EURUSD Price Analysis – September 21

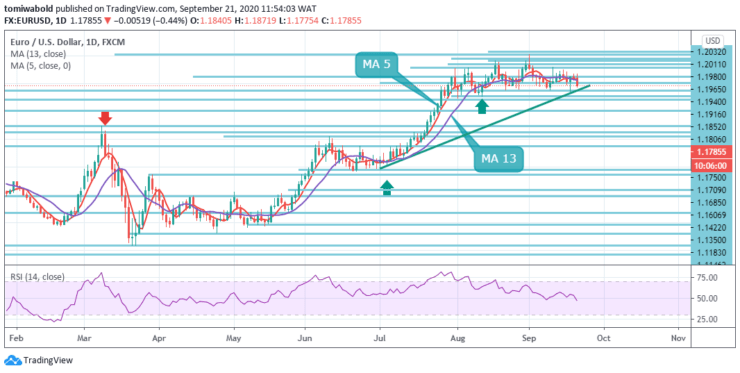

The continuation of the upside momentum in the EURUSD is at risk following the price movement below the 1.18 mark. The better start of the week in the greenback is forcing EURUSD to recede to fresh 2-day lows in the sub-1.18 area on Monday. Concerns about the second wave of the COVID-19 infections weighed on investors’ sentiment.

Key levels

Resistance Levels: 1.2011, 1.1965, 1.1852

Support Levels: 1.1750, 1.1685, 1.1422

As observed on the daily, momentum indicators are turning lower and EUR could continue to trade quietly, expected to be between 1.1750 and 1.1852 levels. From a technical perspective, the emergence of some dip-buying near ascending trendline support at 1.1750 may favor bullish traders.

Hence, any subsequent positive move is more likely to confront a stiff resistance near the 1.1900 marks. That said, some follow-through buying might trigger some near-term short-covering move and push the pair further beyond the 1.1916-40 supply zone, towards reclaiming the key 1.2000 psychological marks.

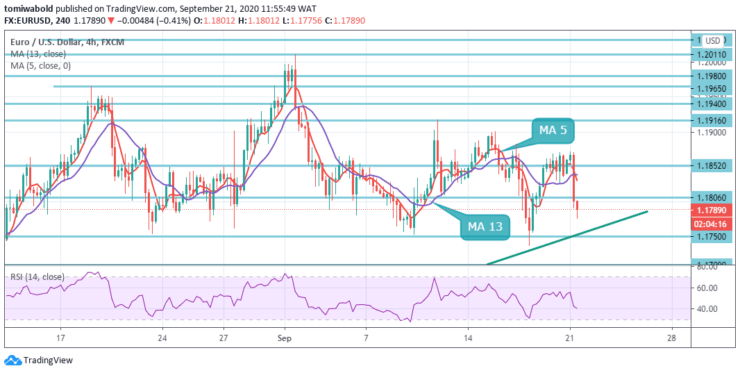

Looking at the 4-hour chart, the pair traded as low as 1.1737 last week before starting a fresh increase. However, there is the battle raging between bears and bulls and the EURUSD is within the bearish zone now.

Intraday bias in EURUSD stays neutral for the moment. On the downside, below 1.1737 level will reaffirm the bearish case, which is the fall from 1.2011 level is correcting the whole rise from 1.0635 level. On the upside, though, a break of the 1.1916 level will revive near term bullishness and bring retest of the 1.2011 resistance level first.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.