Market Analysis – April 17

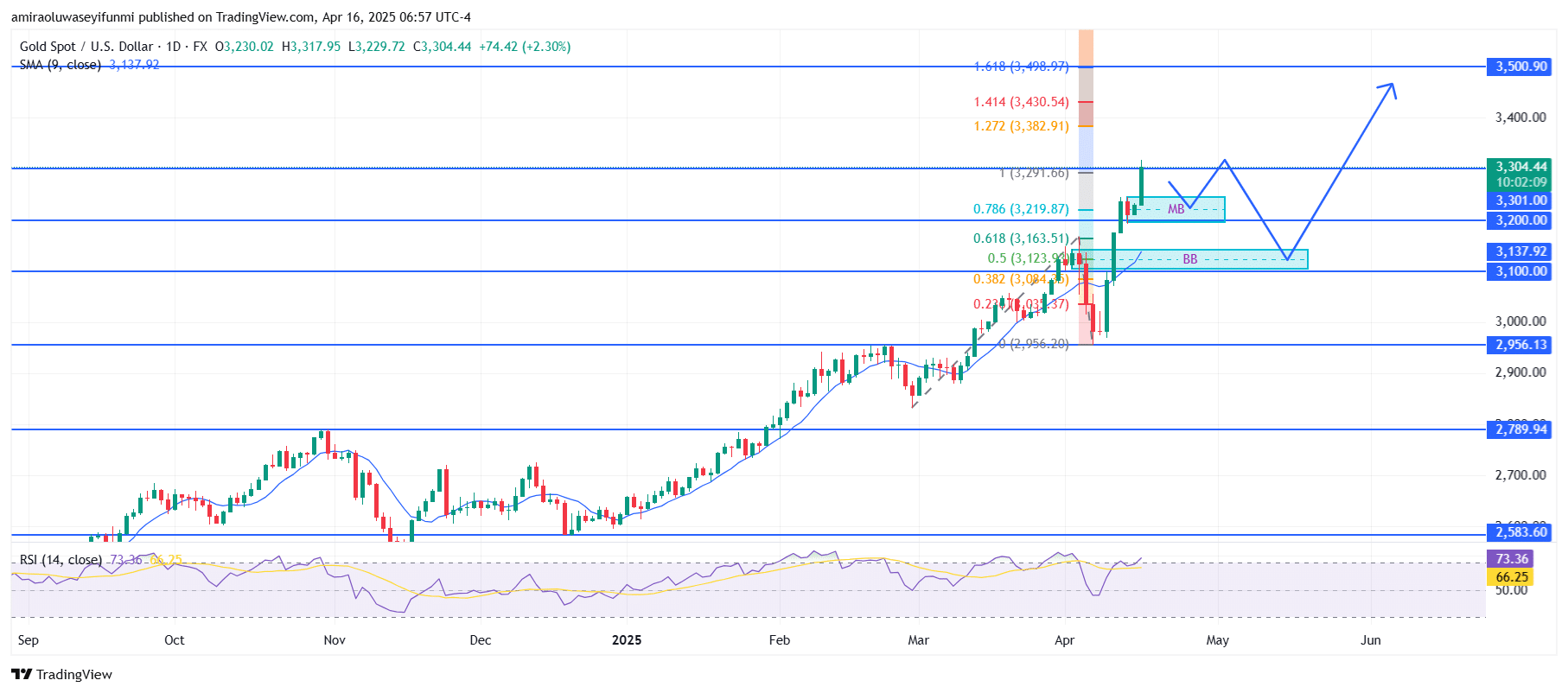

Gold (XAUUSD) continues its upward trajectory as key support levels remain firm. Gold has extended its rally, supported by solid foundational zones and a sustained bullish sentiment. The 9-day simple moving average (SMA), now situated around $3,140, serves as dynamic support, while spot prices linger near $3,300—well above this short-term average. The Relative Strength Index (RSI) is approximately 73, signaling overbought conditions. This suggests the possibility of a short-term pullback, as traders may choose to lock in profits. However, as long as the RSI stays above 70, bullish momentum is expected to persist. Only a drop below the 50 mark would indicate a significant weakening of the upward trend.

Gold Key Levels

Resistance Levels: $3300, $3400, $3500

Support Levels: $3200, $3100, $2960

Gold Long-Term Trend: Bullish

The strong rebound of XAUUSD from the $3,100 level has reestablished that zone as a key support area. Subsequent moves above $3,200 and $3,300 have triggered renewed buying interest, with a breaker block evident between $3,100 and $3,140 and a nearby demand zone around $3,200. The overall market structure—marked by successive higher highs and higher lows—remains clearly bullish. Additionally, the most recent breakout candle, combined with Fibonacci extension levels, strengthens the bullish outlook.

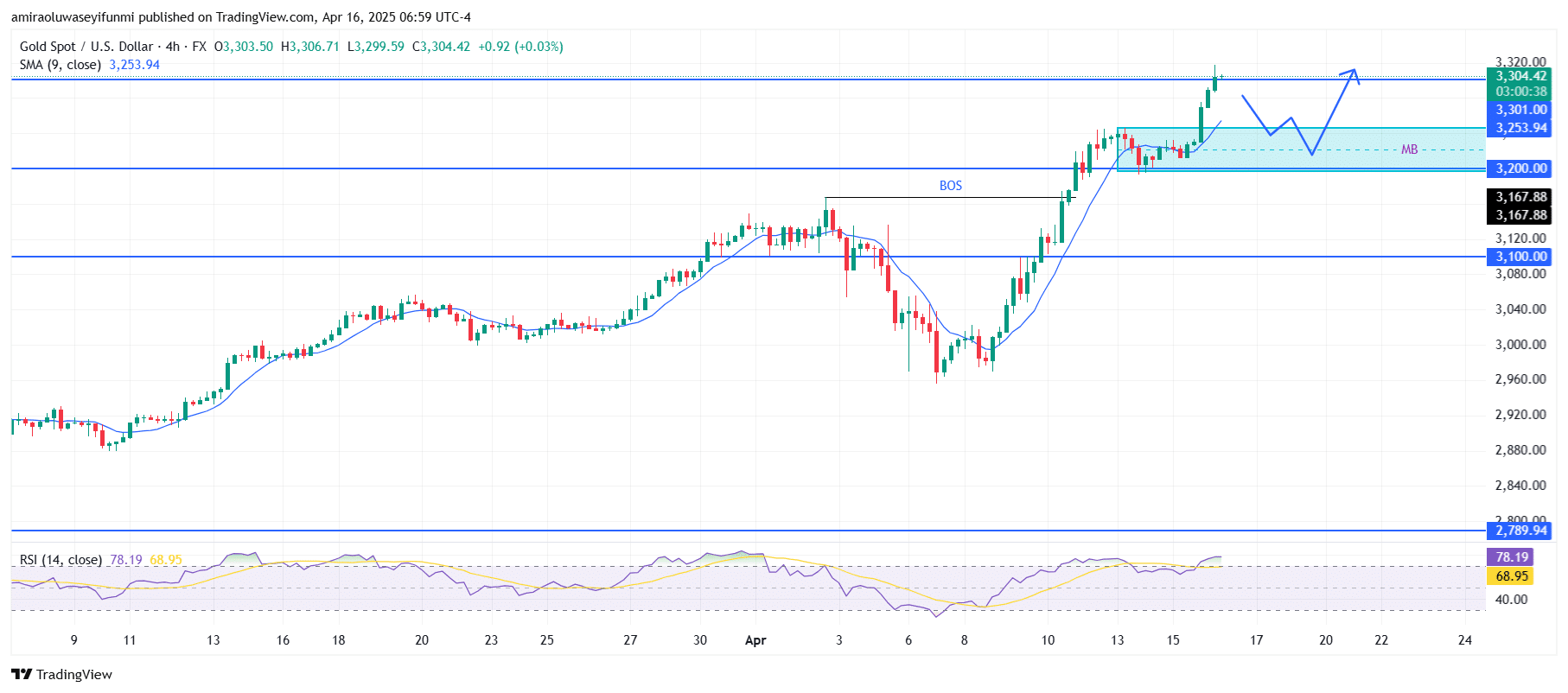

Gold Short-Term Trend: Bullish

On the four-hour chart, XAUUSD maintains its bullish stance, trading well above the 9-period SMA, currently around $3,250. The recent break of structure above $3,200 further confirms the strength of buyers and the continuation of higher highs. However, the RSI’s high reading near 78 points to strong momentum that might soon lead to a slight pullback. A revisit to the $3,200 demand zone could offer a strategic buying opportunity before the market makes another move toward $3,300 and beyond.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.