This surge was precipitated by a modest dip to the $1,863 level, where it was met with heavy dip-buying coupled with a combination of other favorable factors. Majorly, the growing worries over the deteriorating US-China relations diminished investors’ risk appetite, which contributed to the safe-haven appeal for gold.

The United States unexpectedly ordered China to shut down its consulate in Houston by Friday over allegations of spying. China responded immediately and vowed to retaliate in strong countermeasures, stimulating worries over a further escalation of diplomatic tensions between the world powers.

Meanwhile, the recent uptick can also be linked to the fresh supply of the US dollar. Also, the second wave of Coronavirus infections in the US has ‘thrown a wet blanket’ over any optimism for a sharp recovery in the economy, which diminished the demand for the greenback even further.

Additionally, the political stalemate between the Democrats and the Republicans over the next round of the US fiscal stimulus further undermined the USD and bolstered the dollar-denominated commodity.

Nonetheless, the recent optimism over a potential vaccine for the highly contagious virus has kept some hope in the markets and has bolstered risk appetite in the equities market. This, consequently, could keep a lid on further gains for gold in the near-term, considering we are still in overbought territory.

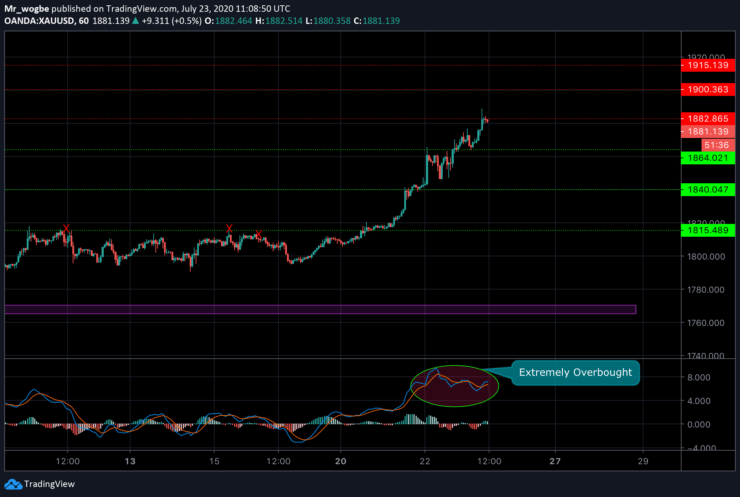

Gold (XAU) Value Forecast — July 23

XAU/USD Major Bias: Bullish

Supply Levels: $1,888, $1,900, and $1,917

Demand Levels: $1,870, $1,864, and $1,860

Gold has refused to show any sign of a slowdown in its bullishness. Despite being well into overbought conditions, the yellow metal continues to conquer even more resistance levels. At press time, gold is contending with the $1,882 resistance and once again, a retrace is likely to occur to ease the overbought conditions.

Given the recent (technical) performance, gold is unlikely to become bearish anytime soon.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.