Market Analysis – June 12

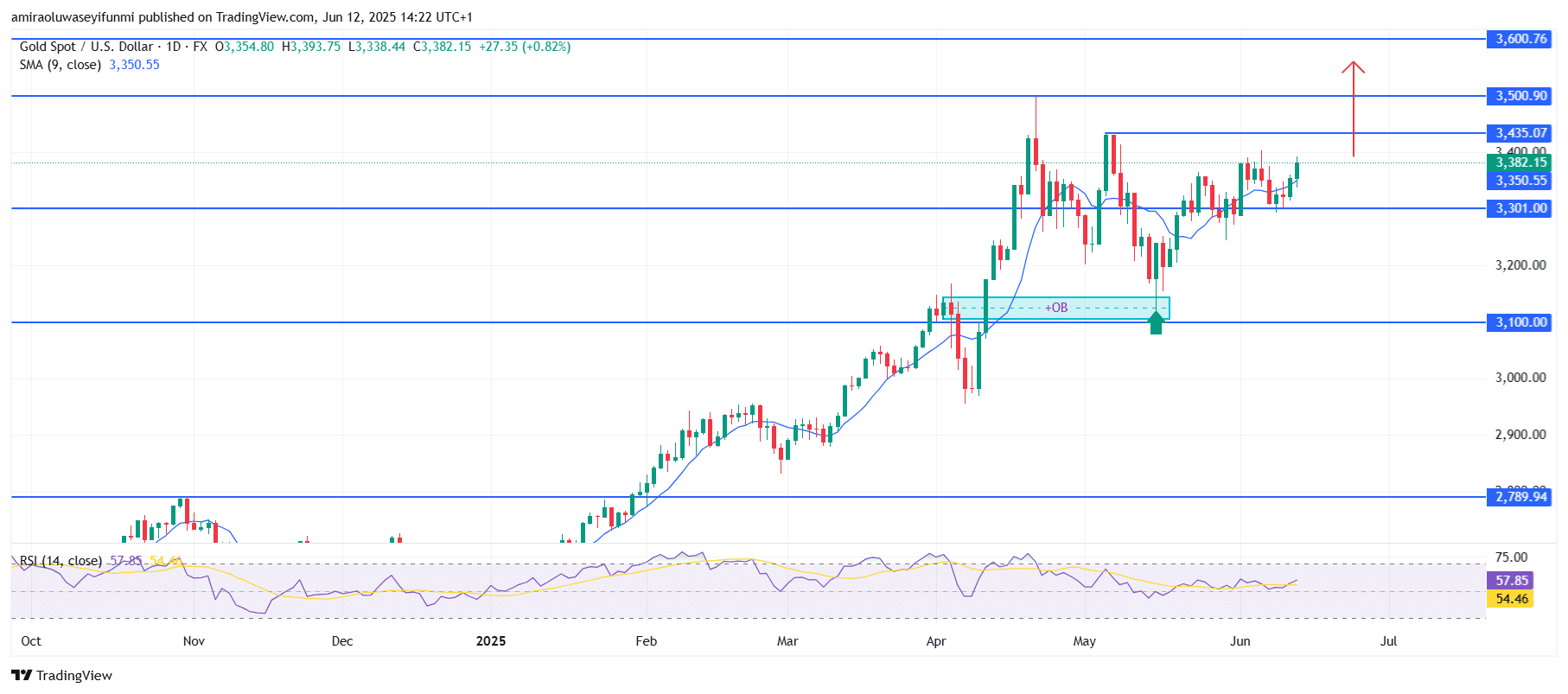

Gold (XAUUSD) gains momentum on a strong bullish structure and solid support. The XAUUSD pair continues to exhibit a clear upward trajectory, consistently trading above the 9-day Simple Moving Average (SMA), which is currently positioned around $3,350. This alignment indicates sustained buying interest, supported by the Relative Strength Index (RSI) reading of 57.93. The RSI confirms bullish momentum while staying below overbought levels. Price action has remained firm above key moving averages, pointing to institutional participation and reinforcing the likelihood of trend continuation.

Gold Key Levels

Resistance Levels: $3,440, $3,500, $3,600

Support Levels: $3,300, $3,100, $2,790

Gold Long-Term Trend: Bullish

From a technical perspective, gold has respected multiple significant demand zones while advancing in measured waves, reinforcing its strong bullish structure. The $3,300 level has proven to be a firm support, with the price rebounding several times from this region. Additionally, a bullish order block near $3,100 served as a key launch point following the previous major correction. The repeated rejections at the $3,440 resistance level underline its importance, and the current push toward this area suggests a potential breakout. Continued consolidation above $3,300 while forming higher lows highlights possible accumulation by large players.

Looking forward, a decisive break and close above the $3,440 resistance zone could initiate another bullish leg toward $3,500. If momentum remains strong, the $3,600 target may be reached in the medium term. Downside pressure appears limited as long as the price maintains support above $3,300, with $3,100 serving as the next critical defense level. Barring significant macroeconomic surprises or policy shifts, XAUUSD appears poised to extend its upward movement.

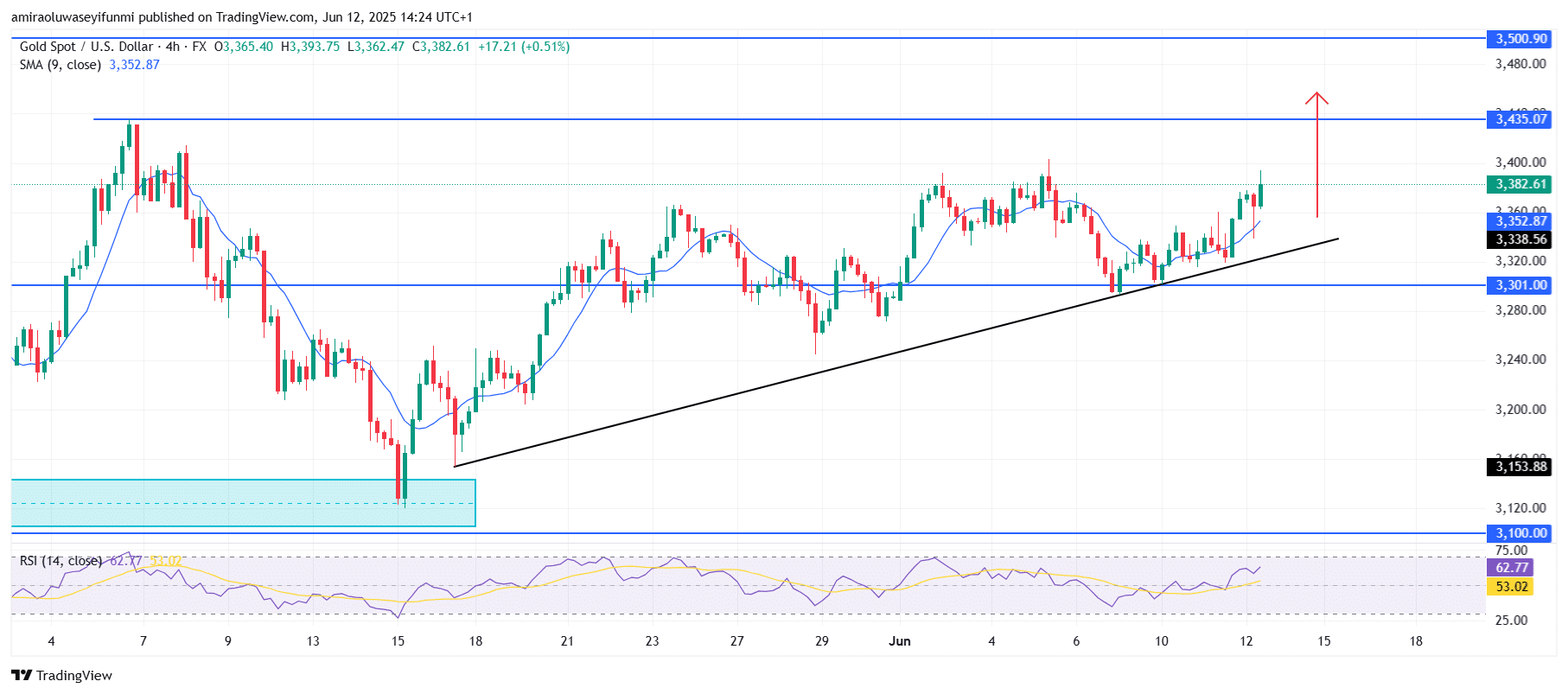

Gold Short-Term Trend: Bullish

On the 4-hour chart, XAUUSD maintains a bullish outlook, supported by a rising trendline and consistent closes above the 9-period SMA at approximately $3,350. The price is gradually approaching the $3,440 resistance level after recently bouncing off the trendline.

Bullish momentum remains intact, as reflected by the RSI reading of 62.68, which suggests strength without overextension. In the short term, a breakout above $3,440 could pave the way for a move toward the psychological $3,500 level. This scenario aligns closely with the current market structure and may offer valuable insights for traders who rely on forex signals for timely decision-making.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.