GBPJPY Price Analysis – June 17

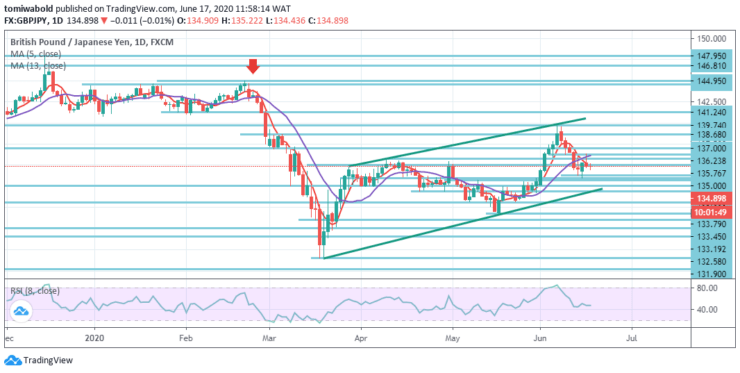

GBPJPY posts low losses of 0.17 percent while falling to a level of 134.72 on Wednesday at the European open. By so doing, the pair depicts the string of losses of two days while extending the pullback from 136.23 level of the prior day. While the UK is providing positive results from its COVID-19 vaccine, the threats of the 2.0 pandemic surge, originating from China, the US, and Japan, is intensifying downside pressure on the pair.

Key Levels

Resistance Levels: 147.95, 139.74, 136.23

Support Levels: 133.45, 129.29, 122.75

Repeated failure of the pair’s second day to cross the moving average 13 upwards and break the horizontal resistance line at level 136.23 depicts the pair’s weakness. As a consequence, sellers may steadily return to support around the level of 133.45.

The moving average of 13 is presently used as an intraday resistance zone and the price may break the level of 135.00 where it had initially halted. On the daily chart, the RSI indicator looks bearish while it’s under the 50 zone and has a bearish swing. The moving average 5’s red line crossed down with more space toward the ascending trendline support.

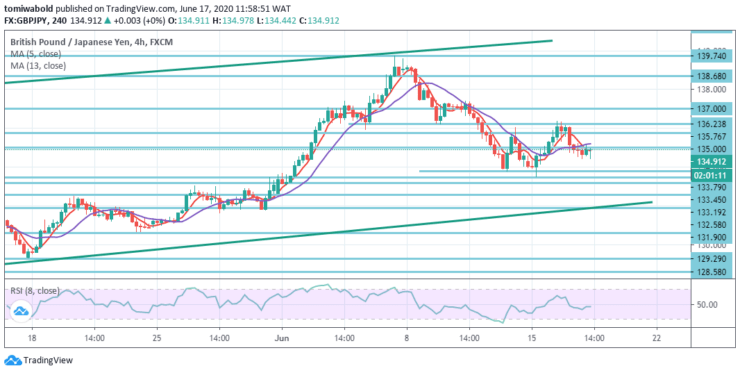

GBPJPY’s recovery slowly declined after failing to sustain above 4 hours moving average 13. Its intraday bias is initially made neutral. On the positive side, a breach of 136.23 minor level of resistance may accelerate the rebound from 133.45 level to 139.74 high level for a retest.

On the drawback, a continuous breach of 4-hour moving average 5 (now at level 134.60) may imply that the entire recovery from level 127.54 is finished. To confirm this bearish case, the decline from level 139.74 should then target support level 129.29.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.