Market Analysis – June 19

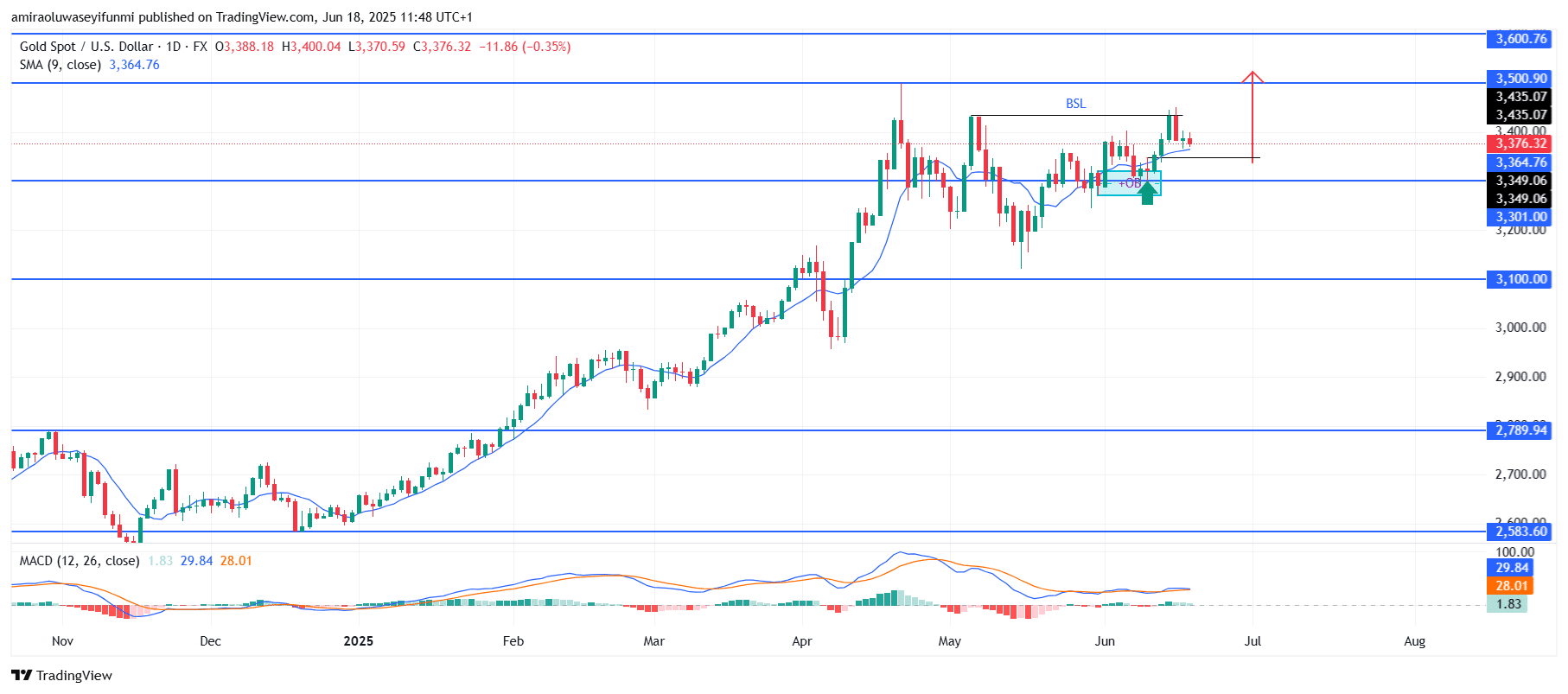

Gold (XAUUSD) continues to maintain bullish momentum, supported by strong technical fundamentals. The overall directional bias remains firmly bullish, as evidenced by its consistent climb above the 9-day Simple Moving Average (SMA), which is currently trading near $3,370. Momentum indicators further support this outlook, with the Moving Average Convergence Divergence (MACD) histogram showing a slight bullish crossover as the MACD line attempts to rise above the signal line. Despite minor pullbacks, price action has followed a pattern of higher lows and steady recoveries, reflecting strong demand in the gold market. The recent pullback from the $3,400 region appears to be a corrective move rather than a reversal, aligning with a healthy bullish market structure.

Gold Key Levels

Resistance Levels: $3,440, $3,500, $3,600

Support Levels: $3,300, $3,100, $2,790

Gold Long-Term Trend: Bullish

A bullish rejection at a discounted level followed by a rebound indicates that the market has just executed a liquidity sweep below a short-term low around $3,350. This reaction occurred within a clearly defined Fibonacci Optimal Trade Entry (OTE) zone, pushing the price back above the critical $3,370 support level. Although there has been a minor retracement since then, the break above the swing high near $3,440 confirms the continuation of the bullish trend. Market behavior suggests a typical reaccumulation phase post-breakout, with shallow pullbacks caused by short-term profit-taking.

This bullish structure supports the likelihood of further movement toward the $3,500 resistance level, which aligns with a previously rejected swing high. A decisive break above this level would open the path toward the $3,600 mark, offering a potential $130 upside from current levels. The bullish outlook remains intact as long as price holds above the dynamic support around $3,360 and continues forming higher lows. For traders seeking actionable entries, forex signals may offer strategic guidance during such setups.

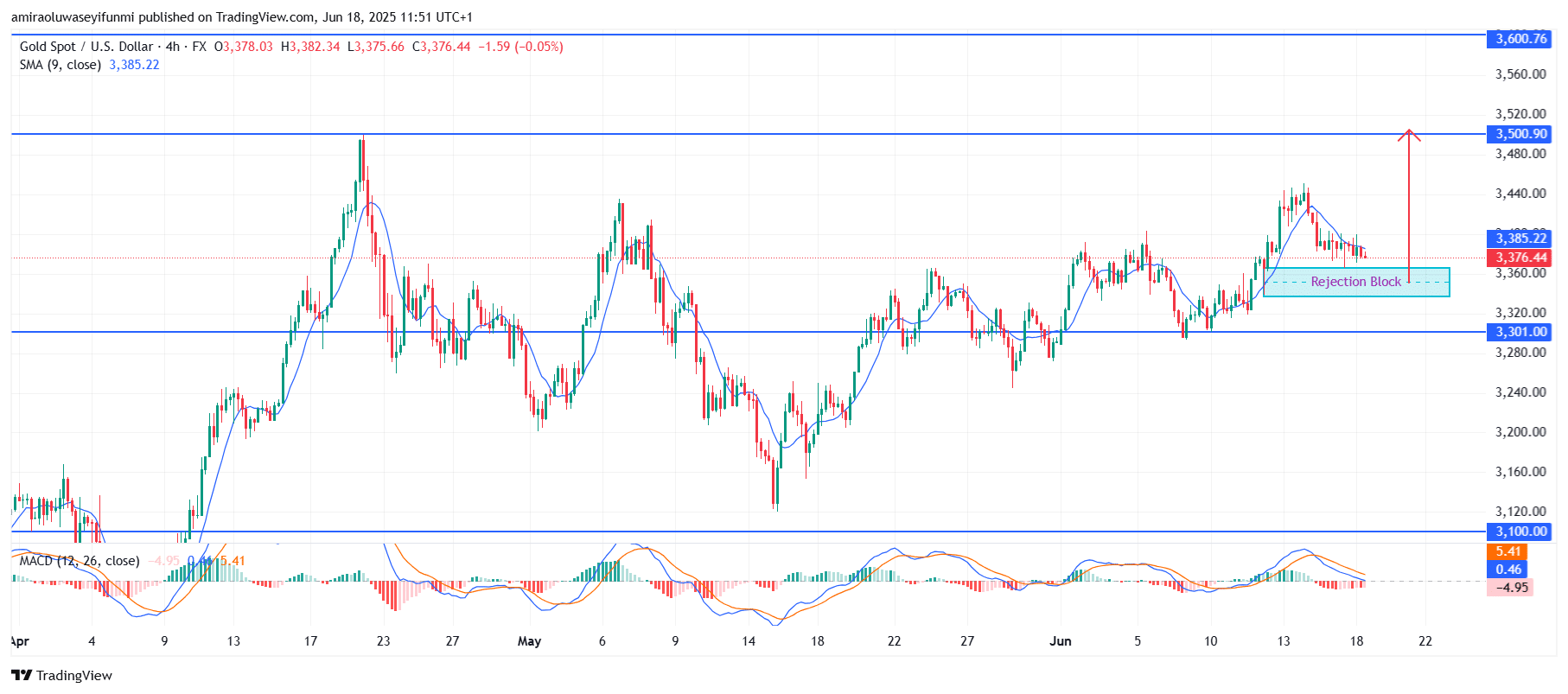

Gold Short-Term Trend: Bullish

Gold (XAUUSD) is currently retracing toward the $3,360 rejection block, which aligns with a former demand zone and may act as a springboard for continued bullish movement. The price remains above the $3,300 support level, and the 9-period SMA is beginning to flatten, potentially indicating base formation.

Although the MACD is currently showing mild bearish momentum, the underlying structure still supports a potential upward move. A strong rebound from the rejection block could accelerate the price toward the $3,500 resistance level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.