AUDUSD Price Analysis – September

AUDUSD takes the bids beyond 0.7300 levels to reverse the early losses while trading near 0.7285 level and recording an intraday low of 0.7253 level, during the early Thursday. Australia’s Unemployment Rate slipped underneath a 7.7 percent forecast and 7.5 percent before 6.8 percent in August.

Key Levels

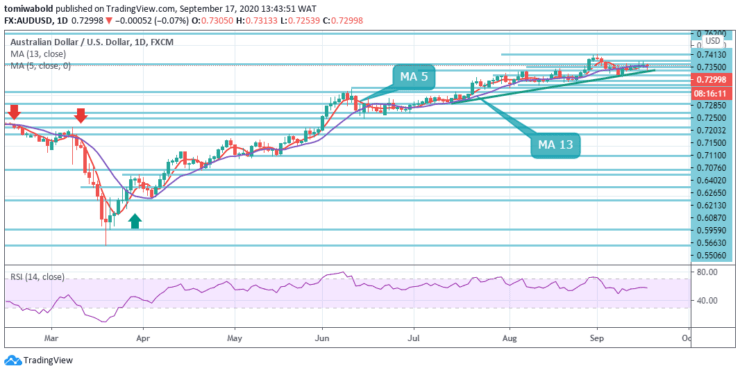

Resistance Levels: 0.7413, 0.7350, 0.7311

Support Levels: 0.7250, 0.7150, 0.7076

The pair’s persistent trading beyond the moving average of 5 and 13, now at 0.7285, guides the bulls towards a peak of 0.7413 on August 31, with the threshold of 0.7400 serving as an interim stop. Besides, an ascending trend line from July 14, now about 0.7250 levels, also serves as solid downside support.

In the broader context, the rebound from the medium-term bottom level of 0.5506 is seen as reversing the entire long-term downward trend from the high level of 1.1079. On the downside, it needs a break of 0.6777 support level to be the first indication of the rebound completion. Or else, in the event of a pullback the trend may remain bullish.

At this stage, the intraday bias in AUDUSD stays neutral. With the support level of 0.7150 unchanged, more increase stays in support. On the upside, the 0.7413 level breach may restart the rally from the 0.5506 level and aim next long-term 0.7635 level.

Even so, for steeper correction, the decisive breach of 0.7150 level may validate short-term topping, and transform bias to the downside. Summing up, a bullish bias persists beyond the short-term moving average of 5 and 13 and the 0.7076 boundaries in the short-to-medium-term period.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.