The yellow metal has caught some fresh buy bids after it bounced off ascending trend-line support. This rise was largely supported by the renewed Coronavirus jitters.

Investors are worried over how a rise in new Coronavirus cases has taken precedence over previous prospects for V-shaped global economy recovery. This has turned out to be one of the major factors underpinning demand for gold.

The intraday positive momentum of gold seemed to be unchanged by the strong recovery in the global equities markets. The risk-on bias was bolstered by an uptick in the US Treasury bond yields which did not affect the yellow metal.

Meanwhile, a beaten-down US dollar price action had no iota of influence on the dollar-denominated commodity. Some follow-through buying bid above the $1,730 pivot has been spotted and will most likely send the yellow metal towards the $1,745 resistance as it ascends towards multi-year highs.

Considering that there are no market-moving economic data from the US today, traders will be looking to Fed Chair Jerome Powell’s comments at a meeting for clues in the US session.

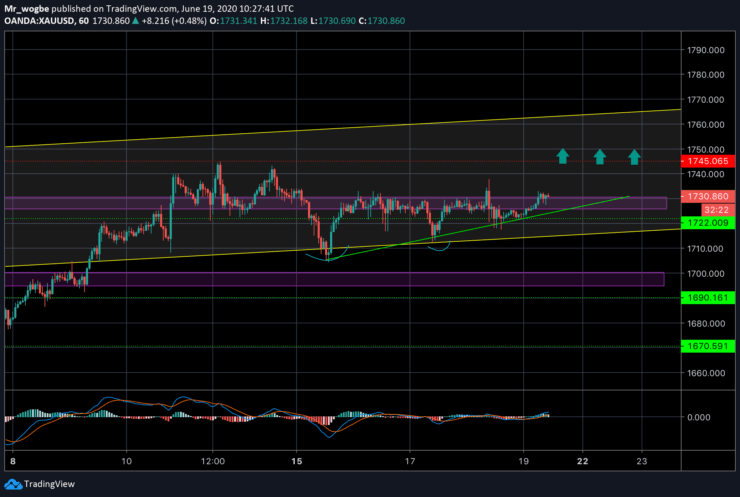

Gold (XAU) Value Forecast — June 19

XAU/USD Major Bias: Sideways

Supply Levels: $1,735, $1,745, and $1,753

Demand Levels: $1,717, $1,710, and $1,705

Gold remains in a strong consolidation range despite several price-boosting factors. At this point, only a break above the $1,745 resistance will solidify any further gains in the near-term. Meanwhile, the prospects for a sustained decline below $1,700 are becoming increasingly invalid.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.