The yellow metal is also supported by the continuous rise of Covid-19 cases across the globe which has given more credence to Gold’s safe-haven status. However, the recent glimmer of hope for a potential COVID-19 vaccine, the easing of lockdown restriction across the globe, and expectations of a “V-shaped” recovery curve for the global economy has capped any strong rally in the near term.

Investors also became optimistic after US President Donald Trump initiated the process to strip Hong Kong of its special status but did not dishonor the US-China phase-one trade deal. Neutral data release in China’s manufacturing sector also bolstered investors’ overall confidence in Gold.

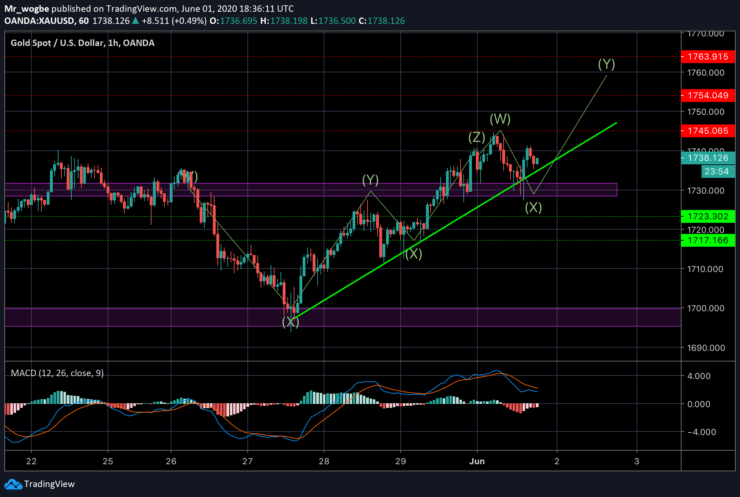

Gold (XAU) Value Forecast — June 1

XAU/USD Major Bias: Bullish

Supply Levels: $1,745, $1,754, and $1,763

Demand Levels: $1,730, $1,722, and $1,717

Gold (XAU/USD) continues to show strong bullishness above the $1,730 pivot. We’re likely to see more volatility in the coming Asian session.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.