XAUUSD Price Analysis – April 29

During the late European session, Gold edged down into the American session and refreshed daily lows as overriding risk-on mood weighs on XAUUSD, but managed to stay just above the round-figure mark of $1,703.00. This emerges amid a significant upturn in crude oil prices, which rather bolstered the optimism of investors and smashed the inherent safe-haven status of the precious metal.

Key Levels

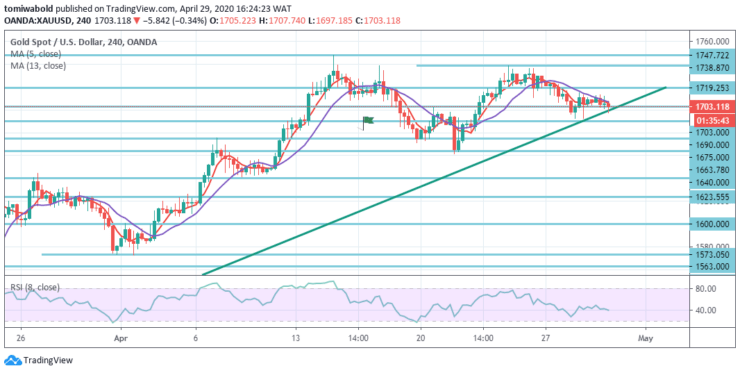

Resistance Levels: $1,780, $1,765, $1,747

Support Levels: $1,690, $1,663, $1,623

XAUUSD Long term Trend: Bullish

Gold has largely kept moving horizontally since the beginning of April. This is trading beyond nearby highs in February-March. But, this looks like a medium to long term uptrend consolidation. Though if the price hits beneath the level of $1,703.00, we may see more pressure to sell.

An upswing may return as soon as the pair soars beyond the resistance level of $1,719.25, preceded by rising to the resistance level of $1,738.87, and if it skyrockets beyond that level, we may predict the pair to hit the resistance level of $1,747.72.

XAUUSD Short term Trend: Bullish

XAUUSD consolidates the progress which began in mid-March as the metal holds beyond the ascending trendline on the four-hour chart. XAUUSD retains a solid bullish momentum as buyers are now searching for a break beyond the level of $1747.00 on a daily exit grounds that may open the doors towards the resistance level of $1,780.

Alternatively, support may appear for the short term near to $1,690 price level, and further below rests the level of $1,663. In the first quarter of this year, freshly issued US GDP came in at 4.8 percent worse than anticipated.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.