GBPUSD Price Analysis – April 29

The GBPUSD wrestled to improve on its initial rebound and continued pulling back from the proximity of the psychologically key 1.2500 marks. The GBPUSD pair recovered a decline from the daily swing lows to sub-1.2400 levels and eventually recovered about 25 pips. Since UK Foreign Secretary Dominic Raab confirmed that the Brexit process would end at the end of this year, the selloff picked up the pace.

Key Levels

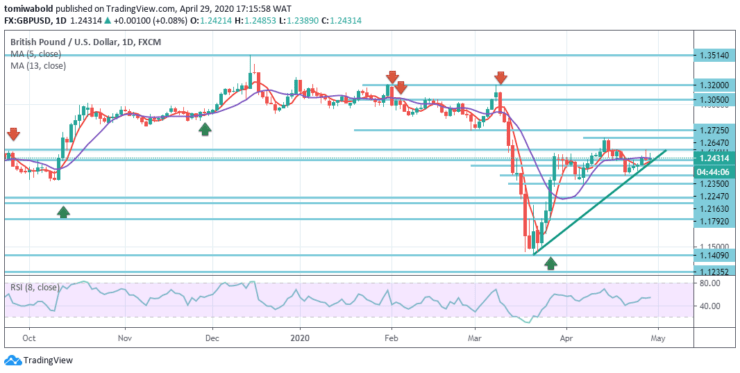

Resistance Levels: 1.3514, 1.3050, 1.2647

Support Levels: 1.2350, 1.1958, 1.1409

GBPUSD Long term Trend: Ranging

GBPUSD holds at a range of 1.2163/2647 levels and holds firm with intraday bias. As long as 1.2163 support level holds, a further increase may continue skewed in favor. Break of 1.2500 levels on the upside may broaden the recovery from 1.1409 to 1.3200 levels of resistance.

On the contrary, a fall of 1.2163 levels may suggest a conclusion of the turnaround from 1.1409 levels, and the Intraday bias may be reversed to the downside for a low level of 1.1409.

GBPUSD Short term Trend: Bullish

The traction on the 4-hour chart stays horizontal, and the currency pair is floating beyond the upward trendline. The Relative Strength Index holds a decent distance above level 50 and thus stays far from overbought levels.

Resistance is pending at a level of 1.2520, and that is the weekly high and a level which also limited GBPUSD in mid-April. This is led by the level at 1.2647, which in itself is a high swing. Support is shown at 1.2350 level, which also formerly limited the GBPUSD, preceded by the lower horizontal line at 1.2247 level, one that has offered support over the last days.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.