The USD has suffered further losses, especially during the Asian session on Wednesday, and has reached a new 3-months low. This is one of the major factors supporting the rise in the price of gold. This coupled with the possibility of a dovish outlook from the Fed in their meeting scheduled for today. Hints of this were picked in the slide in US Treasury bond yields which also gave additional support to the yellow metal.

However, the near-term risk-on sentiment remains as a result of the growing optimism for a V-shaped recovery for the global economy and expectations that the worst of the pandemic is behind us. This sentiment creates further resistance for any significant rally in gold.

Market participants remain focused on today’s Fed interest rates decision and economic projections. Speculators expect that the Fed will likely keep their rates unchanged, however, the focus will be specifically on the comments and tone of the Fed Chair, Jerome Powell, at the post-meeting press conference.

Comments on the future policy path will give investors a better perspective of the market and will determine what the near-term price action of the USD and gold will look like.

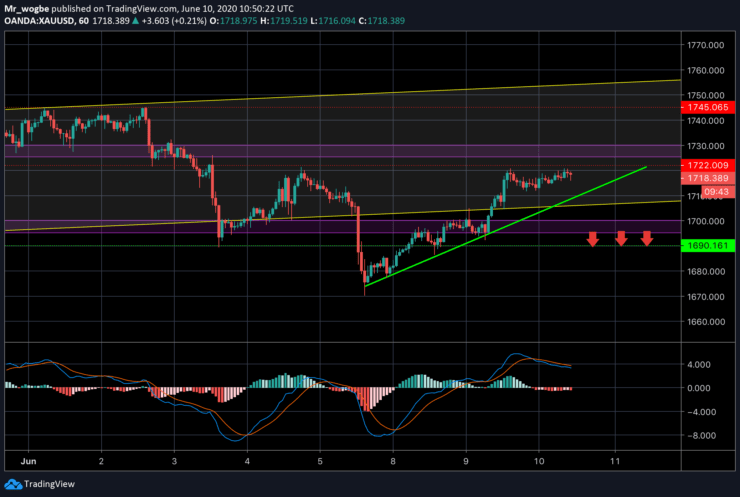

Gold (XAU) Value Forecast — June 10

XAU/USD Major Bias: Bullish

Supply Levels: $1,722, $1,730, and $1,740

Demand Levels: $1,700, $1,690, and $1,677

The resistance at $1,722 has capped any further climb for gold and might continue to do so until after the Fed meeting. This meeting takes center stage in the price action for gold today and so technical floors and ceilings might not be as effective. However, a sustained drop below the $1,700 pivot will most likely send gold spiraling down to $1,670 and below. On the flip side, dovish comments from Powell could return the gold price to the $1,744 in the coming hours.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.