GBPJPY Price Analysis – August 26

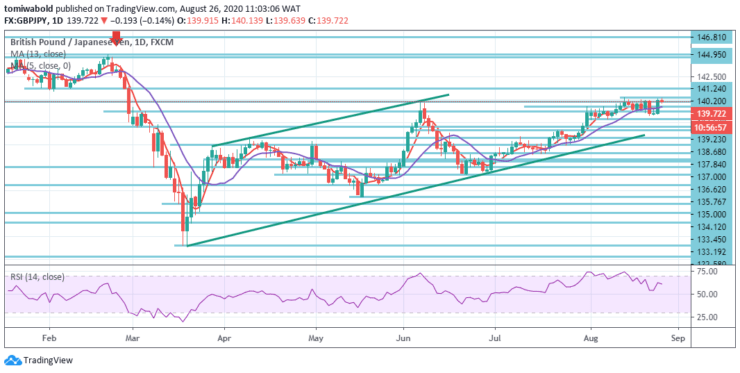

The GBPJPY is exactly at the top zone which is very close to the start of the sellers’ pattern which appeals to a downside bias around 139.70-80 zone. GBPJPY is losing gains at 0.14% on a day while taking the bids near 140.13 high level during the early Wednesday.

Key Levels

Resistance Levels: 147.95, 144.95, 141.24

Support Levels: 137.84, 135.76, 134.12

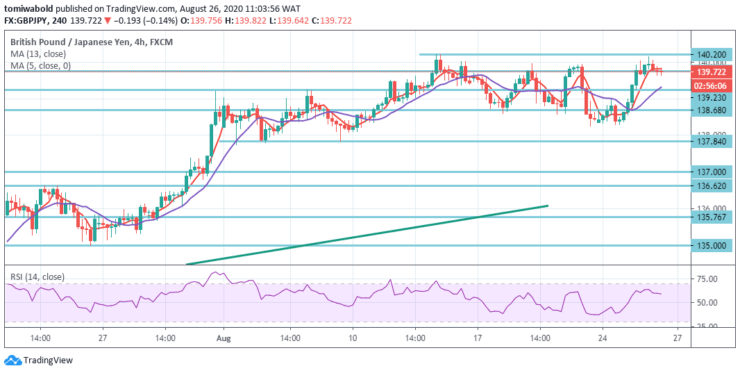

The price may decline straight down from the zone at 139.70-80 into the lower zone in the region of 138.00. The level at 138.68 is the first target and a daily closing beneath may suggest a transition towards levels 137.84 and 137.00. Whenever the price reaches past 140.20 levels, nevertheless, the trend becomes even more over-extended to the upside which is not a positive sign for bears.

So long as resistance level 147.95 holds, there is an eventual downside breakout in support. A steady breach of 147.95 level, nonetheless, may increase the risk of a long-term bullish reversal. Validation of the emphasis would then be shifted to the resistance level 156.59.

GBPJPY’s intraday bias stays neutral, as range trading progresses. Another rally is moderately in furtherance as long as it holds a support level of 137.84. The 140.20 level breach may achieve a 100 percent forecast from 123.99 to 135.76 levels at 141.24 levels, from 129.29.

The breach of 137.84 levels, meanwhile, may suggest short-term topping in 4 hour RSI on bearish divergence condition. For pull back, lower horizontal support line (now at level 136.62) initially, the intraday bias is turned back to the downside.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.