The US equities market opened sharply lower, however, it quickly rebounded and erased those losses. This rebound in equities prices caused the US dollar to weaken significantly, given way for a safe-haven boost for gold.

Also, it has recently been reported that the prospect of a second wave in the Coronavirus outbreak is looking more possible as the number of Covid-19 cases in the US and Japan has surged over the weekend. If this leads to the markets getting wind of further lockdown restrictions, optimism over a V-shaped recovery will be ‘thrown out the window’ and this will cause investors to take a flight to safe-haven assets like gold. This could catalyze gold prices to reach the long-awaited $1,800 price mark.

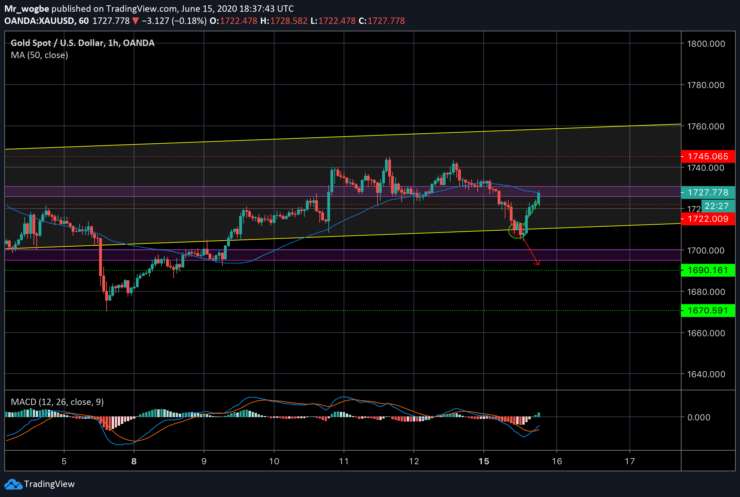

Gold (XAU) Value Forecast — June 15

XAU/USD Major Bias: Bullish

Supply Levels: $1,730, $1,745, and $1,753

Demand Levels: $1,717, $1,710, and $1,705

So far, gold (XAU/USD) has followed our previous projection of a bounce from the baseline of our ascending channel. Gold has recovered strongly above $1,722 and further gains appear to be very likely given US dollar recent weakness. At press time, the yellow metal is trading at $1,727.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.