Gold has now pared more than half of the losses it suffered in last week’s collapse, which saw the commodity drop from $2,030 to $1,860. The precious metal rebounded in the American session on the back of a subdued USD coupled with strong technical support.

Meanwhile, analysts at Citibank have forecasted that gold will likely reach $2,100 within the next three months and $2,300 in six to twelve months. They cite the outstanding pace of ETF investor inflows (which weakens the dollar) and negative real yields as the major proponents for gold’s rally.

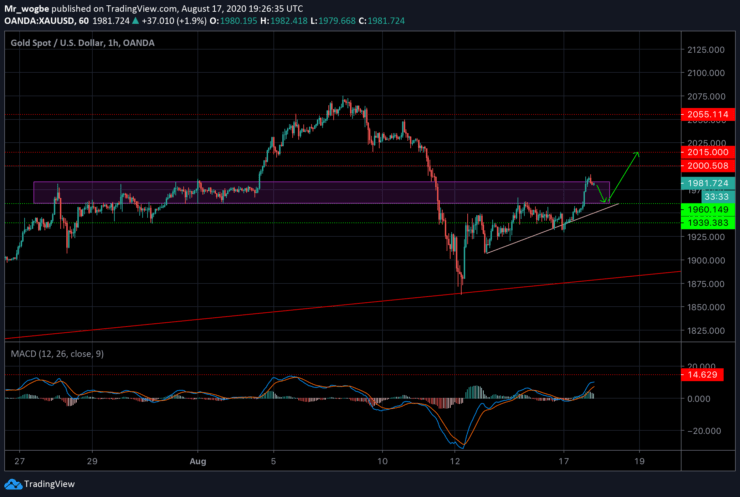

Gold (XAU) Value Forecast — August 17

XAU/USD Major Bias: Bullish

Supply Levels: $1,990, $2,000, and $2,015

Demand Levels: $1,950, $1,930, and $1,900

As projected in this morning’s analysis, gold has broken into a bull-run and has snapped the $1,960 resistance, climbing over the top of the $1983 resistance (the top line of our consolidation range) and has now returned into the region. We expect to see further gains in the near-term as our MACD is now just slightly above its neutral point. However, a slight retrace to the $1,960 could be seen before the surge occurs.

That said, the $2,015 resistance is now our next target to look out for.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.