After having faced strong rejection above the $1950 severally, gold was met with renewed selling pressure, which has erased about $25 from the commodity’s price in just a few hours.

The bearish pressure seen in the yellow metal can be mainly traced to the across-board rebound in the US dollar (DXY), as risk sentiment tightens its hold on Europe as Coronavirus continues to wreak havoc.

Also, it appears that market participants are holding the US currency ahead of the Fed Chair Jerome Powell’s speech scheduled for later on Monday. It is expected that the Fed will maintain its dovish outlook, even into its next interest rate decision on the 5th of November, as the committee remains committed to using everything in their arsenal to bolster the economy in these trying times.

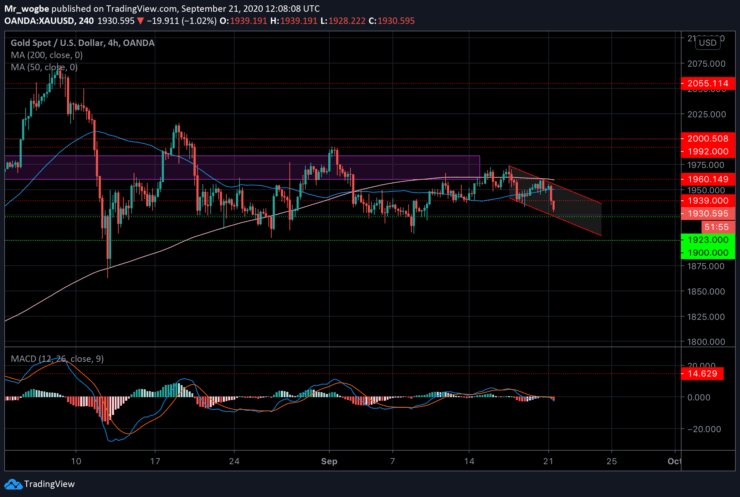

Gold (XAU) Value Forecast — September 21

XAU/USD Major Bias: Bearish

Supply Levels: $1940, $1950, and $1960

Demand Levels: $1923, $1909, and $1900

Gold has now been caught in a very tough bearish momentum on Monday as market risk picks up. The yellow metal has now formed a new downward-facing channel and is currently at the base of this channel. To break out of this downward spiral, gold will first have to break above $1950, where a confluence of technical indicators lay (strong supply level, 50 SMA, and the top of our newly formed channel).

Subsequently, other resistance levels will come into the target. Failure to do so means the commodity risks reaching the $1900 psychological support again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.