Market Analysis – June 26

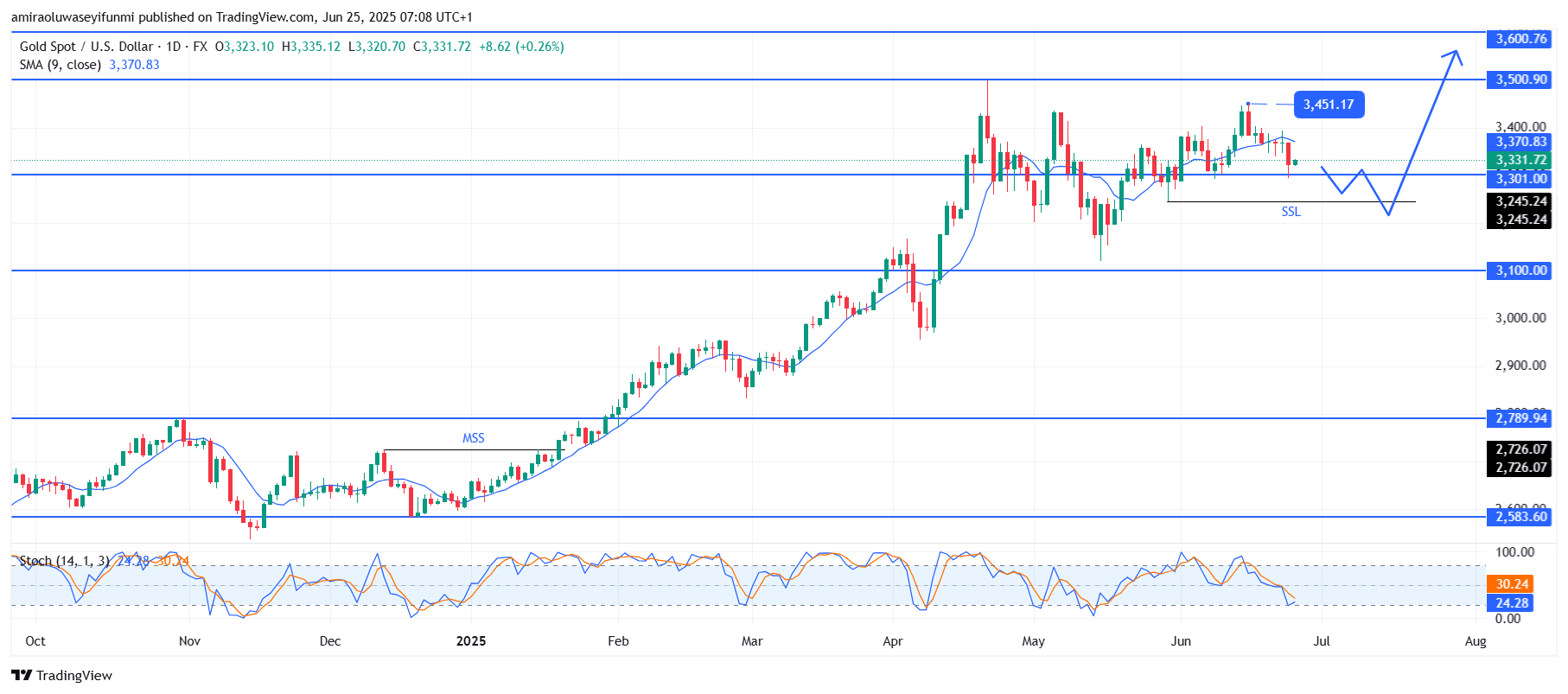

Gold (XAUUSD) is setting up for a bullish continuation from the key support level at $3,300. Over the past several months, gold has maintained a generally bullish trajectory, with the ongoing uptrend experiencing temporary consolidation above the $3,300 mark. The 9-day Simple Moving Average (SMA), currently hovering around $3,370, has recently been tested yet remains unbroken, reinforcing the prevailing bullish sentiment. The Stochastic Oscillator, currently in oversold territory, indicates diminishing selling momentum and suggests a possible bullish reversal. Together, these technical indicators point toward gold preparing to resume its dominant upward trend following a brief period of correction.

Gold Key Levels

Resistance Levels: $3,450, $3,500, $3,600

Support Levels: $3,300, $3,100, $2,790

Gold Long-Term Trend: Bullish

From a technical perspective, the price structure reflects a bullish outlook on the higher timeframe, with a recent pullback toward the $3,300 support cluster. This level aligns with previous swing lows and the midpoint of the recent consolidation zone. A recent high formed near $3,450 before a modest decline, suggesting a possible liquidity sweep ahead of a renewed bullish impulse. This retracement is better interpreted as a natural correction within an ongoing bullish trend, rather than a reversal.

Looking ahead, XAUUSD seems positioned to continue its upward move if it maintains support above $3,300. A strong breakout and close above $3,450 could pave the way for a move toward $3,500, with a potential extension to $3,600 if bullish strength increases. Alternatively, if price dips further, a rebound from the $3,250 area may establish a bullish reversal pattern, signaling renewed accumulation. As long as price stays above the $3,300 demand zone, the dominant outlook remains bullish, aligning with recent forex signals that anticipate upward continuation.

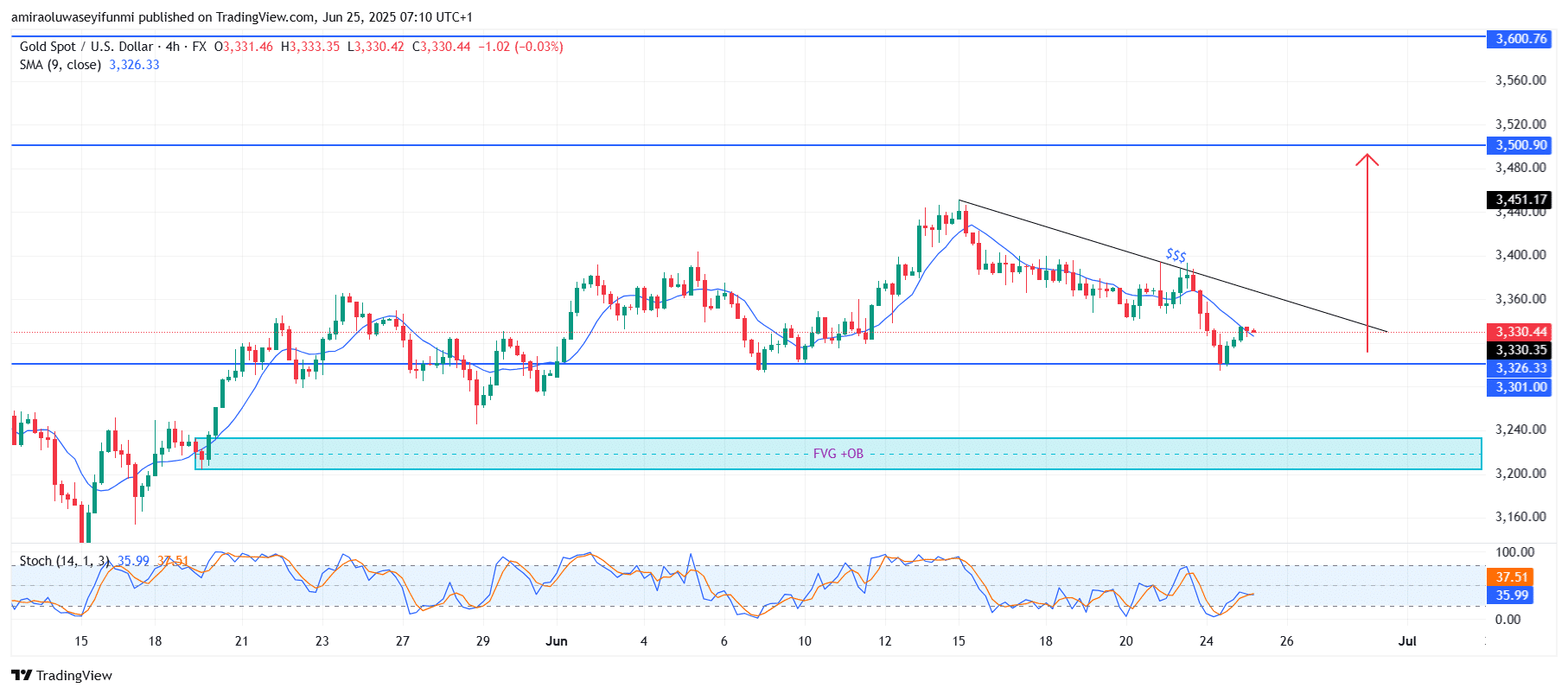

Gold Short-Term Trend: Bullish

On the four-hour chart, bearish pressure is starting to fade as XAUUSD finds support around the $3,300 level. The Stochastic Oscillator is beginning to curve upward from oversold conditions, highlighting reduced selling momentum and the possibility of renewed bullish activity. Should bulls manage to reclaim the $3,360–$3,450 zone, the price could gain traction toward the $3,500 resistance level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.