The yellow metal was met with a fresh supply near the $1900 hurdle on Wednesday, which stalled this week’s bullish bounce from the $1849 support. The pullback represented the first bearish move in the past three days and was ignited by a goodish pickup in the US dollar (DXY) demand.

Meanwhile, the first US Presidential Debate between President Trump and Democratic opponent Joe Biden failed to rile the markets up, as many expected would happen. However, Trump’s assertion that the election result might not be agreed upon after Election Day has infused additional uncertainty into the markets. This comes amid the ever-increasing number of COVID-19 cases.

Other than a strong across-board recovery in the USD, an uptick in the US Treasury bond yields has added to the outflow of demand from the non-yielding commodity. Nonetheless, Trump’s comments in yesterday’s debate caused a fresh wave of global risk-aversion across markets.

Moving on, market participants will be looking at the US economic docket today—which features the ADP report, the final Q2 GDP report, Chicago PMI, and the Pending Home Sales data—for clues. Furthermore, influential comments from FOMC members later today will likely influence the greenback’s price dynamics in the North American session.

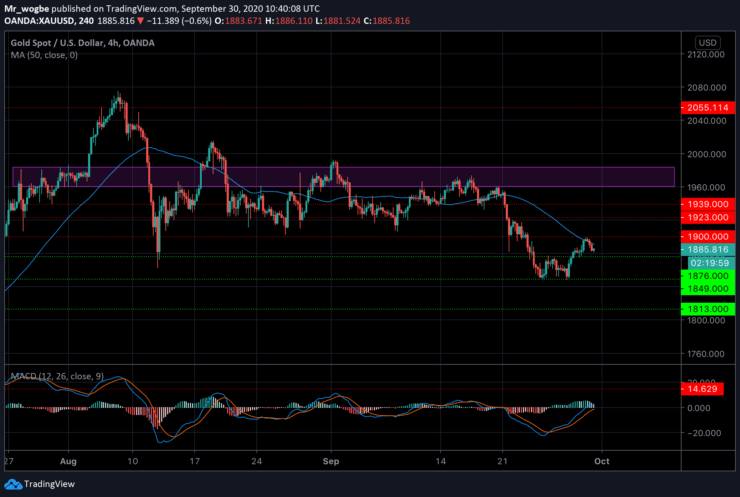

Gold (XAU) Value Forecast — September 30

XAU/USD Major Bias: Sideways

Supply Levels: $1900, $1923, and $1939

Demand Levels: $1876, $1849, and $1844

Technically, the XAU/USD has failed to break the strong $1900 psychological support. In the meantime, we expect a retest of that line, which could be very crucial to what gold does next. Meanwhile, over the past few hours, we’ve seen gold record consecutive lower highs, signaling that we could see the commodity hit the $1876 support before a retest of the $1900 line.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.