The upbeat market sentiment appears to be a factor in keeping the yellow metal under pressure. However, a weaker US dollar, coupled with fears over a second wave of the virus, and growing geopolitical tensions might sustain the commodity from falling lower.

The global risk sentiment was bolstered by the Fed’s decision to begin buying investment-grade US corporate bonds, the Trump administration’s decision to inject another $1 trillion into infrastructure spending, and a positive breakthrough in the battle against the Covid-19 pandemic.

However, investors are becoming increasingly bearish following a sharp rise in Covid-19 infection in the US and the escalating geopolitical tensions in Asia. It was reported yesterday that tensions in the Korean Peninsula intensified after North Korea blew up a joint liaison office in South Korea. Also, India and China suffered some casualties in a clash at the Himalayan border area.

Furthermore, a weaker USD caused by a fresh leg down in the US Treasury bond yields could provide more boost for the dollar-denominated commodity.

In the meantime, market participants will be focused on the US housing market data and the Fed Chair’s second-day testimony today for meaningful trading opportunities.

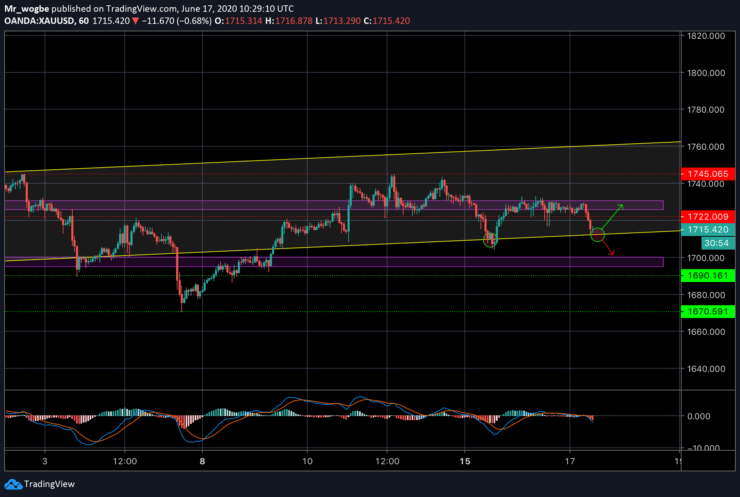

Gold (XAU) Value Forecast — June 17

XAU/USD Major Bias: Sideways

Supply Levels: $1,730, $1,735, and $1,745

Demand Levels: $1,710, $1,704, and $1,700

Gold remains under a strong bearish influence and a drop below $1,700 could confirm this sentiment. However, it seems very unlikely that bears will take control considering the macroeconomic conditions at play. We will be looking at our key support at $1,711 (ascending channel baseline) for the near-term trading sentiment. A bounce off that line could send gold back to the $1722 – $1,735 consolidation range and possibly higher. On the flip side, a failure to bounce off that line could send gold quickly to the $1,704 – $1,700 region.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.