The yellow metal continued on its correction from the $1962 region and has remained depressed for the fourth consecutive session since the US dollar (DXY) picked-up strong demand last week.

Yesterday’s discouraging release of the US Consumer Confidence Index prompted more worries over the recovery of the US economy and extended some support to the USD’s appeal as the global reserve currency. This is coming in the heels of the recent development of a new potential treatment for the highly-infectious Coronavirus disease, which further tarnished gold’s safe-haven appeal.

Furthermore, a strong follow-through rally in the US Treasury bond yields exerted additional pressure on the non-yielding commodity.

However, gold will likely remain stuck-in-place as traders (bulls and bears alike) stay on the sidelines ahead of the Jackson Hole Symposium, which begins tomorrow.

In the meantime, market participants will be looking at the US Durable Goods Orders. However, for reasons explained in this article, there would likely be little or no effect on the market from this data release.

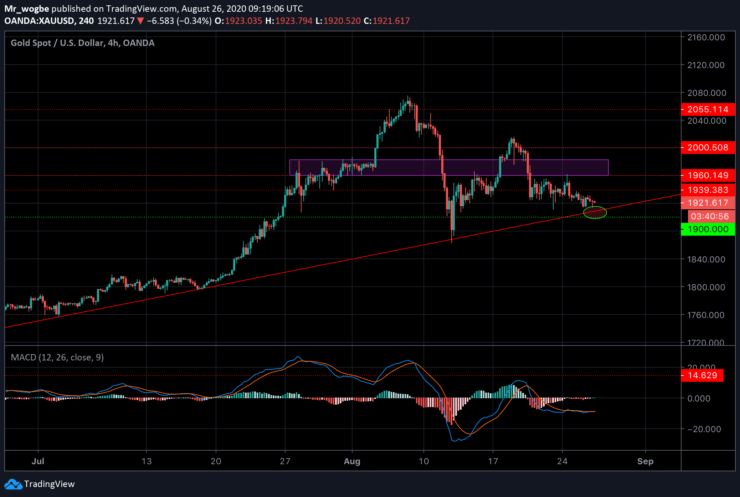

Gold (XAU) Value Forecast — August 26

XAU/USD Major Bias: Sideways

Supply Levels: $1939, $1960, and $1983

Demand Levels: $1913, $1900, and $1865

Gold continues to drag along as significant volatility has been taken out of the market ahead of the event. XAU/USD is now trading close to the prevailing trendline and given that a breakout to the downside hasn’t occurred yet, we can expect to see this line act as a bounce in the near-term. That said, a significant rally from that bounce doesn’t seem likely given the market climate.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.