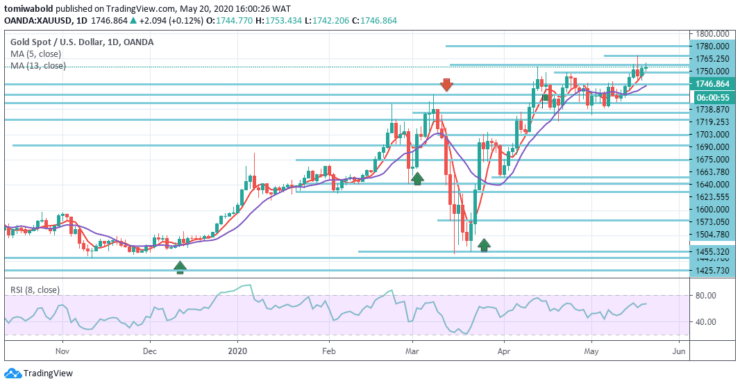

XAUUSD Price Analysis – May 20

Gold continues to capitalize on its modest gains higher, moving towards the latest high around the $1750 price level, but the precious metal has been capped by the upbeat market mood and recent greenback upturn. A solid rally in the US equity futures also kept a lid on any potential profits for the commodity denominated in the dollar.

Key Levels

Resistance Levels: $1780, $1765, $1750

Support Levels: $1719, $1,690, $1,663

XAUUSD Long term Trend: Bullish

At the time of press, gold is trading at a level of $1747 per ounce, and the upward wedge support is at $1738. Once proved a collapse may well open the way to a $1719-level re-test. Conversely, embracing levels above $1750 may divert the attention to recent highs close to $1765 level.

There is potential to retry the $1750.00 handle briefly and beyond. A breakout beyond this level may see more gains emerging but only anticipate a push higher at a strong closing above the previous $1765.00 mark. To the downside, the previous level of resistance close to $1719 is inclined to act as support that could stop the precious metal from posting further medium-term declines.

XAUUSD Short term Trend: Bullish

The rate traded past the $1750.00 mark earlier in today’s session. The yellow metal is likely to obtain support from the moving average of 13 near the level of $1744.00 and continue to appreciate in the short run against the US dollar. In this scenario, the rate may aim the upper region of the horizontal line of resistance at the level of $1770 which is the monthly R1.

That being said, if the exchange rate does not exceed the level of $1765.00, in the short term it is probable that gold may trade horizontally against the greenback. The RSI is also trying to create a bullish flag in the positive area with its trigger line, implying even more gains even in the short term.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.