Market Analysis – September 25

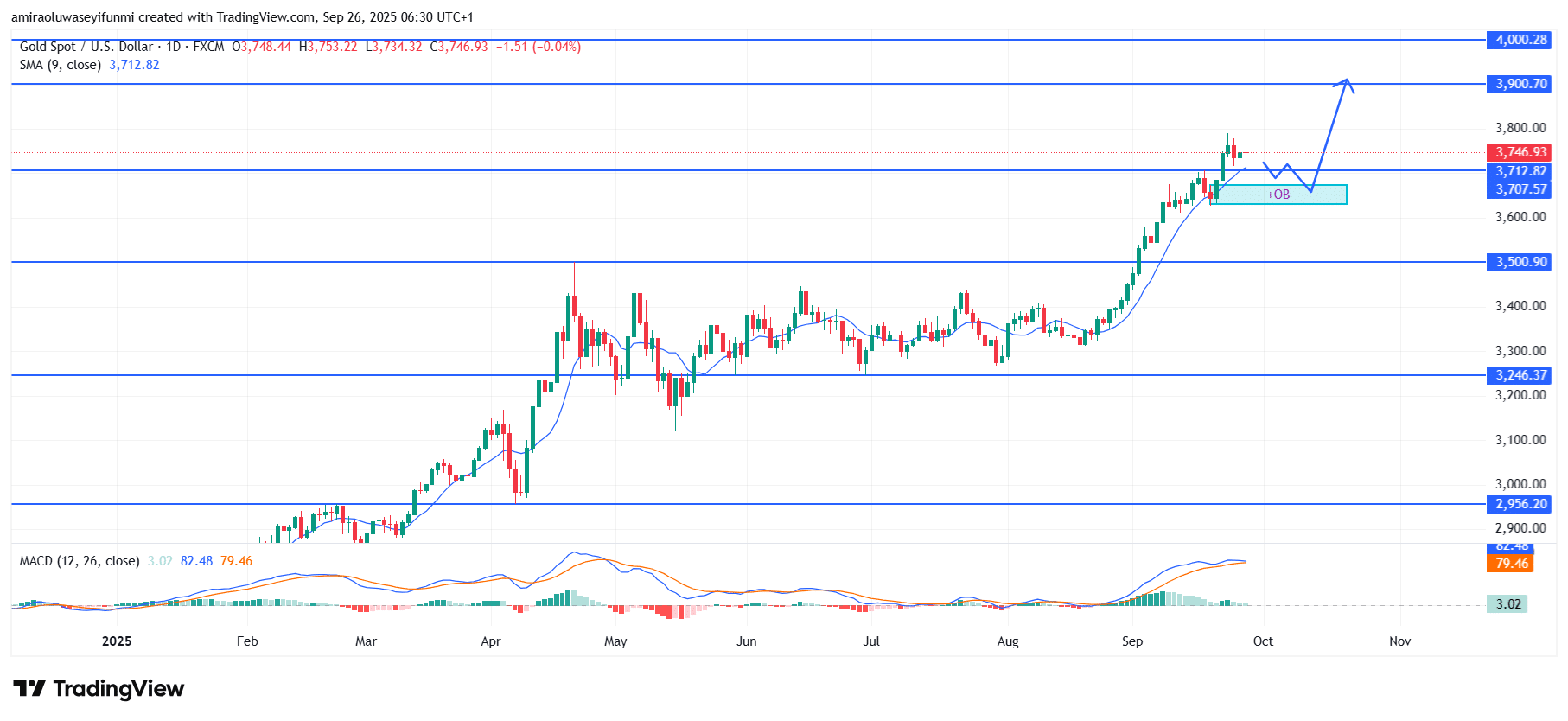

Gold (XAUUSD) sustains bullish momentum with higher targets in sight. Gold continues to maintain its upward trajectory, with prices holding firmly above the 9-day Simple Moving Average near $3,710, reinforcing the constructive outlook. The MACD setup remains tilted to the upside, with the signal line supporting sustained momentum, indicating that market participants continue to price in persistent demand. The alignment between momentum measures and trend indicators reflects a solid appetite for appreciation, supported by steady accumulation.

Gold Key Levels

Resistance Levels: $3710, $3900, $4000

Support Levels: $3500, $3250, $2960

Gold Long-Term Trend: Bullish

Technically, the modest pullback from $3,750 reflects a controlled correction rather than weakness, with strong support anchored between $3,710 and $3,700. This demand cluster, acting as an order block, is critical in sustaining the bullish bias and providing opportunities for renewed entries on dips. The current price structure highlights successive higher highs and rising lows, confirming the resilience of the bullish cycle while reducing immediate downside risks.

Forward outlook suggests gold advancing toward the resistance corridor near $3,900, with room to test the psychological threshold at $4,000 if momentum persists. Any short-term retracement into the $3,710–$3,700 region is expected to attract fresh demand, setting the stage for continued gains. As long as market momentum remains intact, directional bias favors sustained appreciation, with $3,900 identified as the next key target ahead of a possible push to $4,000.

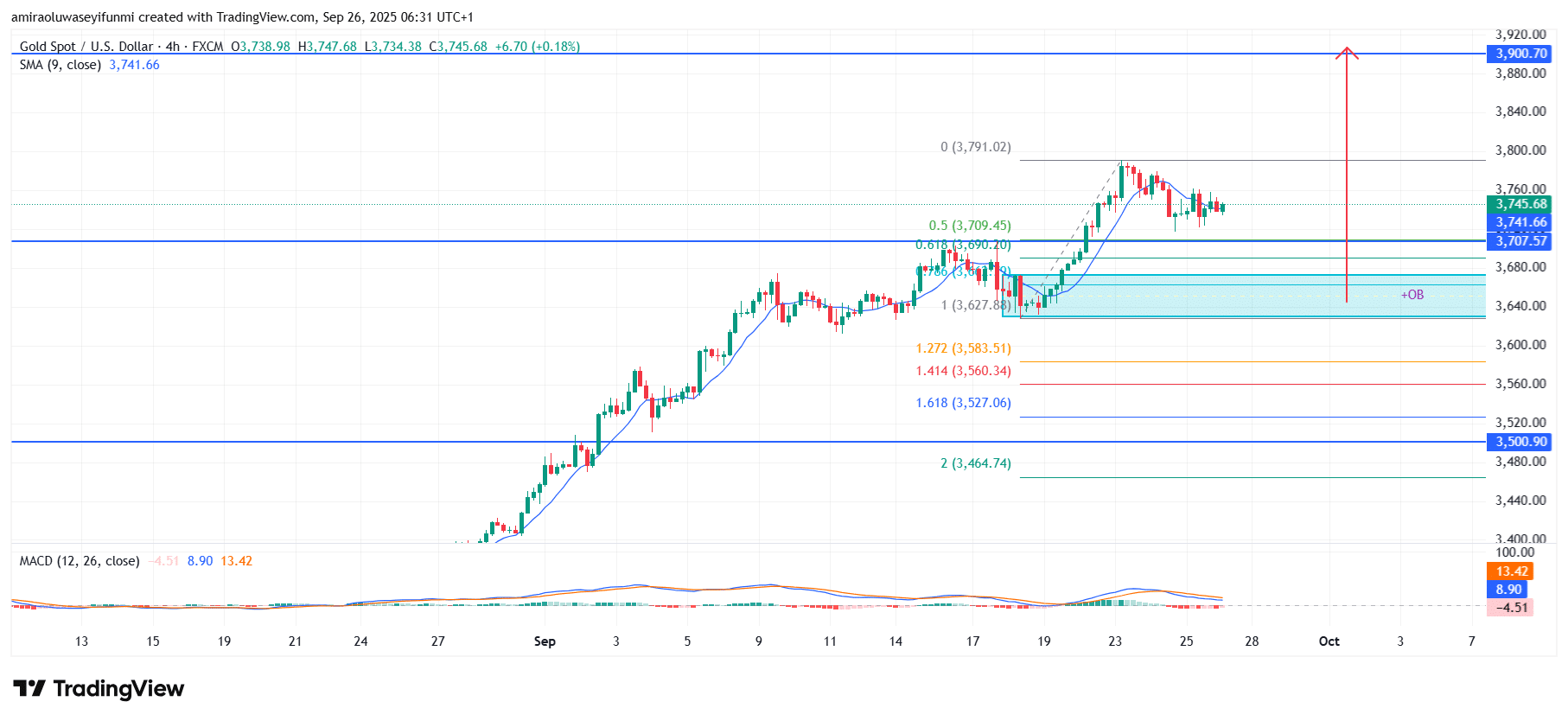

Gold Short-Term Trend: Bullish

Gold (XAUUSD) is holding above the 9-day SMA near $3,742, indicating sustained bullish pressure. Price has respected the Fibonacci retracement zone around $3,710, reinforcing its role as strong support. Momentum indicators remain constructive, with MACD positioned to strengthen further if buying resumes. The next upside target lies at $3,900, with potential extension toward $3,920, a move that traders may track closely using forex signals for timely confirmation.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.