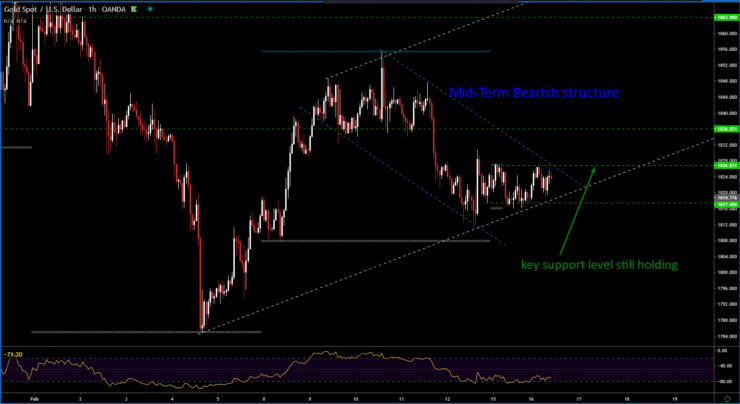

Key support zone: 1818

Mid term trend in Gold is bearish

Gold keeps holding a key support level inside of a mid-term bearish structure which gives us opportunities to go short in this metal.

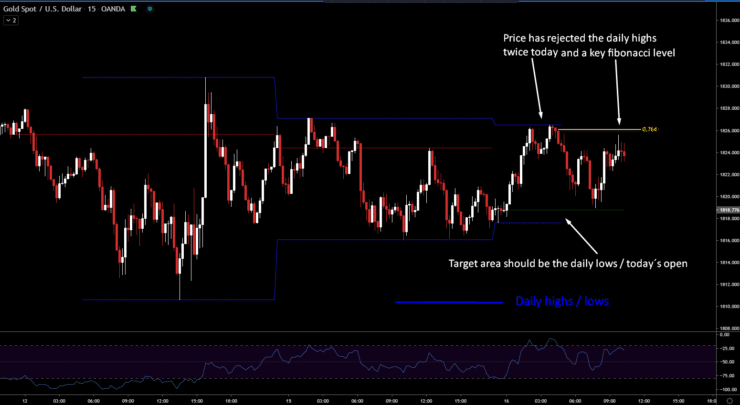

The short side in Gold should be in play whilst the daily highs and the key resistance zone are not breached. This is why we use stop orders to keep us involved if and only if there is momentum to the downside on our side.

The key 76.4% retracement in this chart that is capping Gold´s move to the upside comes from Monday’s range (1810.70-1830.90) which is important since the oscillator just printed bearish divergence on the 15-minute chart.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.