EURJPY Price Analysis – June 26

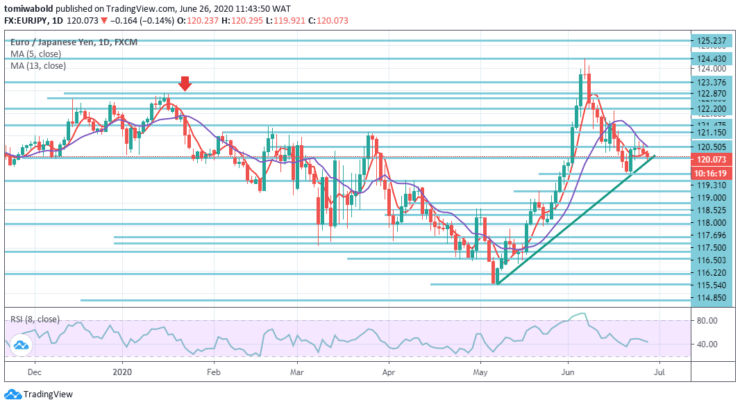

The EURO is dropping against Japan’s safe-haven yen, but it stops at around 120.00 marks for the moment. So far, the pair has lost about 0.2 percent with a weighted risk bias on the back of rising reports of coronavirus and the proposal of the US government to raise tariffs on European products.

Key Levels

Resistance Levels: 124.43, 122.20, 120.50

Support Levels: 119.00, 117.50, 114.85

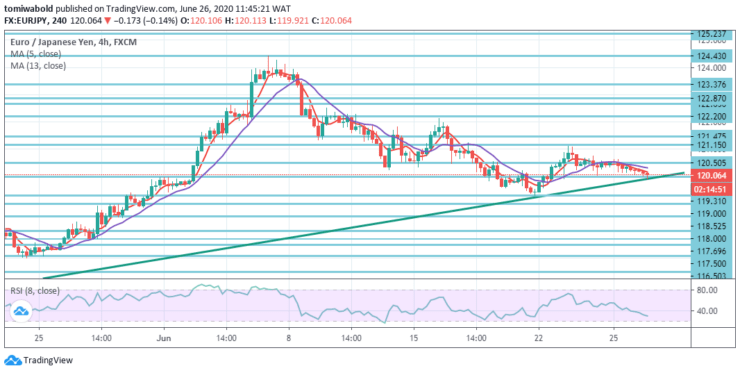

After a botched effort earlier in the week to exceed the 121.00 marks, this week so far, EURJPY is now aiming to consolidate in the mid-120.00s. The 121.00 territory also aligns with the highs from March.

However, strong support seems to have formed in the mid-119.00s at the ascending trendline. A breach underneath this region in the medium term may open the path for a larger retracement. In the wider context, the position on the cross is anticipated to stay positive beyond the horizontal support level at 119.31.

Intraday bias in EURJPY stays initially neutral. With resistance level, 122.20 unchanged, a decline from level 124.43 is still in support of proceeding. The 119.31 level market breach may attempt a retraction of 61.8 percent from 114.85 to 124.43 at 118.52 levels.

Breaking of 122.20 level can, however, alter bias back to the upside for attempting level 124.43. In short, EURJPY is anticipated to halt the upper-run in the short term, while bullish sentiment may progress in the medium term once the price validates an exit beyond 122.20 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.