GBPUSD Price Analysis – May 20

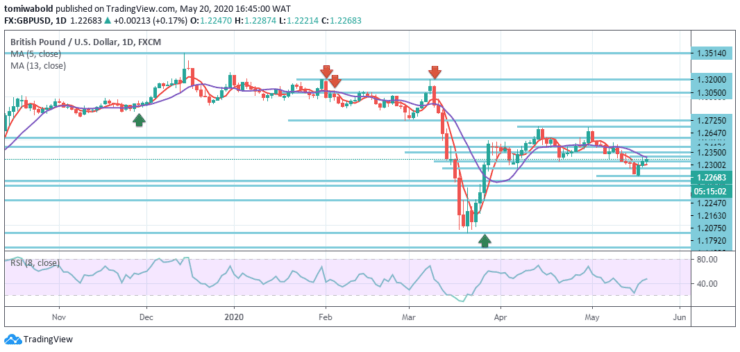

The Pound Sterling has been on Wednesday’s back foot and intensified lower after an analysis showed Britain’s inflation dropped sharply in April, striking the lowest as of 2016 due to an interruption by the coronavirus. The weakness was, however, protected by the 1.2240 regions as GBPUSD regains traction towards the 1.2300 level.

Key Levels

Resistance Levels: 1.3200, 1.2647, 1.2350

Support Levels: 1.2075, 1.1792, 1.1409

GBPUSD Long term Trend: Ranging

GBPUSD runs underneath the moving average of 13 as seen in the daily chart, indicating a bearish bias as the market is marginally rebounding from 6-week lows. Recognize that the support cluster founded by a range of 1.2163/1.2247 levels confronts the currency pair.

Once the support and resistance offered remain, the pair may probably stabilize in the short run. Similarly, once the specified resistance does not hold it is probable that within the following trading session the exchange rate may attain the weekly R1 at the 1.2350 thresholds.

GBPUSD Short term Trend: Bearish

GBPUSD reacts even though the spot on the four-hour chart is still trading beneath the main horizontal level at 1.2350. Presently the market is constrained by a level of 1.2300 beyond the moving average of 5.

Since the underlying trend is down on the 4-hour time frame, bears may return soon and attempt to push prices beneath the 1.2200 marks on the way to the 1.2075 level. A strong breach beyond 1.2300 level, on the other hand, may offer further but minimal progress. Resistance levels can be seen close to 1.2412 and 1.2520.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.