Market Analysis – August 21

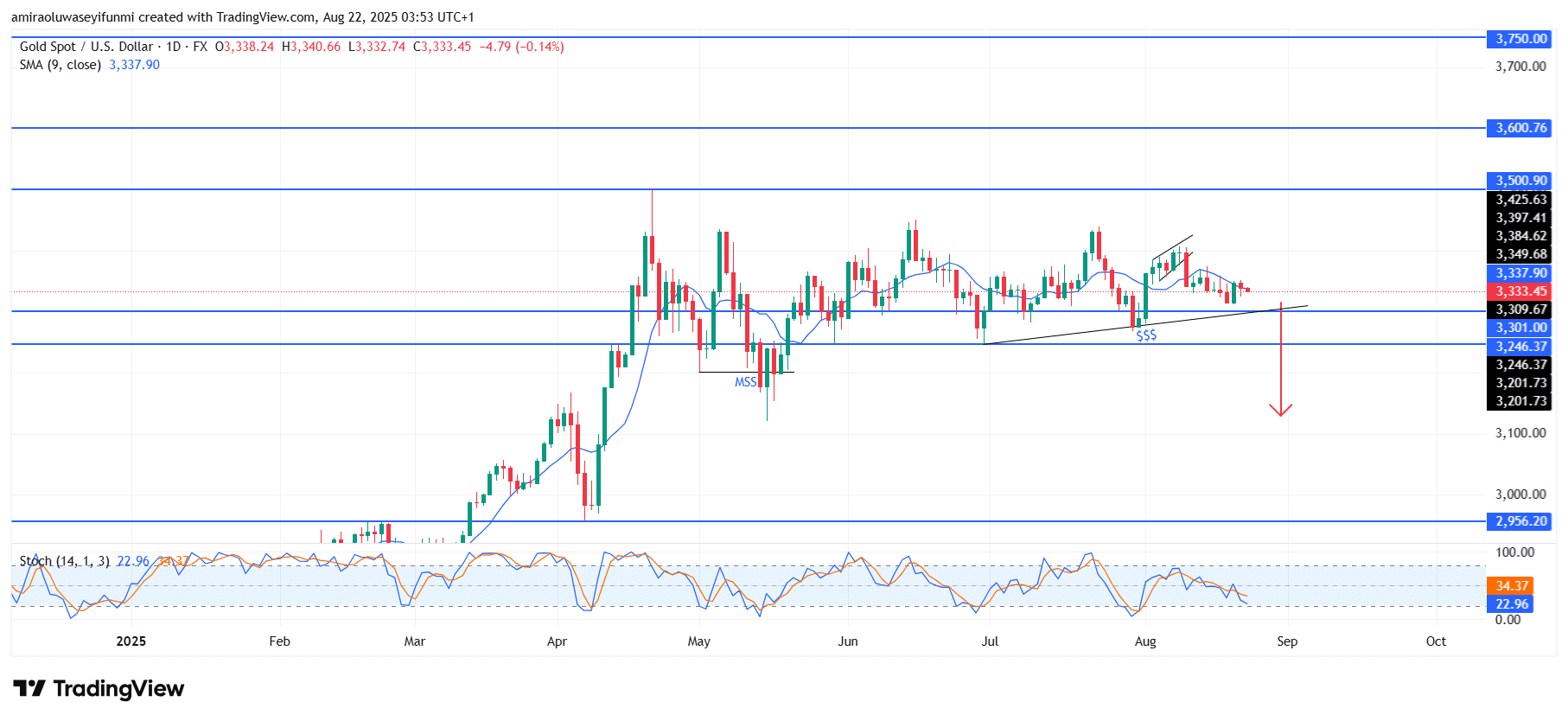

Gold (XAUUSD) outlook signals a weakening structure and bearish continuation bias. Gold has been under pressure as recent daily sessions reflect a gradual loss of momentum, aligning with the downward tilt of the Stochastic Oscillator and a flattening 9-day moving average.

Price action has struggled to hold strength above $3,350, with sellers increasingly gaining control at this level. The overall structure suggests that bullish momentum is exhausted, opening the way for a corrective move. From a technical perspective, the market has repeatedly tested the $3,310–$3,300 support zone, failing to reclaim higher ground above $3,380.

Gold Key Levels

Resistance Levels: $3,500, $3,600, $3,750

Support Levels: $3,300, $3,250, $2,960

Gold Long-Term Trend: Bullish

The chart signals a breakdown risk beneath the ascending support trendline, which, if confirmed, could accelerate bearish flows. Previous failed rallies toward $3,420–$3,430 highlight the presence of strong supply overhead, preventing a sustainable breakout to the upside.

Looking forward, a decisive move below $3,300 could lead to further downside toward $3,250, with an extended decline possibly exposing $3,200 as the next demand level. If selling pressure strengthens, a deeper retracement into the $2,960 region remains possible. Unless price action decisively reclaims and sustains above $3,380, the bearish trajectory continues to dominate the outlook for XAUUSD in the near term.

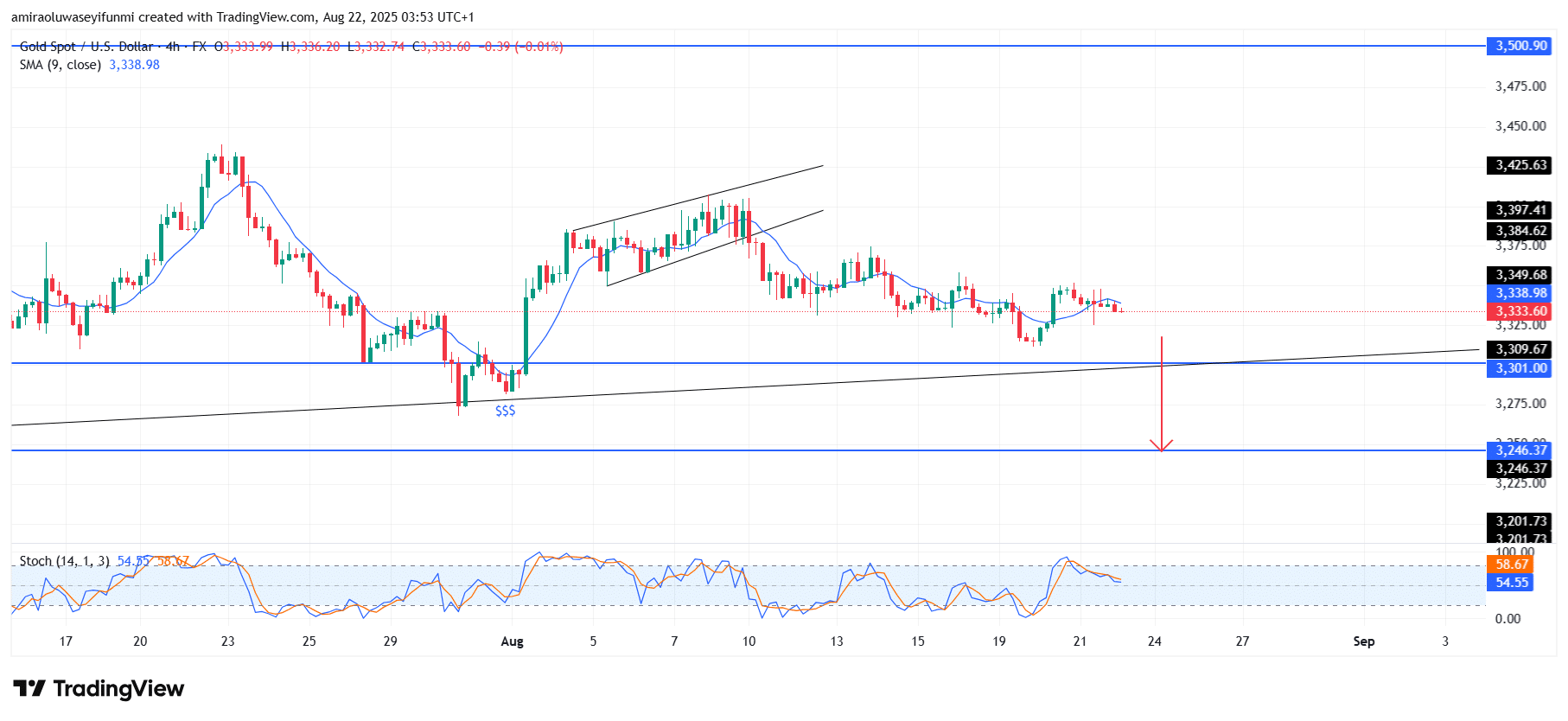

Gold Short-Term Trend: Bullish

Gold (XAUUSD) is displaying bearish momentum on the four-hour chart as price trades below the 9-period SMA. A breakdown beneath the ascending trendline support near $3,310 could increase downside pressure.

The Stochastic indicator leans toward a bearish crossover, reflecting weakening buying interest. If support at $3,300 fails, sellers may push toward the $3,250 zone. For traders, combining technical setups with forex signals may provide better insight into short-term entry and exit points.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.