XAUUSD Price Analysis – March 18

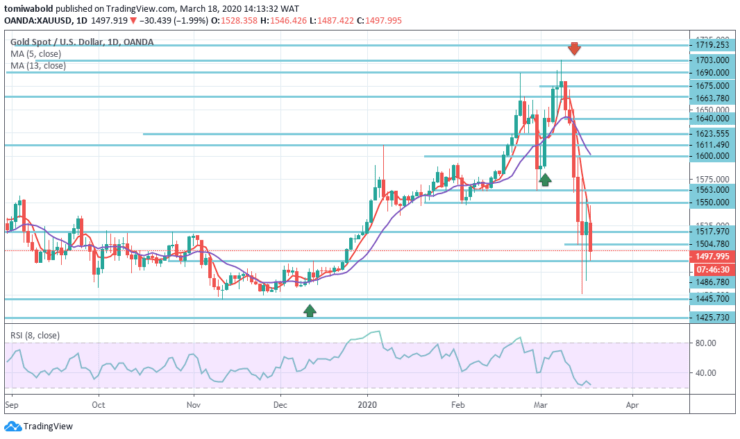

Currently, Gold trades at $1,503 level per Oz, as at the time of writing, setting a session high of $1,546.42 level a few hours ago. The yellow metal has so far traded further within the $1,554 to $1,465 price range of the previous day. Despite the declines in US stock futures, the yellow metal has pulled back from session highs.

Key Levels

Resistance Levels: $1,640, $1,600, $1,550

Support Levels: $1,486, $1,445, $1,425

XAUUSD Long term Trend: Bearish

The RSI oscillator reflects on the broader structure that the yellow metal is moving in a corrective sequence and may establish a new bearish movement. A sell-side position would trigger if the price closes below the $1,504.78 level per ounce.

In our optimistic forecast, we predict a potential price goal of $1,486.78 level per ounce and Gold could drop to $1,455.70 level if the bearish sentiment gathers traction, and even fall to $1,425.73 level per ounce.

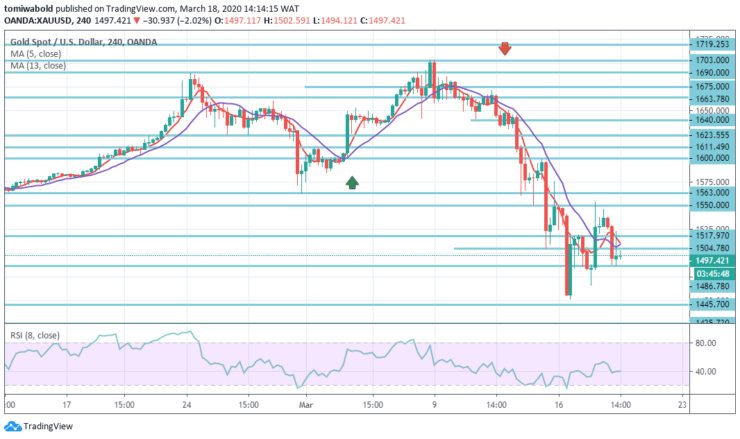

XAUUSD Short term Trend: Bearish

In the previous session, the exchange rate of XAUUSD increased to level $1,550.00. The pair fell to the near-term horizontal support zone at $1,486.78 level during today’s morning. If the retracement holds, some upside potential would likely prevail. In this case, the pair may have to surpass the level of upper horizontal resistance at $1,550.00 near term.

On the other hand, the yellow metal may probably stay near $1,517.97 level under pressure from the moving averages. In this scenario, gold might in the short term trade sideways against the US dollar.

Instrument: XAUUSD

Order: Sell

Entry price: $1,517.97

Stop: $1,550

Target: $1,486.78

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.