The dollar index fell by about 0.5% yesterday, giving gold more steam to recover major portions of its early decline following the Fed’s announcement that it would begin buying corporate bonds through the Secondary Market Corporate Credit Facility (SMCCF).

The apex bank has launched several emergency facilities over the past three months to cushion the economic impact of the Coronavirus outbreak. Consequently, its balance has grown by over $3 trillion since March.

Gold’s recovery and the US dollar weakness could be turned over if the number of Coronavirus cases continues to rise in China, the US, and in other nations across the globe. The equities markets in Asia, the US, and Europe fell yesterday following renewed fears of a second wave of the virus outbreak. However, the equity market sentiment turned risk-on in the American trading session most likely as a result of the Fed’s announcement. If this sentiment stays on, the dollar could come under immense selling pressure which will help gold print more gains.

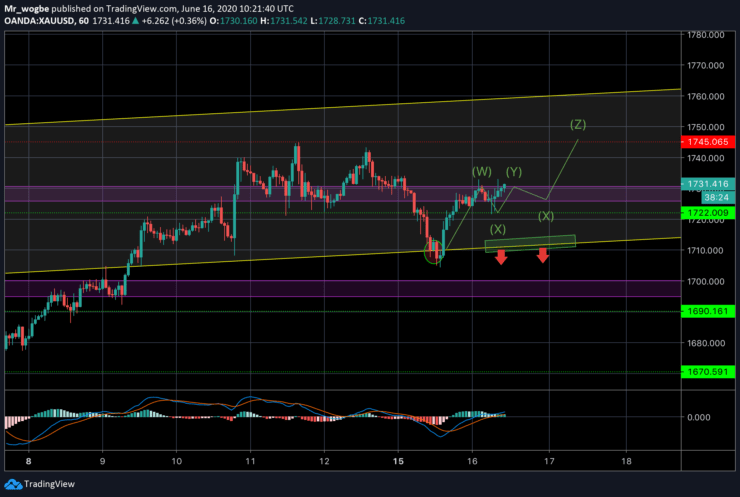

Gold (XAU) Value Forecast — June 16

XAU/USD Major Bias: Bullish

Supply Levels: $1,735, $1,745, and $1,753

Demand Levels: $1,717, $1,710, and $1,705

Gold is currently locked in a battle with the $1,730-35 level. Sellers will be looking for an opportunity to send gold lower if it drops below the $1,722 level. Failure of bulls to defend this line could send prices down to the $1,711 level (baseline of our ascending channel). Alternatively, a break above the $1,735 level could send prices higher. Also, market participants will be looking at the US retail sales data and the US Fed Chair testimony set for later in the day. A dovish comment from Powell could send gold flying above the $1,735 with ease.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.