Market Analysis – April 24

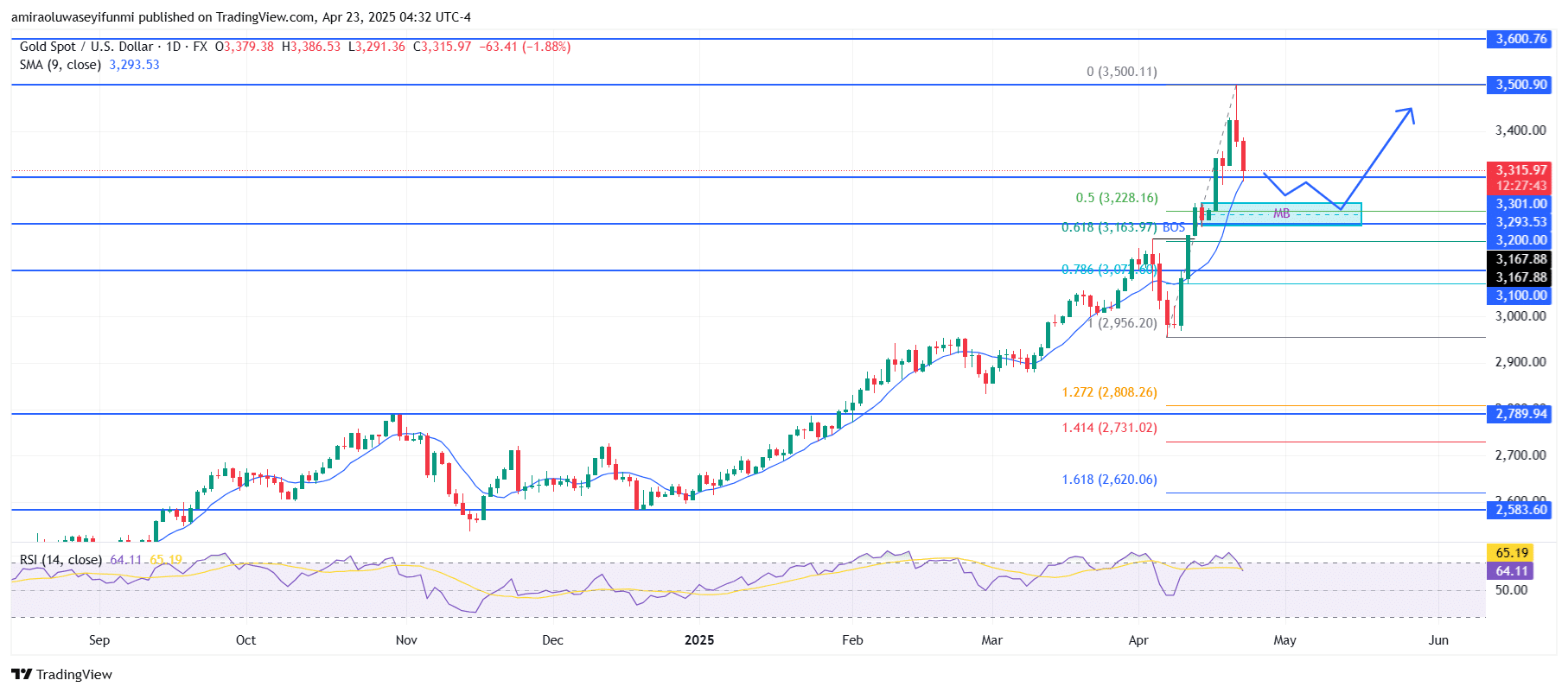

Gold (XAUUSD) remains bullish, with the recent retracement offering fresh buying opportunities. On the daily chart, the 9-day Simple Moving Average (SMA) is currently positioned around $3,290 and continues to slope upward, signaling sustained bullish momentum. The Relative Strength Index (RSI) is at 64.03, still within bullish territory but easing from previous overbought levels above 70, suggesting that the current pullback may represent a healthy correction. The price remains above the SMA, which acts as dynamic support near the $3,290 level.

Gold Key Levels

Resistance Levels: $3300, $3500, $3600

Support Levels: $3200, $3100, $2790

Gold Long-Term Trend: Bullish

The price action indicates that Gold (XAUUSD) recently surged to a high close to $3,500 before facing resistance and pulling back. The retracement has found temporary support within the $3,160–$3,230 demand zone, aligning with the 50% and 61.8% Fibonacci retracement levels from the previous upswing. This zone also matches a bullish order block, enhancing its importance as a potential reversal area. Previous resistance around $3,200 may now function as support, further strengthening the bullish outlook.

If buyers maintain control above $3,160, XAUUSD could consolidate before advancing toward the $3,500 psychological level, and potentially $3,600 if bullish momentum strengthens. A temporary sideways move within the $3,160–$3,230 range is likely before any significant breakout to the upside. Should the price fall below $3,160, the next key support can be found around $3,100. Nonetheless, as long as price remains above that zone, the overall market structure stays bullish.

Gold Short-Term Trend: Bullish

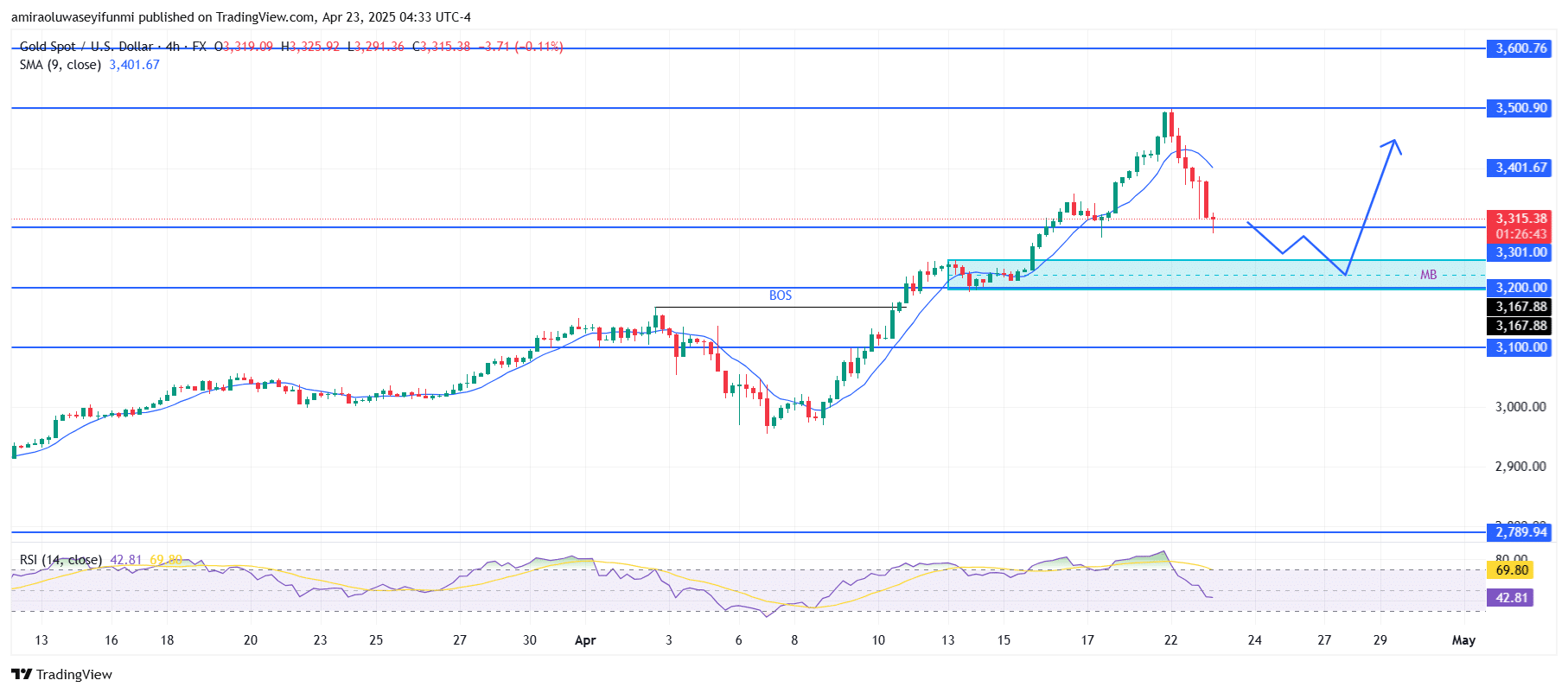

XAUUSD maintains its bullish stance on the four-hour chart, despite the ongoing pullback. The price is nearing a significant demand zone around $3,200, which aligns with a previous breakout structure. Traders using forex signals may find this area critical, as the RSI has decreased to 42.90, suggesting the market is cooling off and potentially setting up for a bullish reversal. A bounce from this demand zone could propel prices back toward the $3,400 and $3,500 resistance levels.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.