Market Analysis – May 29

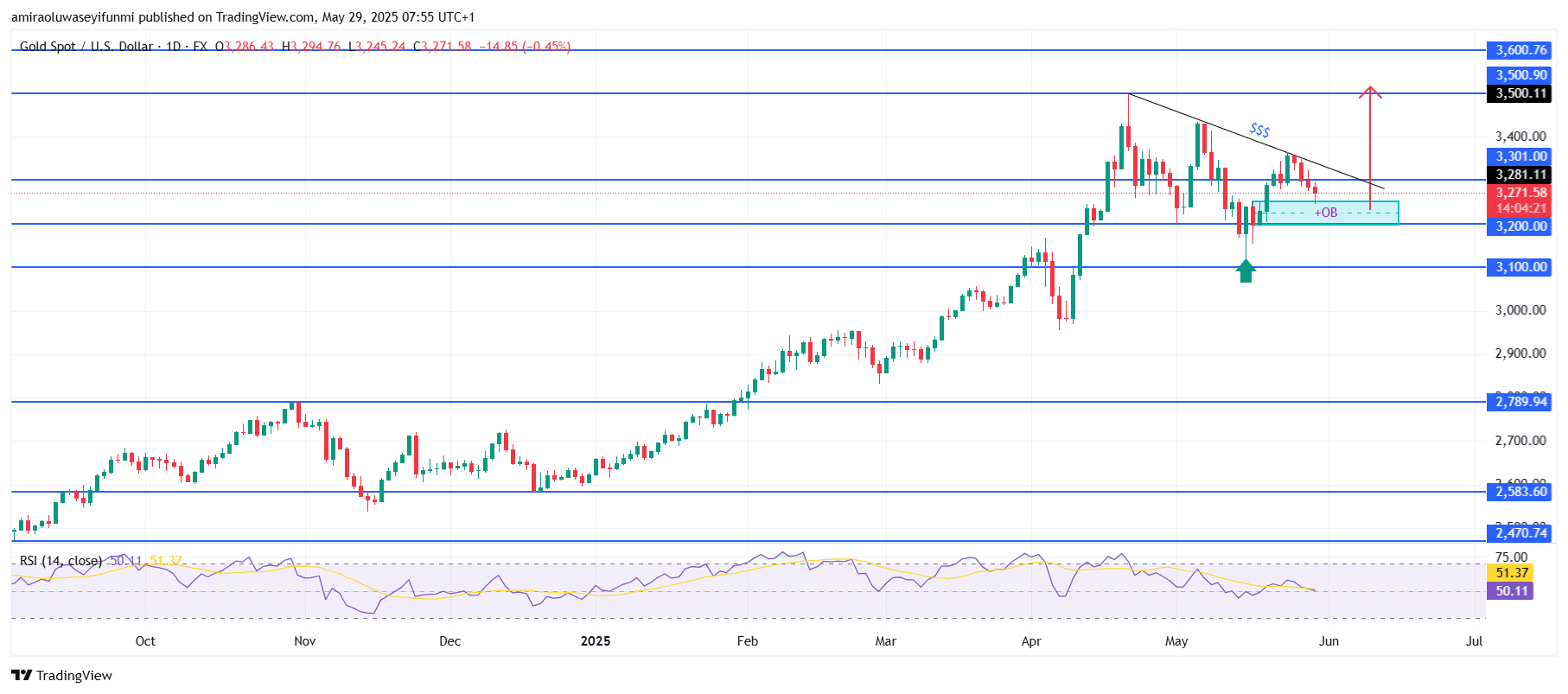

Gold (XAUUSD) is poised for a bullish breakout amid ongoing consolidation and indications of a short-term reversal. From a technical perspective, the RSI (Relative Strength Index) is hovering close to the neutral 50 mark, specifically around 50.15, signaling a potential momentum shift. The RSI has consistently formed higher lows in recent sessions, pointing to underlying bullish divergence. This is further supported by the price’s recent rebound near the $3,200 support zone, where buying pressure re-emerged. Additionally, price action has responded well to the 14-day RSI trendline bounce, reinforcing the likelihood of a bullish move as sellers show signs of weakening around key demand zones.

Gold Key Levels

Resistance Levels: $3300, $3500, $3600

Support Levels: $3200, $3100, $2790

Gold Long-Term Trend: Bullish

Price action highlights a bullish setup developing within a descending triangle formation. Despite recent lower highs along the descending trendline, the $3,200 support—aligned with a known order block—has held strong, confirming demand strength in that area. A bullish hammer candlestick appeared following a dip into this zone, indicating robust buying interest. Moreover, liquidity above the $3,300 short-term resistance is now exposed, increasing the chance of a breakout as the market begins to establish higher lows. The bears’ failed attempt to breach the $3,200 level, followed by a sharp rejection, suggests potential bearish exhaustion.

The outlook for XAUUSD now leans strongly bullish, dependent on a breakout above the $3,300 trendline resistance. A successful move past this level would set sights on $3,500 as the next target, with potential to extend toward $3,600—coinciding with previous liquidity zones and historical resistance. From the current price range ($3,270–$3,300), the setup offers an attractive risk-to-reward profile for long entries, supported by bullish divergence and a strengthening market structure. A sustained close above $3,300 would invalidate the ongoing consolidation phase and likely prompt a measured move of approximately $300, in line with the range of the prior leg. This setup may be of particular interest to traders using forex signals for timely entries.

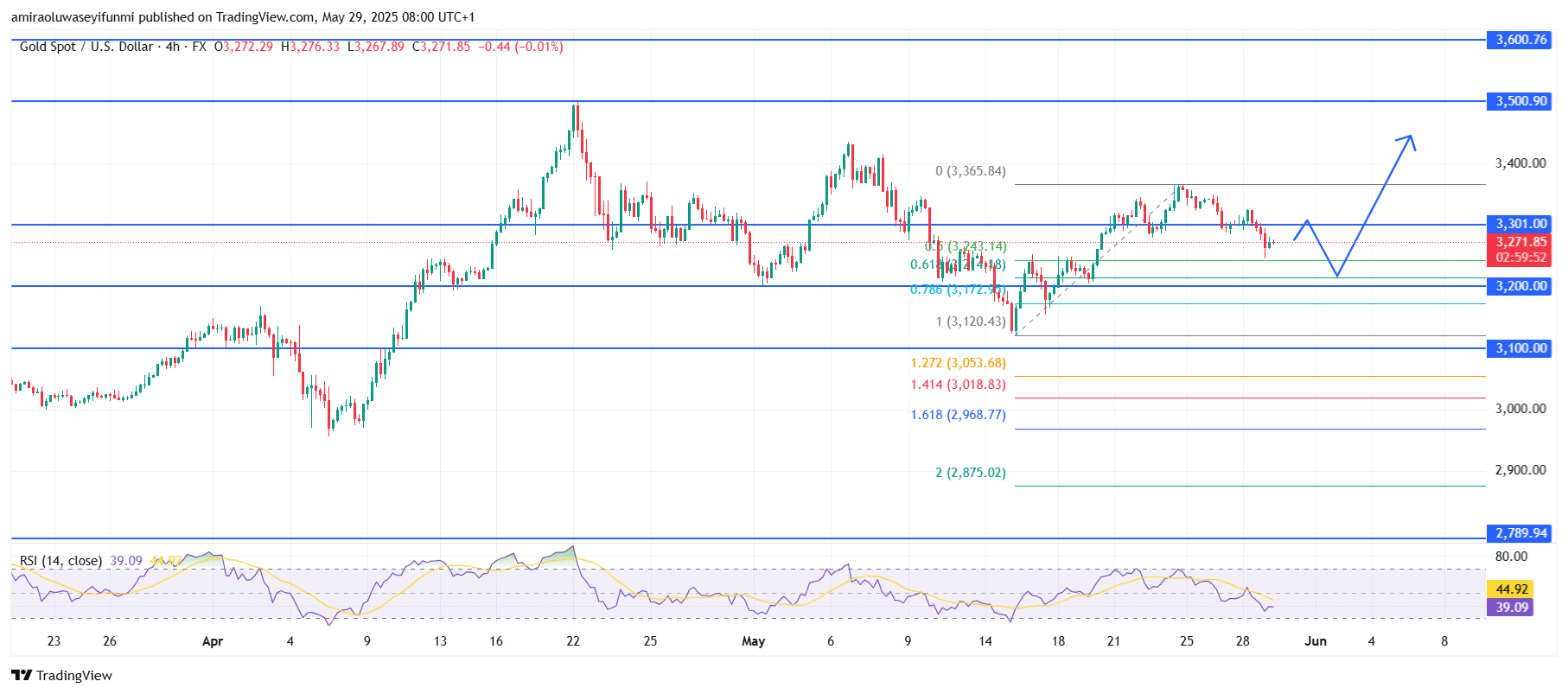

Gold Short-Term Trend: Bullish

Gold (XAUUSD) continues to exhibit bullish tendencies on the four-hour chart, with price action respecting the critical $3,200 support zone, which aligns closely with the 0.618 Fibonacci retracement level. The RSI currently reads 39.05, nearing oversold conditions, which could imply a forthcoming bullish momentum shift.

A potential reversal is expected from the $3,200 level, suggesting the formation of a higher low within the existing structure. If the price successfully reclaims the $3,300 level, it could pave the way for a move toward the $3,500 and $3,600 resistance levels.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.