Traders appeared to be disappointed with yesterday’s Federal Reserve policy statement, which showed that the bank remained committed to keeping interest rates lower for longer to help bolster inflation. With the absence of any quantitative easing, gold traders feel less incentivized to place any aggressive bullish bets.

Gold bears have now been emboldened even further, considering that the US dollar (DXY) is beginning to rally even though Fed Chair Jerome Powell announced that the bank will be keeping its interest rates close to zero until inflation rises above 2% at a minimum.

The recent growth of the greenback can be largely attributed to the steady recoveries in major financial markets like China and the US, as recent data shows that the world powers are fast-tracking their economic recovery significantly.

Meanwhile, gold continues to be supported by the growing worries over the Coronavirus pandemic as the total global cases approach 30 million. This, coupled with the grim outlook for a sharp economic recovery in the near-term (particularly in emerging markets), could help gold facilitate a bounce back to the $2000 level.

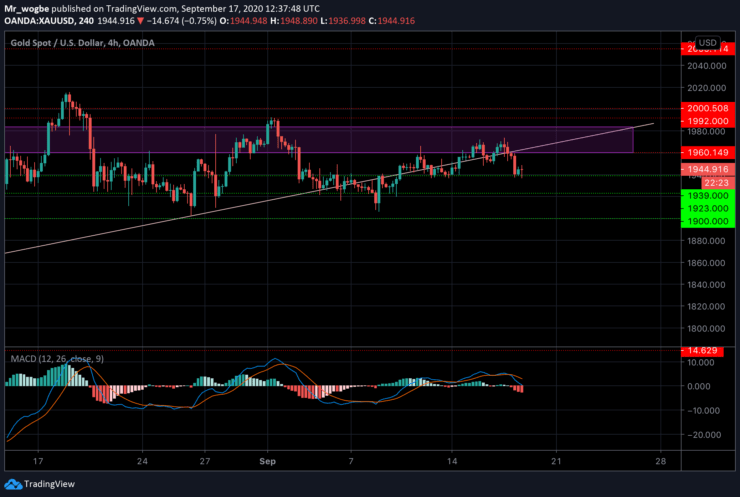

Gold (XAU) Value Forecast — September 17

XAU/USD Major Bias: Sideways

Supply Levels: $1950, $1960, and $1983

Demand Levels: $1940, $1923, and $1909

Following the FOMC meeting yesterday, gold has, once again, gone below our ascending trendline, indicating renewed weakness. Before the meeting, the XAU/USD showed a strong inclination for maintaining a bullish momentum for the time being.

Gold is now battling with the $1940 support, at press time, as staying above that level could help the commodity in reclaiming a bullish stance. Meanwhile, a break below that level could send the precious metal to the $1923 support and lower.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.