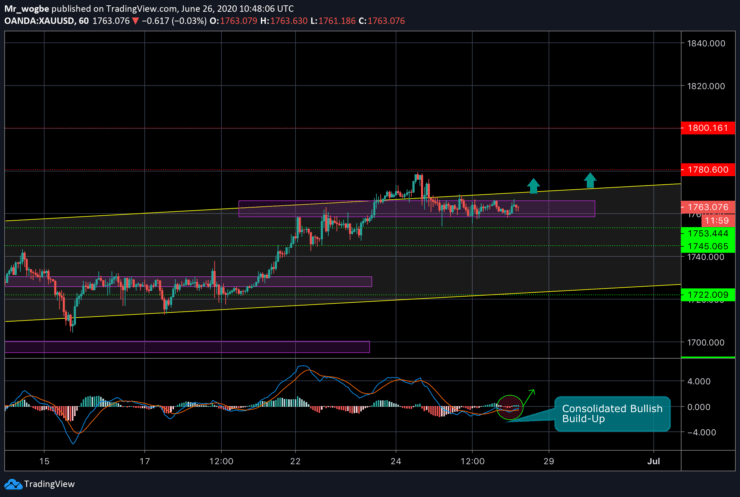

Gold (XAU) Value Forecast — June 26

XAU/USD Major Bias: Sideways

Supply Levels: $1,765, $1,780, and $1,800

Demand Levels: $1,753, $1,745, and $1,735

Gold has entered a consolidation range between the $1,765 and $1,758 level. Based on our momentum indicator, this consolidation is acting as a build-up phase for a likely sharp burst to the ambitious $1,800 level. We will see a rally upwards once gold picks up enough buyers at this level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.