Market Analysis – October 2

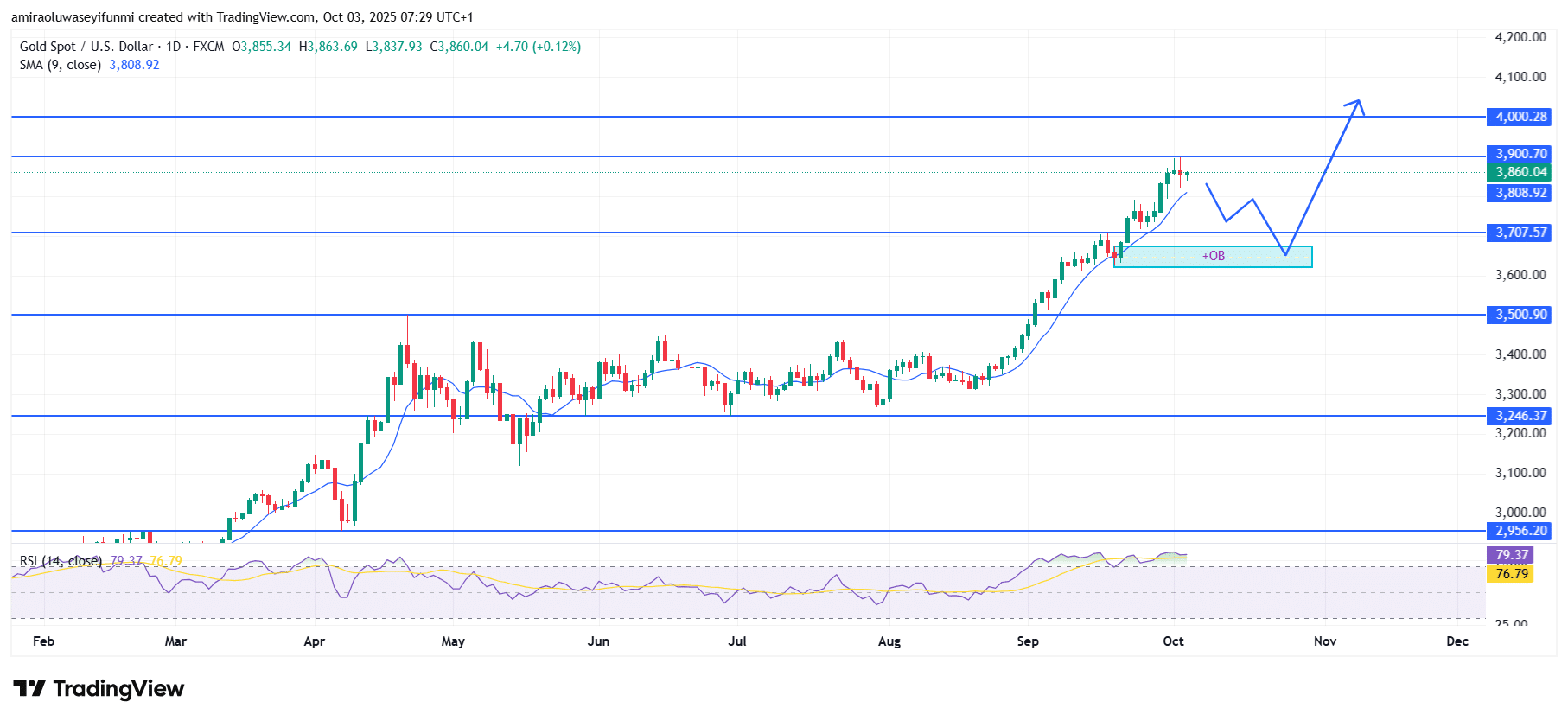

Gold (XAUUSD) maintains its upward drive with favorable technical alignment. Gold (XAUUSD) continues to hold a bullish stance, with price hovering near $3,860 while remaining well above the short-term moving average around $3,810. The Relative Strength Index (RSI) is trading above 76, indicating strong market demand despite being in overbought territory. This alignment of momentum and structure reflects solid buyer conviction, reinforcing the ongoing trend and showing little evidence of weakening demand at this stage.

Gold Key Levels

Resistance Levels: $3900, $4000, $4200

Support Levels: $3710, $3500, $3250

Gold Long-Term Trend: Bullish

Gold has pushed through successive resistance levels and is currently consolidating between $3,810 and $3,900. A significant demand zone lies near $3,710, where buyers are expected to defend price in the event of a corrective dip. The sequence of higher highs and higher lows confirms the bullish structure, with $3,710 acting as key support and $3,900 now marking immediate resistance.

Looking ahead, XAUUSD could experience a minor retracement before resuming its upward path. A revisit to the $3,710–$3,800 range may serve as a launch point for renewed bullish momentum, targeting a return toward $3,900 and higher. If strength persists, the next major obstacle lies at $4,000, where heavier resistance is expected. A decisive breakout above $4,000 would set the stage for fresh highs, extending gold’s long-term bullish outlook.

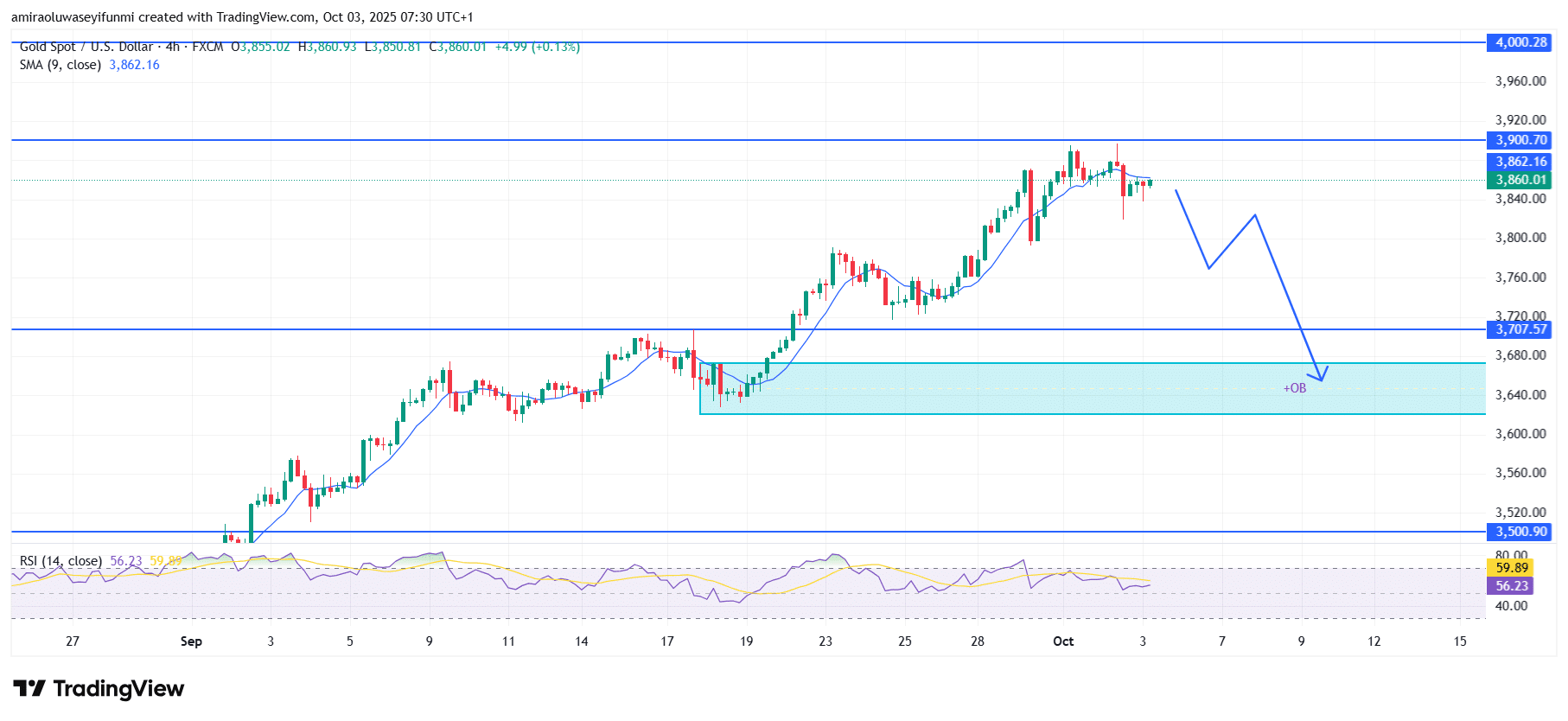

Gold Short-Term Trend: Bearish

Gold (XAUUSD) is showing weakness after failing to sustain above the $3,900 resistance zone. Price is currently trading just below the 9-period SMA, pointing to a short-term bearish bias.

A corrective decline toward the $3,710 support area appears likely, with the order block near $3,640 offering deeper demand. Unless buyers step in strongly, momentum favors a short-term retracement before any recovery attempt, providing traders with a timely forex signals indication to watch for potential re-entry opportunities.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.