EURUSD Price Analysis – July 23

EURUSD’s upward traction stopped from its rise to a level of 1.1600 as the technical view of the pair indicates a correction. The Euro’s advance edges lower on Thursday in early European trading, as increasing U.S./China tensions affect risk sentiment. China is set to respond in retaliation to the US shutting of its Houston embassy.

Key Levels

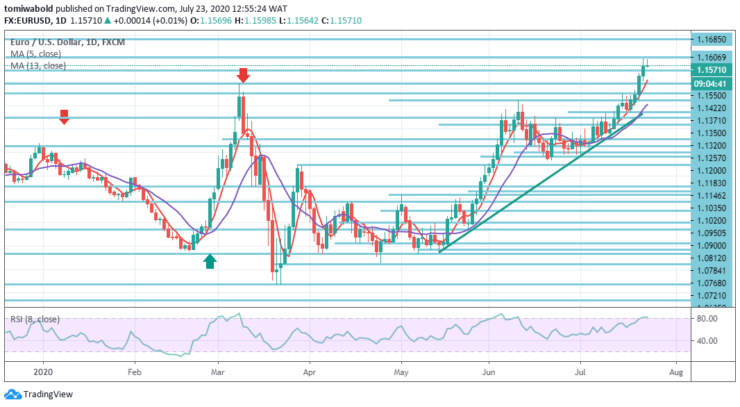

Resistance Levels: 1.1750, 1.1685, 1.1606

Support Levels: 1.1550, 1.1422, 1.1350

During Thursday’s European trading hours EURUSD traded close to 1.1598 level, confronting rejection at 1.1602 level. The pullback may be pushed farther down to levels beneath 1.1550, as the relative strength index (RSI) on the daily chart indicates an overbought condition.

The trend according to the daily chart may stay bullish as long as the pair holds beyond the ascending trendline and both MAs beyond the 1.1400 marks. A required downside correction of EURUSD is anticipated, as the pair has grounds to correct downwards.

At this point, the intraday bias in EURUSD stays on the upside. Present 1.0635 level rally may attempt a 100 percent projection of 1.0784 to 1.1422 levels from 1.1183 next to 1.1750 level. If the predicted resistance persists, a reversal to the south is probable to appear.

On the downside, a support level breach of 1.1400 is required to indicate short-term tops. Anything else, the forecast in the event of a fall must stay bullish. So for now, note that the pair may gain support from the 5 moving average and the 1.1550 horizontal support level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.